One platform,

limitless opportunities

The GDS Link Decisioning Platform empowers lenders to streamline operations, make precise decisions, and unlock growth in today’s complex lending environment. Built for speed and scalability, the platform seamlessly integrates real-time analytics, advanced AI models, and diverse data sources to deliver unparalleled accuracy and efficiency.

Whether you are optimizing loan originations, mitigating risk, or ensuring compliance, GDS Link provides the tools to adapt to evolving customer demands and market challenges. With its modular and flexible design, the platform supports organizations of all sizes, enabling smarter decisions across the entire credit lifecycle.

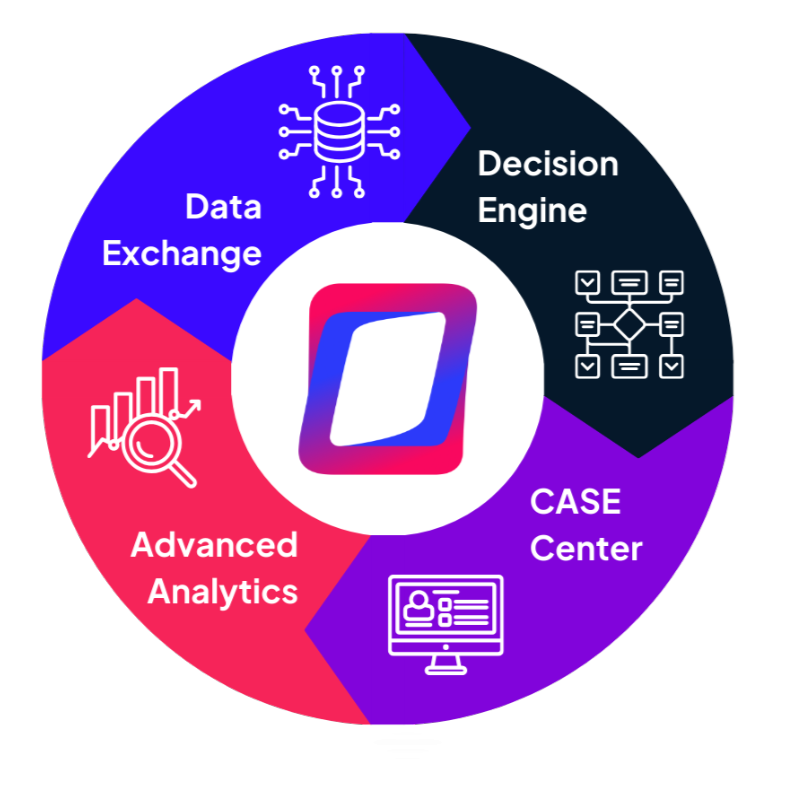

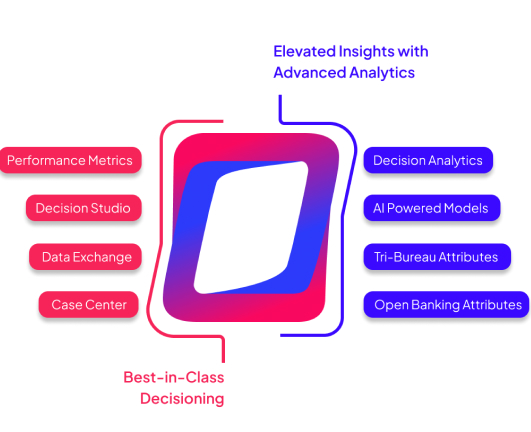

One platform linking decisioning and analytics

The GDS Link Decisioning Platform is a fully integrated solution that adapts to your unique business requirements.

- End-to-end decisioning to manage every phase of the credit lifecycle

- AI-powered analytics to leverage advanced models and real-time insights

- Seamless integration connecting to over 200 data sources and existing systems

- Scalable and flexible to grow with your business and adapt to market demands

Our platform allows you to make quick, better decisions, so you can see every opportunity and push your business to its full potential.

Explore our core capabilities

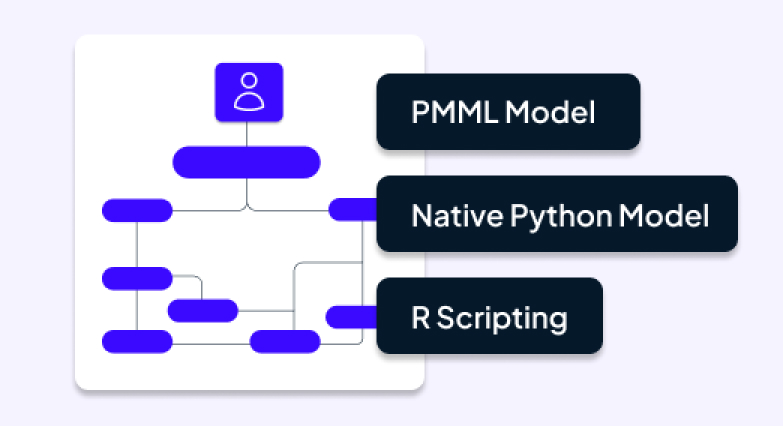

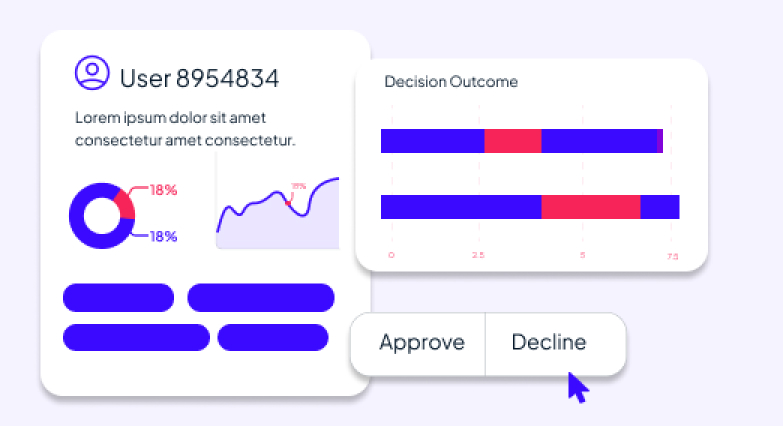

Automate your credit risk strategies with dynamic tools that deliver faster, more precise outcomes while adapting seamlessly to evolving business needs.

- Support for diverse model types, including PMML, Python, and R, for tailored decisioning.

- Scalable workflows to optimize originations, underwriting, and other critical processes.

Optimize your decision-making with advanced analytics and performance monitoring, delivering precise, real-time insights and adaptability.

- Comprehensive tri-bureau and open banking attributes for deeper consumer insights.

- Real-time monitoring of models, policies, and systems to drive continuous improvement.

Trusted by brands worldwide

Join leading financial institutions and innovative lenders who trust GDS Link to transform their decision-making processes.

Real Clients, Real Results

The numbers don't lie

trusted by lenders worldwide

decisions are made every year

driving innovation in credit risk

Frequently Asked Questions

Not able to find answers you’re looking for?

Reach out to our customer support team.

The GDS Link Decisioning Platform is an advanced risk decisioning solution that streamlines credit decision-making through real-time analytics, AI-driven models, and seamless data integration. It empowers lenders to optimize workflows, manage risk, and ensure compliance across the entire credit lifecycle.

The platform leverages AI-powered analytics and supports diverse model types, including PMML, Python, and R, to deliver precise, data-driven decisions. Real-time monitoring ensures continuous improvement of workflows and decision strategies.

Yes, the GDS Link Decisioning Platform is designed for seamless integration with your current systems. Its pre-built connectors and APIs simplify data aggregation and enable efficient decisioning processes.

Banks, credit unions, fintechs, and specialty lenders can leverage the platform to enhance loan originations, improve underwriting accuracy, manage risk effectively, and stay compliant with evolving regulations.

The platform offers unmatched integration capabilities, with access to tri-bureau and open banking data, low-code customization, and advanced performance monitoring for models, policies, and systems, ensuring precision and scalability for any lending environment.

Experience the GDS Link Decisioning Platform

With advanced analytics, seamless data integration, and real-time decisioning, our platform empowers smarter, faster, and more precise lending outcomes. See how Modern Lending Made Simple can help you optimize risk, streamline workflows, and scale your operations with confidence.