Unified Credit Data for Smarter, Consistent Lending Decisions

Fragmented credit data across different bureaus can lead to inconsistent borrower evaluations and inaccurate risk assessments. GDS Link’s Credit Attributes module standardizes data from Experian, Equifax, and TransUnion, providing a unified view of credit profiles for more accurate, data-driven decisions.

Part of the GDS Link Decisioning Platform, this module delivers access to over 7,000+ standardized attributes across diverse risk categories. Empower your lending strategies with a complete borrower profile, improve decision accuracy, and reduce manual effort through seamless data integration.

Comprehensive credit insights that drive smarter lending

Consolidate data from the three major credit bureaus into a unified format to ensure consistency in borrower evaluation and assessment.

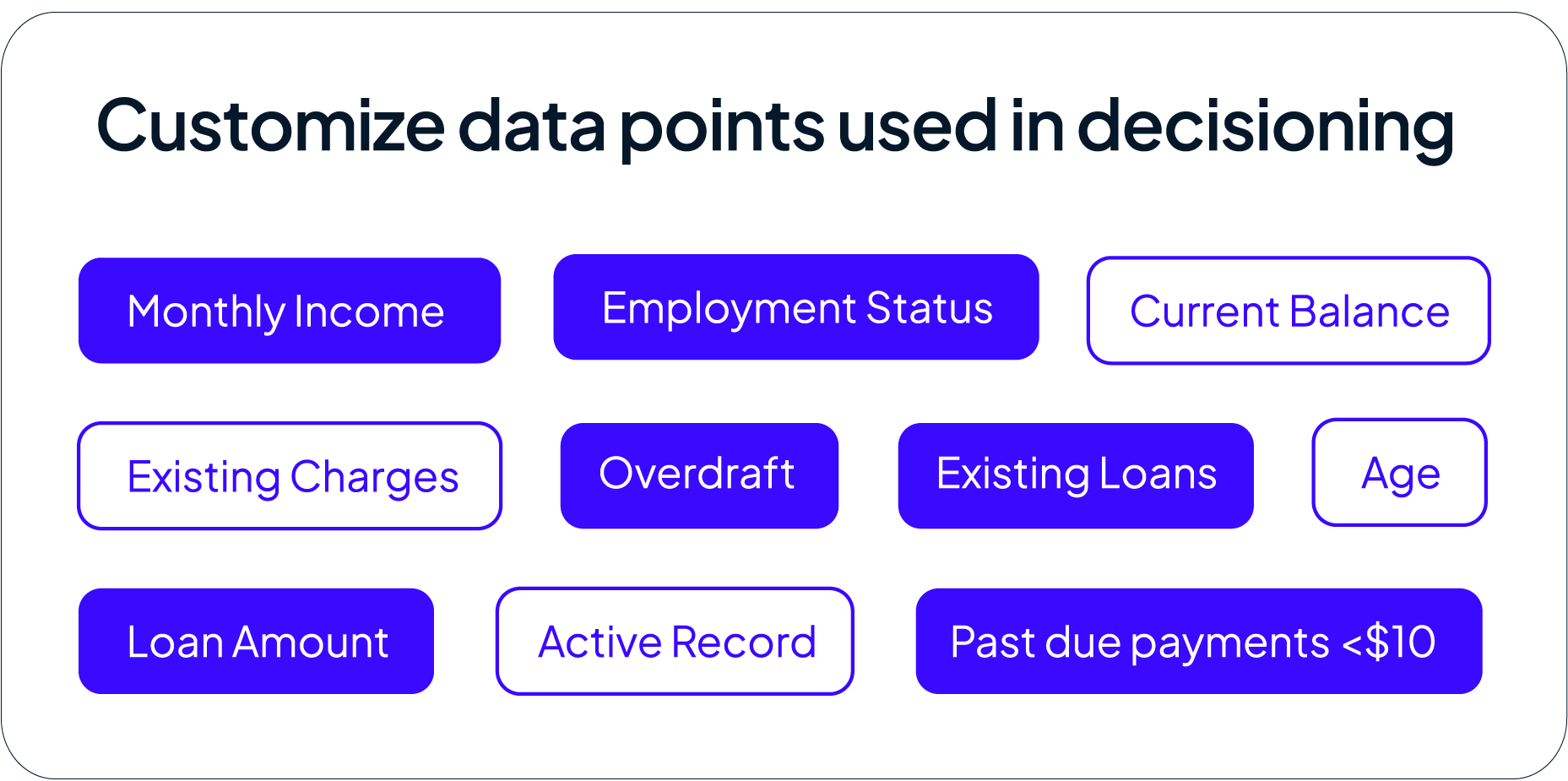

Access over 7,000+ attributes across various categories, including credit utilization, payment history, account balances, and derogatory events, for a complete borrower risk profile.

Minimize data discrepancies and streamline decision workflows by integrating consistent, high-quality credit data directly into your risk evaluation process.

Eliminate data fragmentation for accurate lending decisions

Inconsistent or incomplete credit data can result in inaccurate borrower assessments and missed lending opportunities. GDS Link’s Credit Attributes module consolidates multi-bureau data into a standardized structure, allowing lenders to build a more accurate picture of borrower creditworthiness. This reduces risk, improves decision-making consistency, and accelerates lending operations across all channels.

Unified credit data across all major bureaus

Simplify the risk evaluation process by consolidating borrower data from Experian, Equifax, and TransUnion into a standardized format for streamlined decisioning and consistent risk assessments.

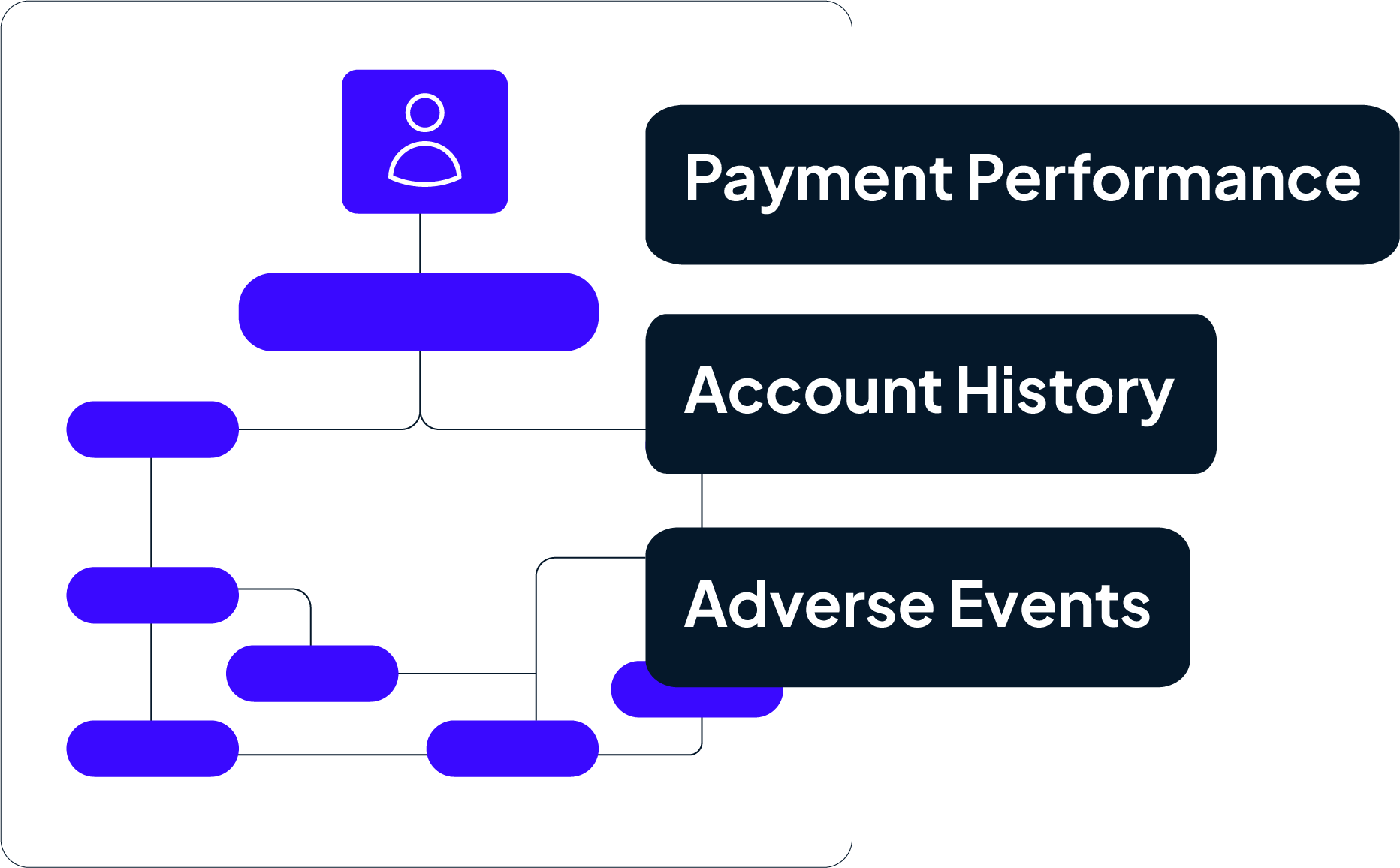

Extensive risk attribute library

Utilize over 7,000+ attributes covering multiple risk categories, including payment performance, account history, credit utilization rates, and adverse events, to build more accurate and predictive risk models.

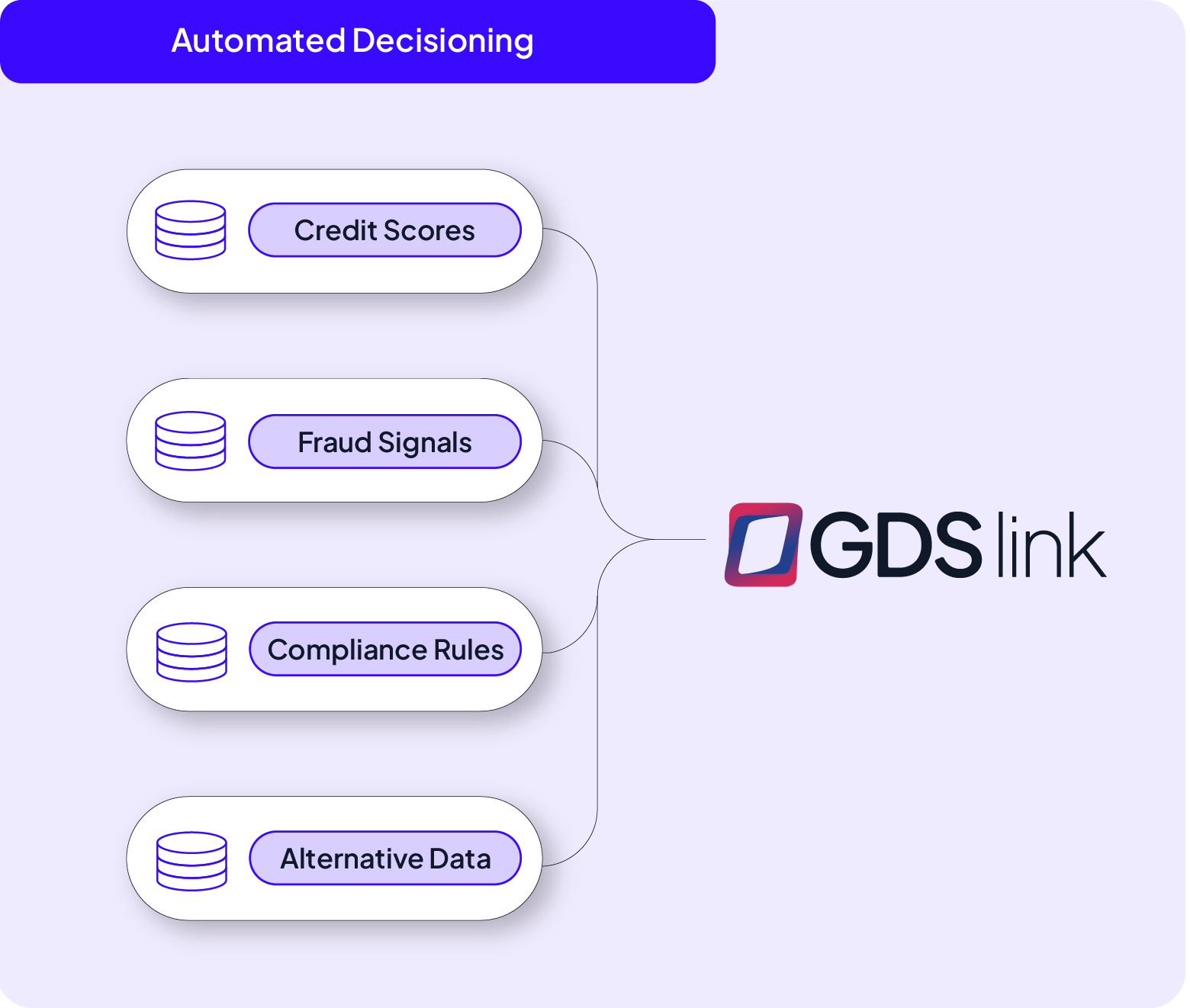

Seamless integration with decisioning workflows

Integrate standardized credit data directly into your lending workflows with flexible APIs and minimal IT effort. This ensures that all decision-making processes use the same consistent, high-quality data, reducing errors and improving efficiency.

Tailored credit data solutions for every lending institution

Unify credit data across loan products for consistent evaluations, improved compliance, and enhanced underwriting accuracy.

Read More

Deliver more personalized lending experiences by integrating enriched credit attributes into member-focused strategies.

Read More

Leverage a comprehensive view of borrower credit profiles to expand lending opportunities and better serve underbanked markets.

Read MoreUnify credit data for smarter, faster lending decisions

Modern Lending Made Simple starts here. GDS Link’s Credit Attributes provides a standardized, consolidated view of borrower data from all major credit bureaus. Working in concert with Decisioning Platform ecosystem, it empowers lenders to reduce risk, improve lending decisions, and streamline operations through a unified credit data framework.