Smarter Collections with AI & Automation

Effective collections require more than just debt recovery—they demand proactive risk management, borrower engagement, and data-driven precision. Traditional approaches are slow and costly, but GDS Link automates workflows, optimizes outreach, and ensures compliant, tailored recovery strategies powered by AI.

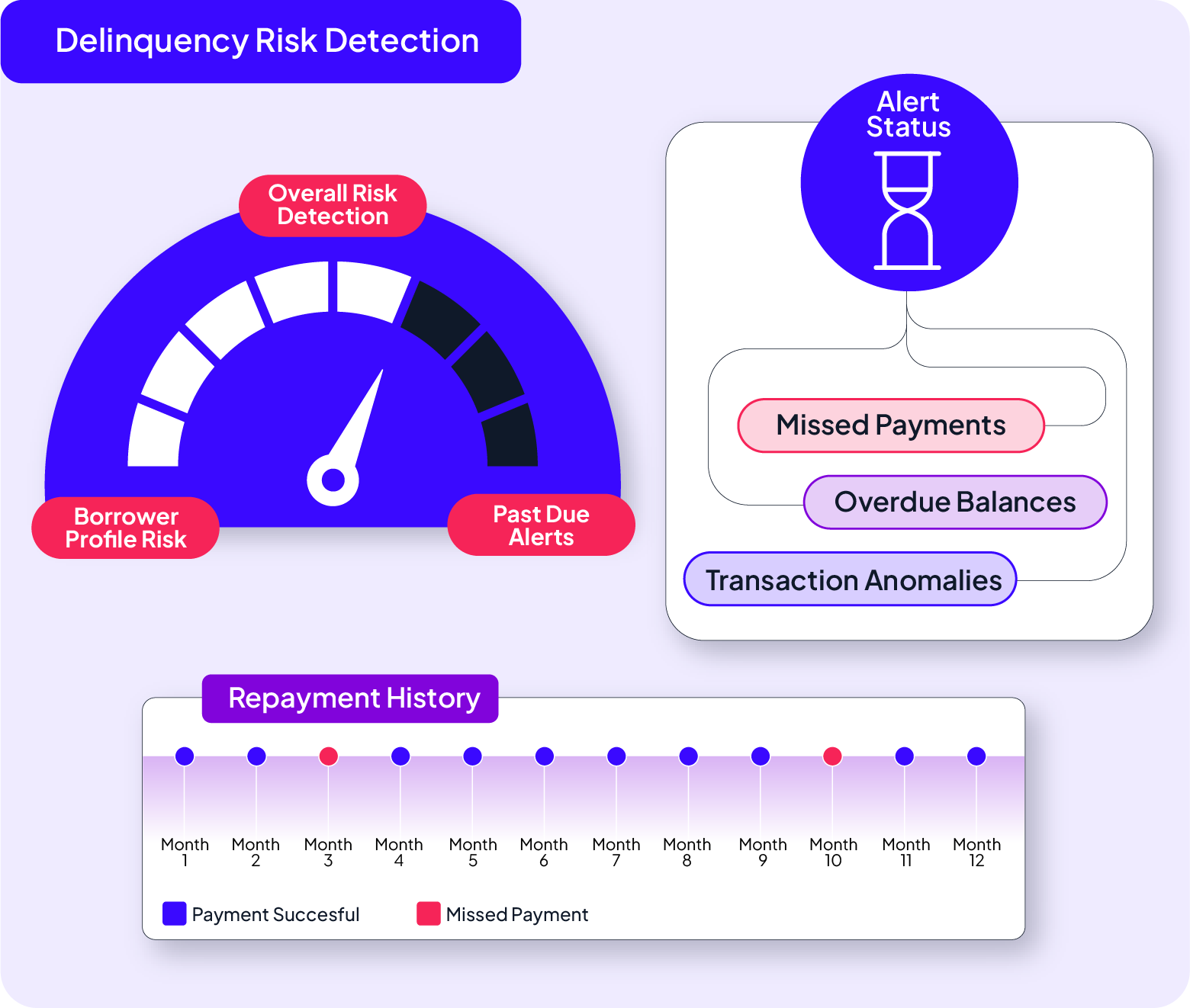

With real-time risk monitoring and behavioral analytics, lenders can detect at-risk accounts early, take preventive action, and maximize recoveries. Unlike vendor-restricted solutions, GDS Link gives lenders full control, enabling faster, more flexible strategy adjustments—without IT or third-party reliance.

Maximize recovery & reduce delinquencies with GDS Link

AI-driven precision for smarter collections

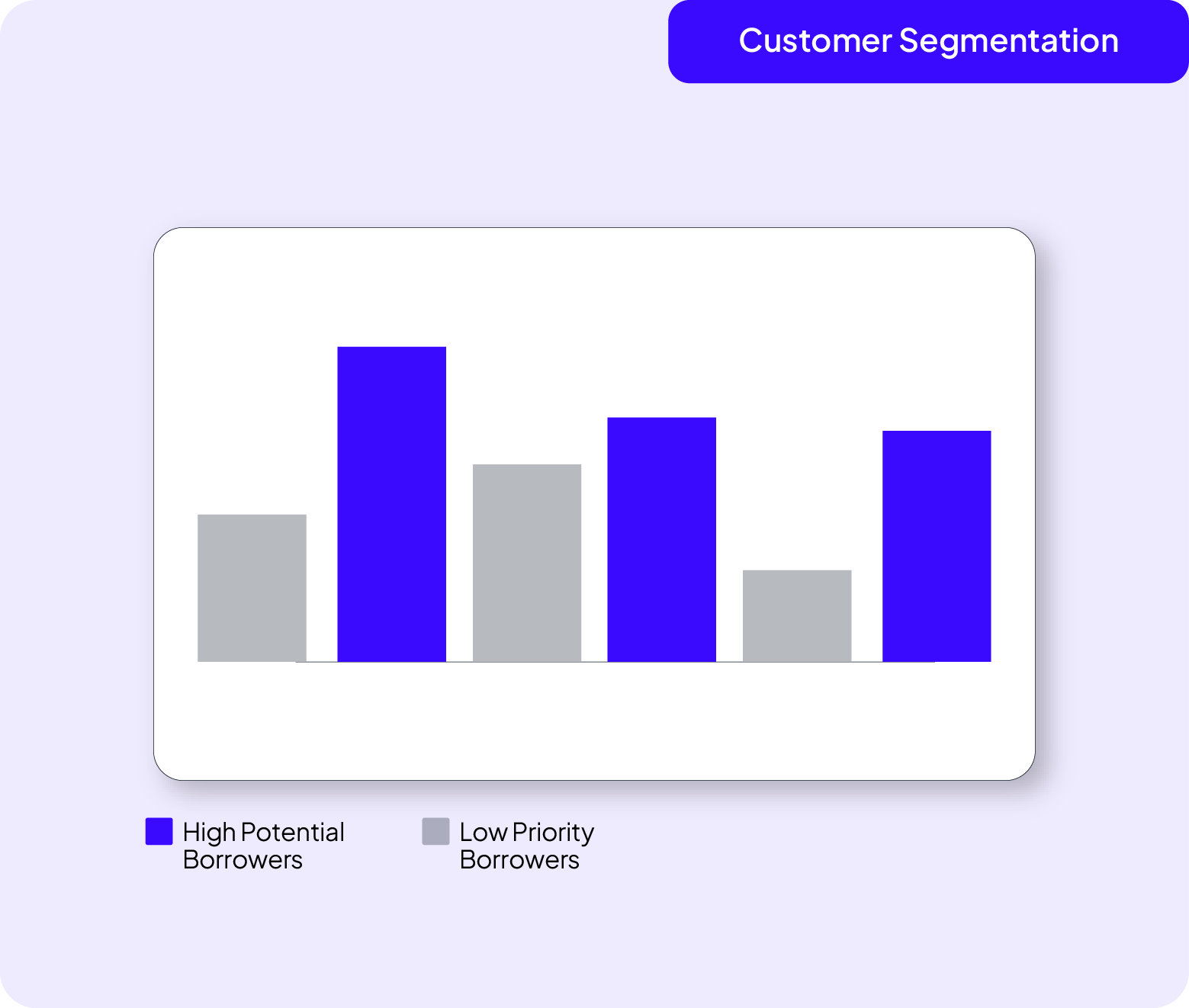

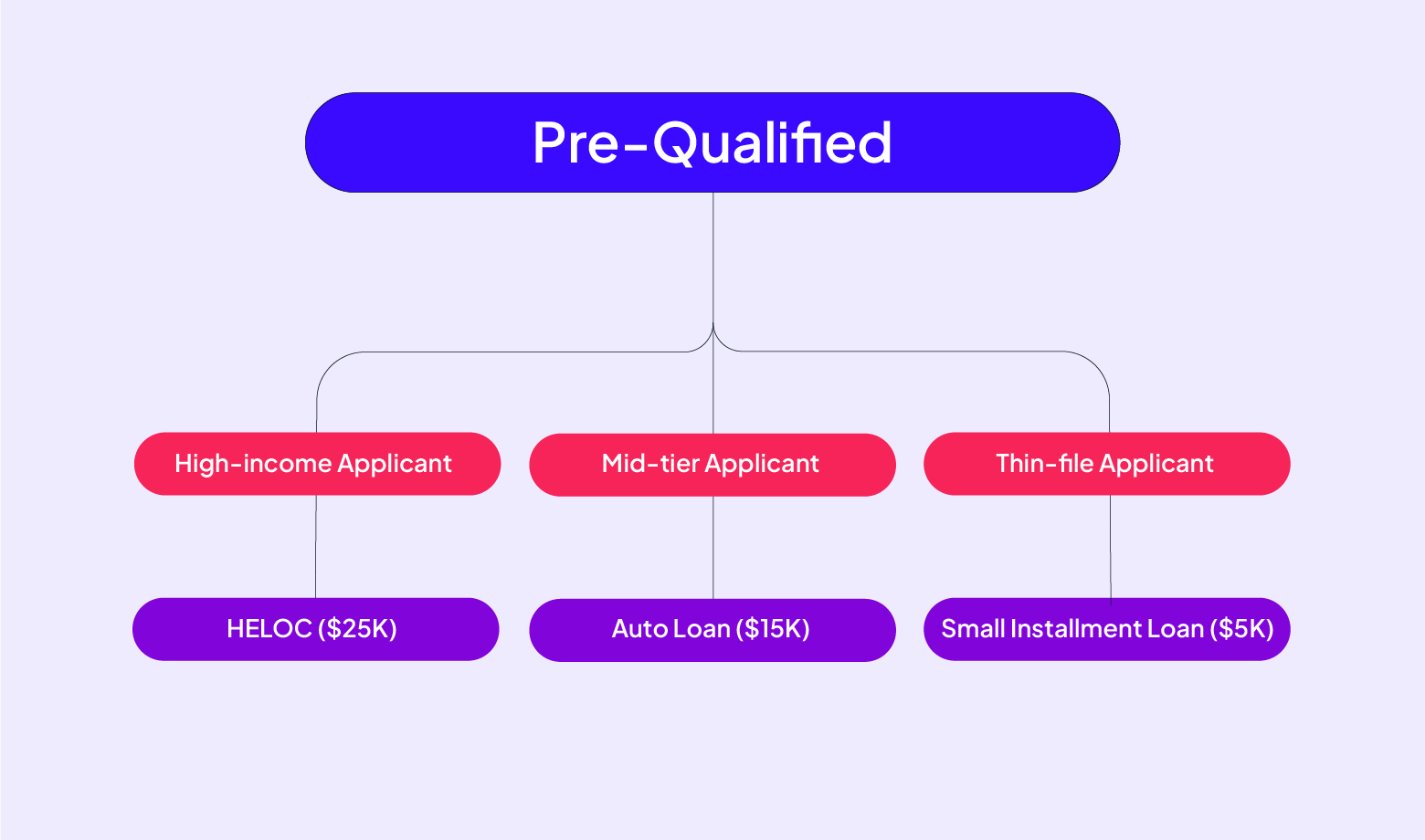

Targeted Risk Segmentation: Identify delinquent accounts early with predictive analytics and apply tailored recovery strategies for higher success rates.

Dynamic Escalation Strategies: Adjust collections tactics in real time based on borrower behavior, risk profiles, and repayment likelihood to increase recovery rates.

Automated Compliance Monitoring: Ensure regulatory adherence with built-in dynamic compliance management that adjusts strategies based on jurisdictional requirements.

Personalized borrower engagement to boost outcomes

AI-powered Outreach: Automate borrower contact through intelligent prioritization, ensuring high-risk accounts are addressed first for maximum impact.

Multi-Channel Communication: Engage borrowers via their preferred channels—SMS, email, phone, or in-app messaging—for higher response rates and improved repayment outcomes.

Tailored Repayment Recommendations: Generate personalized repayment plans using real-time behavioral and financial insights to help borrowers meet their obligations while improving satisfaction.

End-to-end automation for operational efficiency

Real-Time Monitoring and Escalation: Track account activity continuously and trigger immediate interventions to prevent delinquency progression.

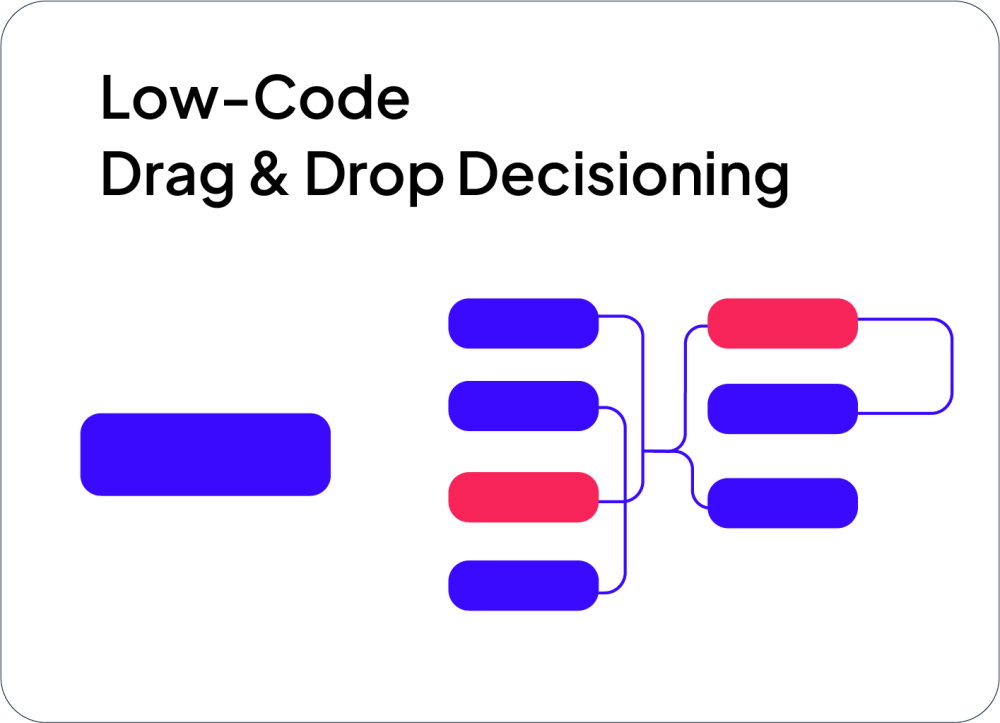

Configurable, No-Code Workflows: Adjust collection strategies and workflows instantly without IT support, enabling rapid responses to changing borrower behavior.

Fully Automated Collections Lifecycle: Streamline account validation, skip tracing, repayment plan generation, and follow-up outreach for a more efficient and effective collections process.

Why GDS Link outperforms other collections solutions

Use machine learning models and behavioral analytics to predict delinquency risks, prioritize recovery efforts, and dynamically adjust collections strategies in real time

Unlike rigid competitor solutions, GDS Link empowers lenders with fully configurable, no-code automation, enabling them to manage collections workflows without limitations.

Leverage event-triggered automation, borrower behavior analysis, and tailored outreach strategies to engage customers more effectively and improve repayment rates.

"With GDS Link, we increased our collections recovery rates by 30% while reducing operational costs through automation and AI-driven borrower engagement."

Own your strategy, seize every opportunity

Improve recovery rates and reduce delinquencies with GDS Link’s advanced collections strategies. Contact us to learn how our solutions can optimize your collections processes.