Unlock Borrower Insights with Open Banking Data

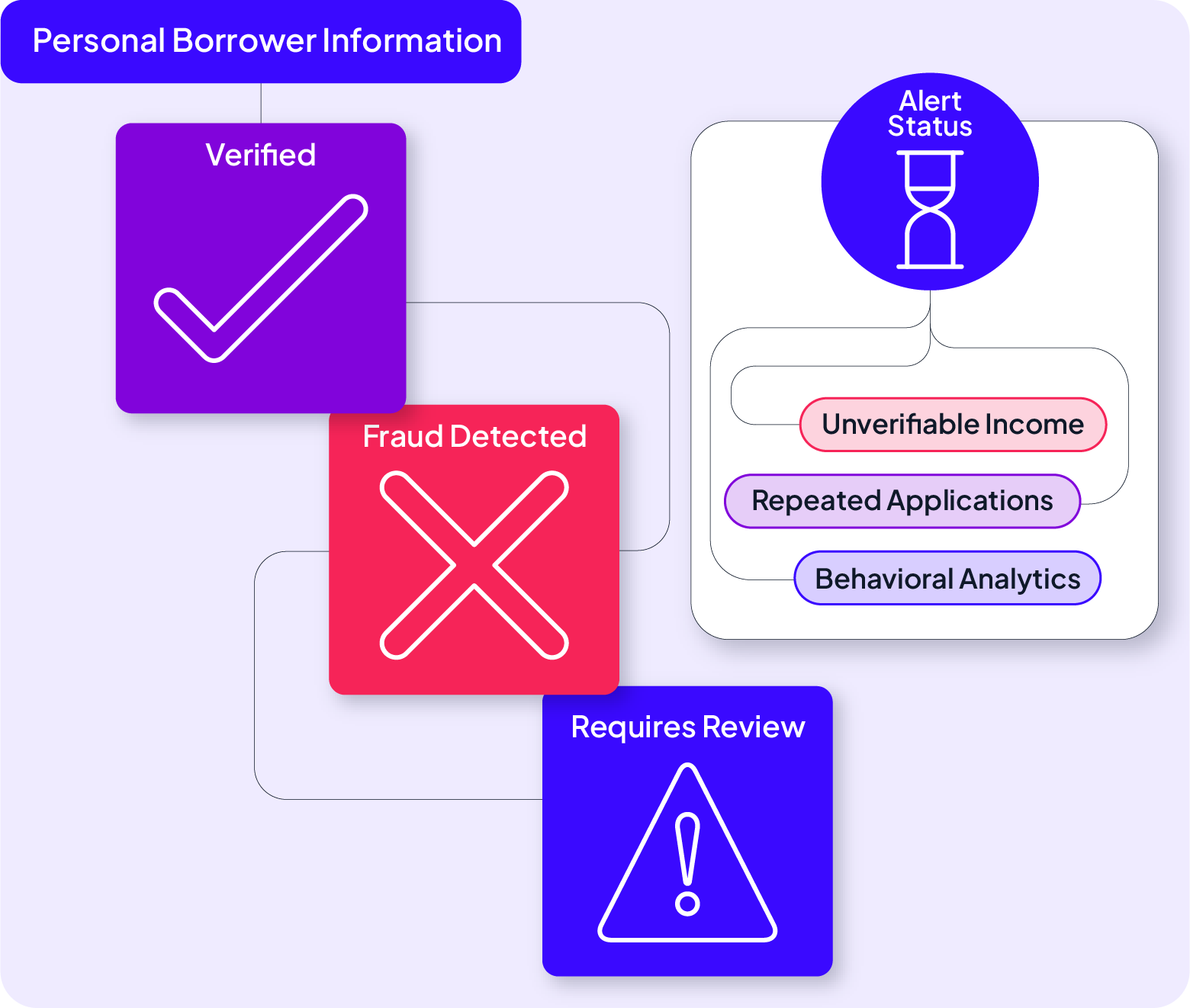

Traditional credit data no longer paints a complete picture of a borrower’s financial health. To remain competitive, lenders need deeper visibility into real-time financial behavior. GDS Link’s Open Banking Attributes module integrates transactional data directly from consumers’ bank accounts, providing powerful insights into income, spending habits, and cash flow.

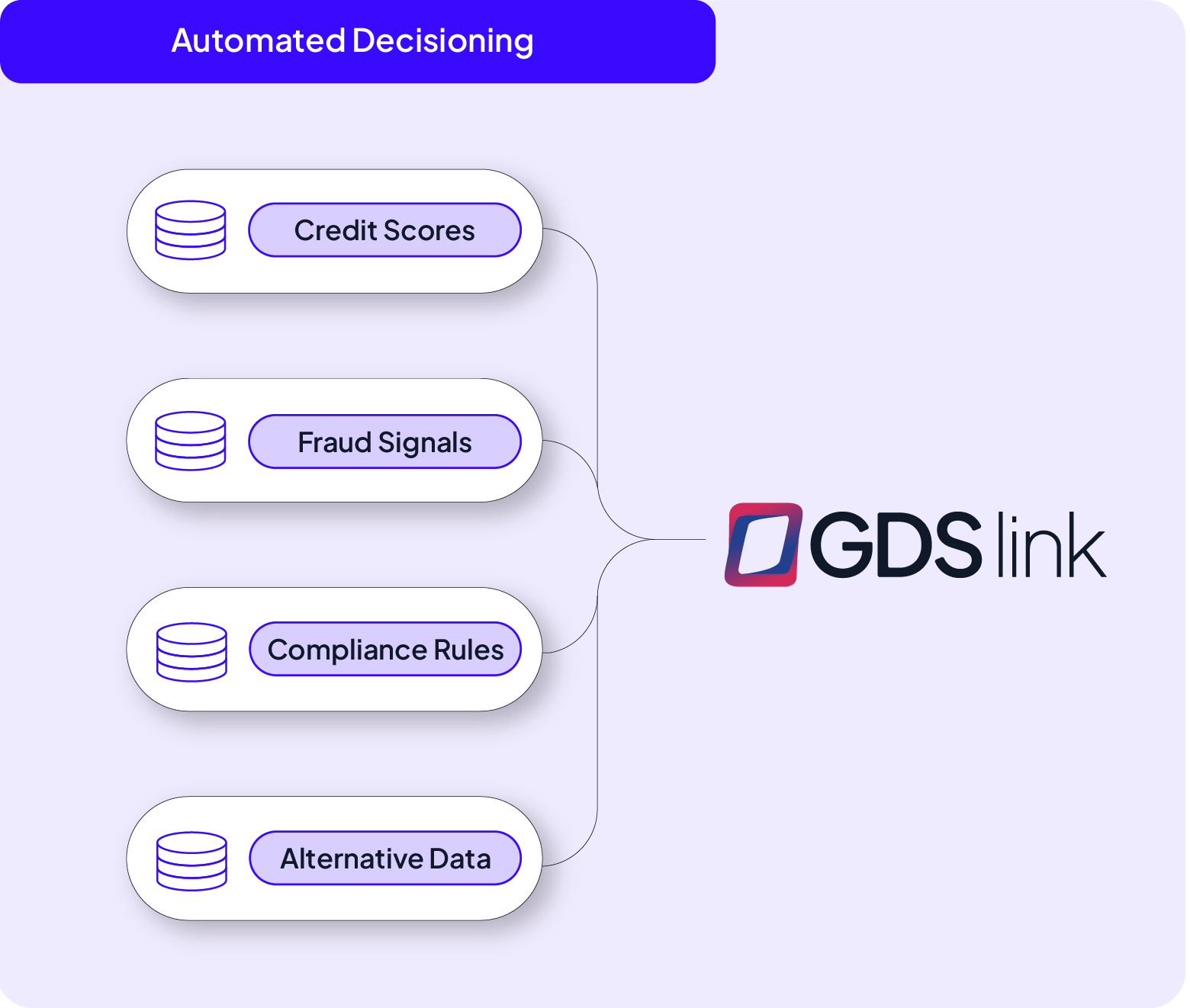

Part of the GDS Link Decisioning Platform, Open Banking Attributes enable lenders to enhance credit assessments with real-time financial data. Gain a clearer understanding of borrower affordability, reduce risk exposure, and expand access to credit with smarter, data-driven decisions.

Enhance credit decisions with real-time financial data

Connect directly to consumer bank accounts with secure, consent-driven API integrations for up-to-date financial insights.

Analyze income streams, recurring expenses, and cash flow trends to determine borrowers’ true financial capacity.

Effectively service underbanked borrowers or those with thin credit files using alternative insights beyond traditional credit scores.

Transform credit risk assessments with deeper financial insights

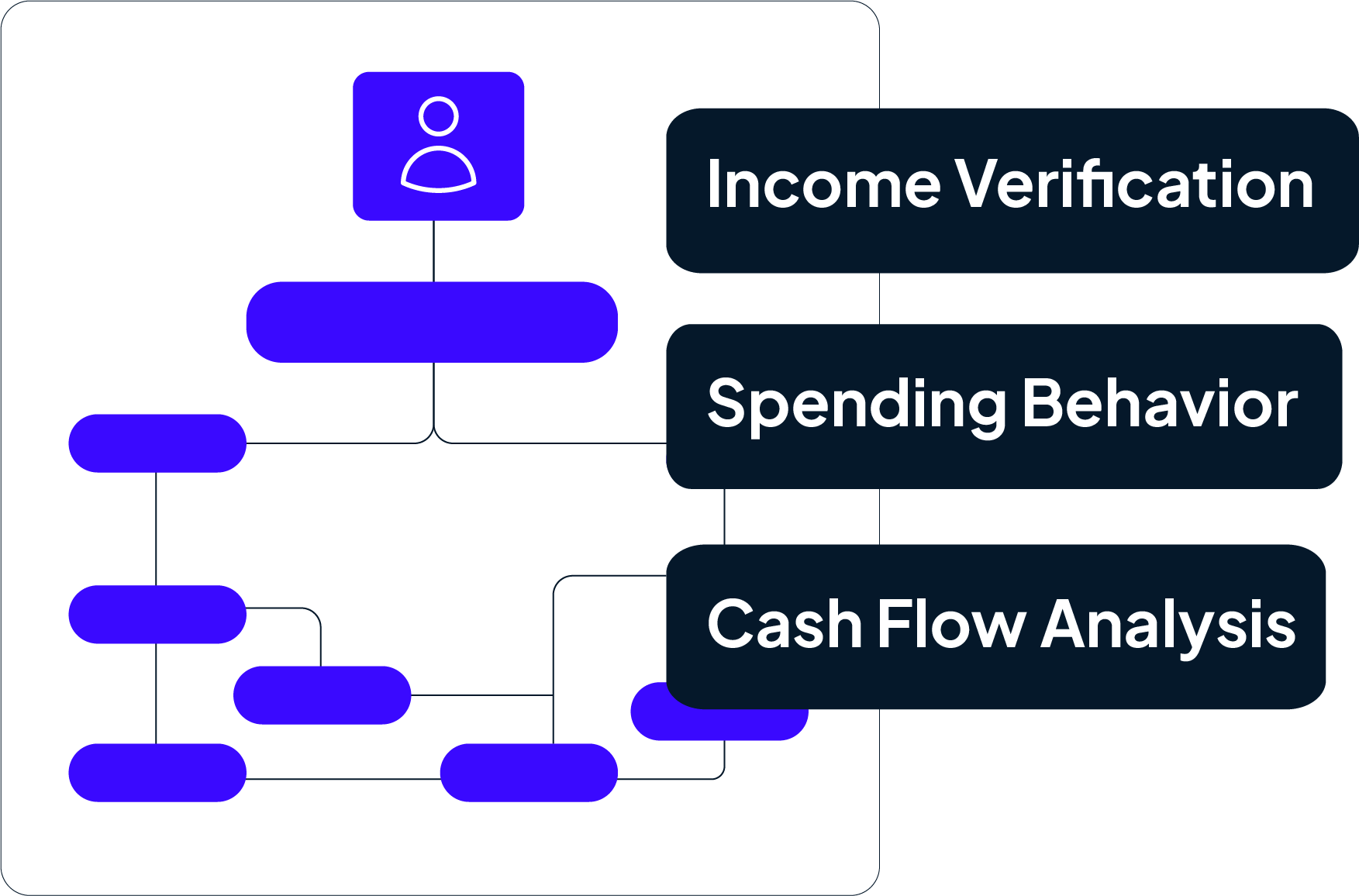

Traditional credit scoring models can leave out valuable financial data, limiting opportunities for lenders and borrowers alike. GDS Link’s Open Banking Attributes provide real-time access to income verification, spending behavior, and cash flow analysis—empowering lenders to expand credit access while minimizing risk exposure.

Comprehensive financial data coverage

Access over 850+ standardized financial attributes across multiple open banking providers. This data spans account balances, income streams, spending habits, and recurring obligations, offering lenders a clear and complete picture of borrower financial health.

Accurate, enhanced income verification

Verify income directly from connected bank accounts to ensure lending decisions are based on current financial data. This reduces reliance on outdated reports and enhances affordability assessments, especially for self-employed and gig workers.

Seamless integration into lending workflows

As part of the GDS Link Decisioning Platform, this module integrates smoothly with existing workflows through secure APIs, reducing IT overhead while improving operational efficiency.

Comprehensive credit data for every lending institution

Integrate open banking data to personalize loan offers and improve underwriting accuracy.

Read More

Enhance affordability assessments with deeper insights into members’ income and cash flow.

Read More

Expand credit access to underserved borrowers by leveraging alternative data for risk evaluation.

Read MoreUnify credit data for smarter, faster lending decisions

Modern Lending Made Simple starts here. With GDS Link’s Open Banking Attributes, lenders gain access to rich, real-time financial data and unlock smarter, more inclusive lending decisions. As part of the GDS Link Decisioning Platform, it ensures your lending strategies are always informed by the most up-to-date financial insights.