Monitor and Optimize

Lending Policies in Real-Time

As lending policies evolve and regulatory landscapes shift, lenders need tools that ensure compliance and optimize decision-making in real time. GDS Link’s Policy Monitoring & Insights module helps financial institutions track, analyze, and refine credit policies dynamically—reducing risk exposure and ensuring regulatory adherence.

Part of the GDS Link Decisioning Platform, this module empowers lenders to enforce real-time policy compliance, monitor adherence to internal rules, and gain actionable insights for continuous improvement. Stay ahead of regulatory changes while enhancing decision precision and operational efficiency.

Proactive policy monitoring for smarter lending decisions

Ensure consistent application of lending rules across all decision workflows and stay ahead of regulatory changes.

Minimize the need for manual oversight with automated rule enforcement and comprehensive built-in regulatory checks.

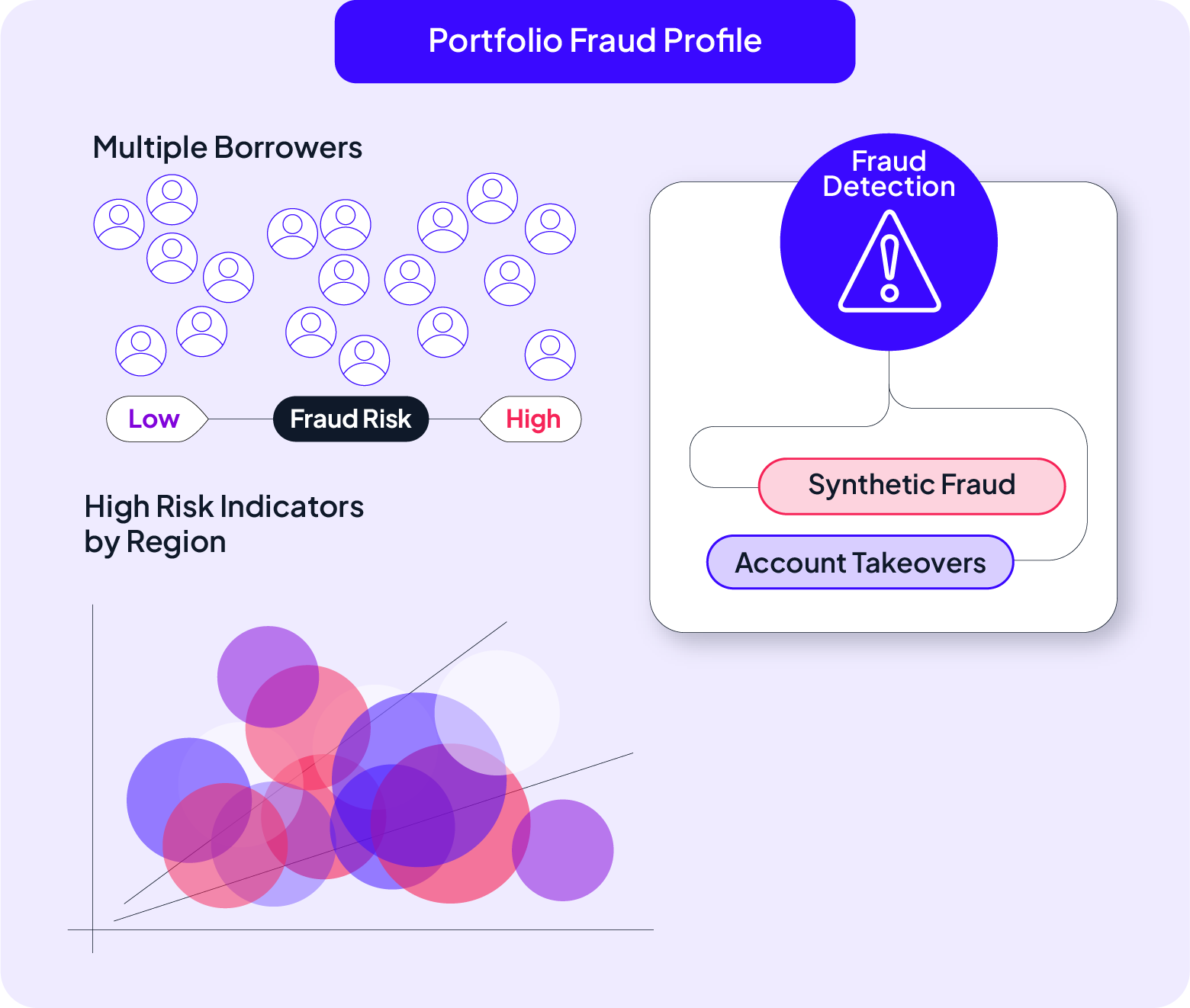

Leverage real-time analytics to identify policy gaps, measure effectiveness, and optimize risk strategies.

Empower smarter, more agile credit policy management

Maintaining up-to-date lending policies while managing regulatory compliance is complex and time-consuming. GDS Link’s Policy Monitoring & Insights module automates policy enforcement, tracks adherence, and provides actionable analytics to help lenders refine credit risk strategies in real time—reducing operational risk while improving portfolio performance.

Rapid policy deployment

Easily implement and update credit and risk policies without relying on IT resources. This module gives users the power to adjust decision rules in real time, allowing lenders to respond immediately to market changes, regulatory shifts, or evolving business strategies—ensuring your lending operation remains agile and competitive.

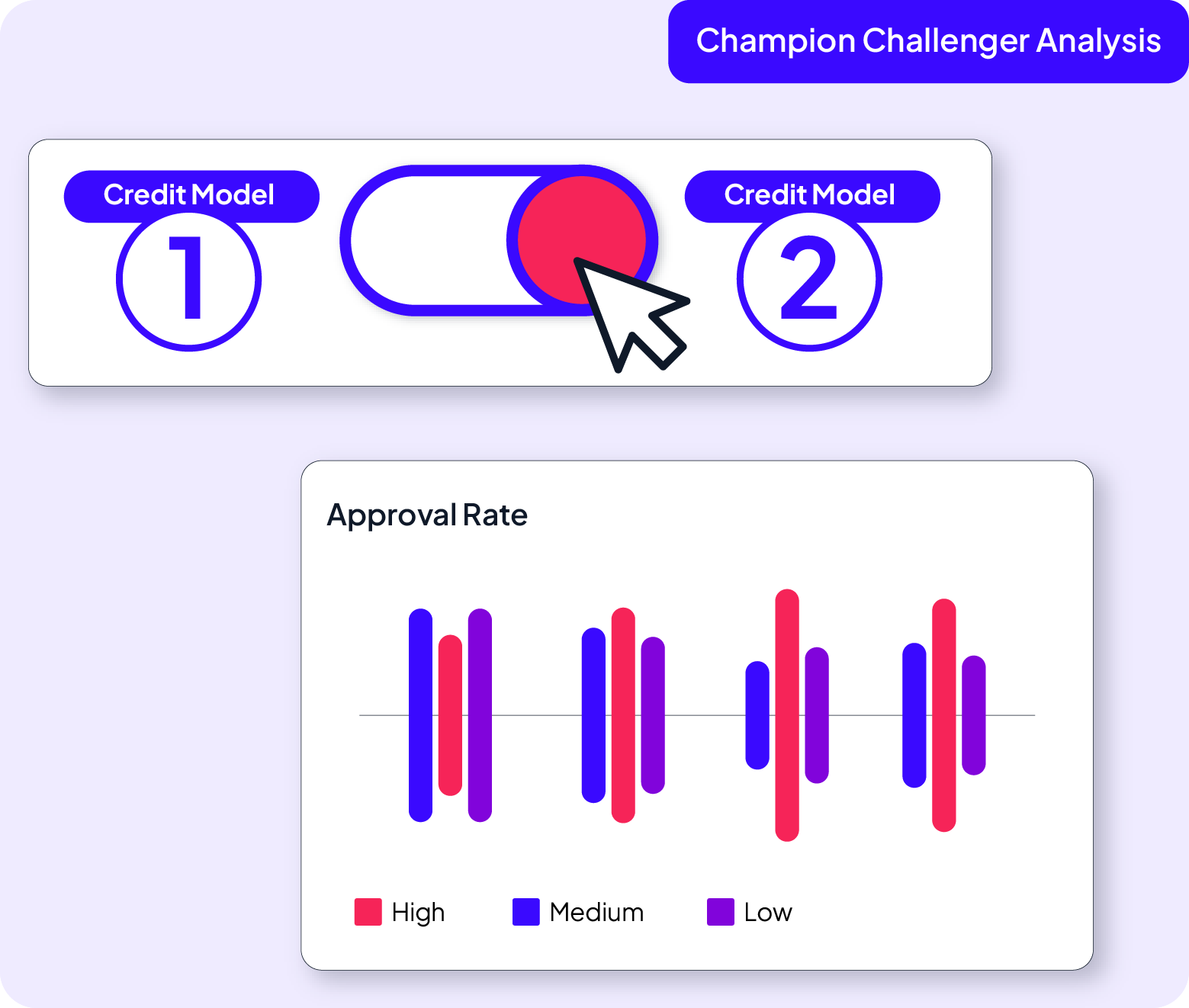

In-depth policy testing and simulation

Before deploying policy changes, simulate outcomes using live data and historical scenarios. This allows lenders to understand the potential impact of new strategies on approval rates, risk exposure, and compliance—without jeopardizing current operations. Confidently refine decision logic while minimizing risk.

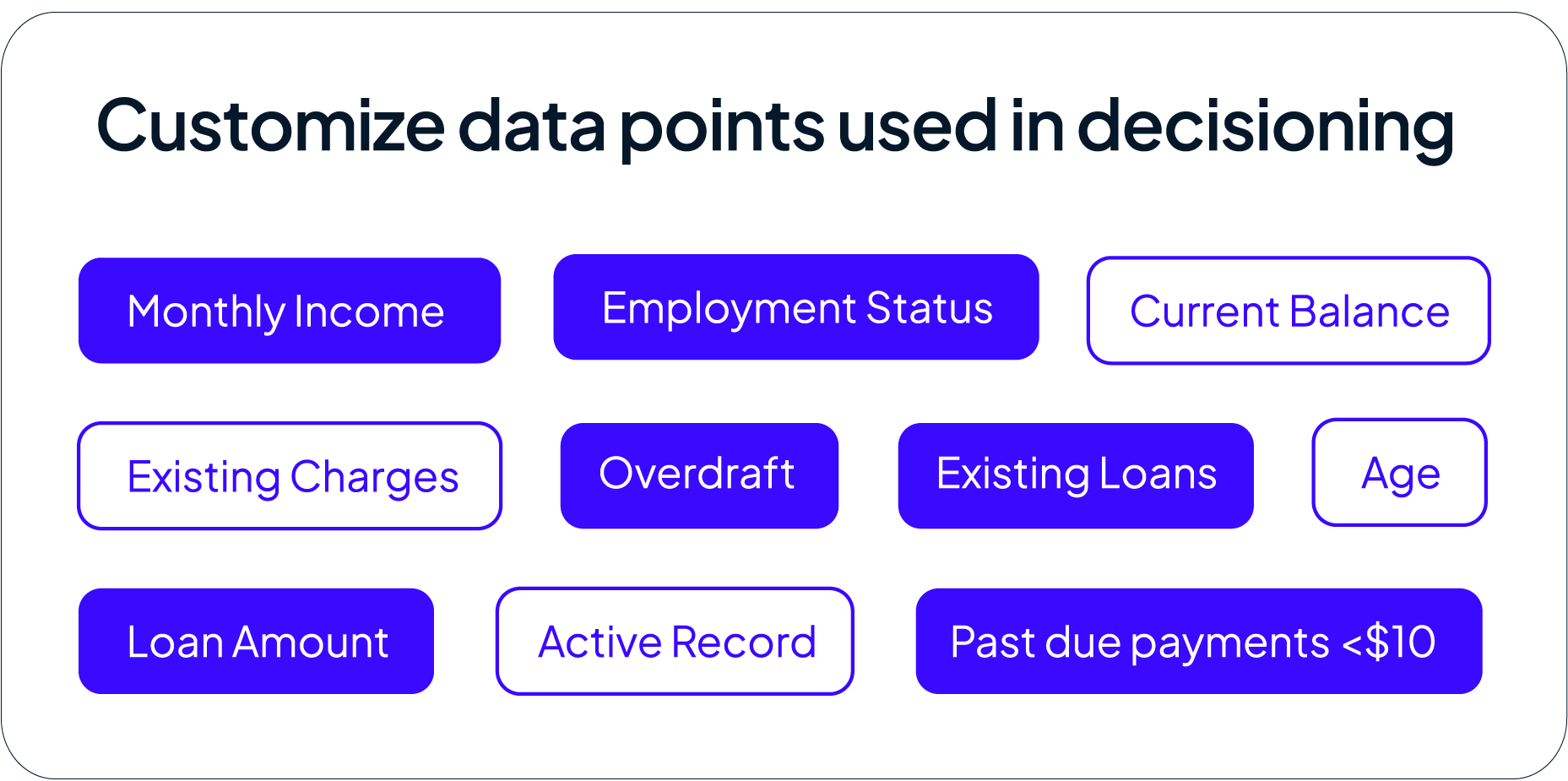

Full control over credit risk strategies

Own every aspect of your credit and risk policies with customizable decision frameworks tailored to your institution’s specific needs. Adjust thresholds, modify risk scoring models, and fine-tune decision parameters in real time to stay aligned with business objectives while optimizing portfolio performance.

Comprehensive credit data for every lending institution

Streamline risk strategy updates and accelerate policy adjustments with real-time deployment tools while improving decision accuracy across all lending products.

Read More

Enhance member-centric lending by customizing risk policies to meet evolving member needs, offering more competitive loan terms while maintaining responsible lending practices.

Read More

Stay ahead of market shifts with flexible, data-driven risk strategies, ensuring adaptability without disrupting the speed or efficiency of digital lending processes.

Read MoreUnify credit data for smarter, faster lending decisions

Modern Lending Made Simple starts here. GDS Link’s Policy Monitoring & Insights empowers lenders to own their risk and credit strategies with unmatched flexibility. As part of the GDS Link Decisioning Platform, ensure your institution remains competitive, compliant, and responsive to shifting market demands.