Develop, Deploy, and Monitor Custom Credit Models with Confidence

Generic predictive models rarely align with the unique risk profiles and business goals of modern lenders. GDS Link’s Custom Model Development & Monitoring module empowers financial institutions to create tailored AI-powered models and monitor their performance in real time. Stay ahead of market changes, ensure model stability, and optimize risk strategies without disrupting your lending workflows.

GDS Link's dedicated team of data scientists helps you build custom models that reflect your business needs while offering real-time monitoring to detect degradation early. Ensure your models remain accurate, effective, and aligned with evolving market demands.

Tailor and maintain predictive models for optimal lending decisions

Build models specifically designed for your business needs, addressing unique risk factors and operational requirements.

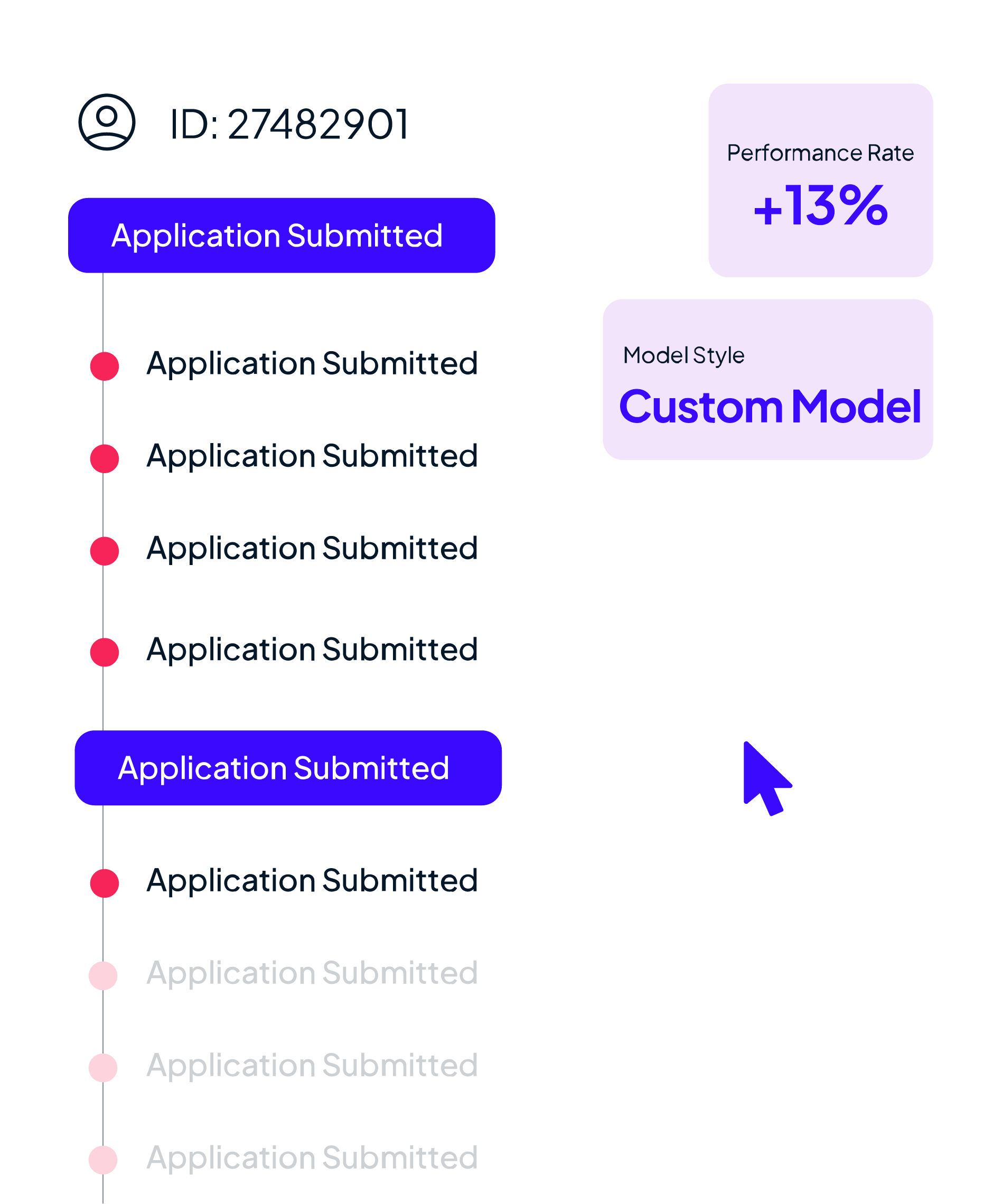

Track performance, detect degradation early, and ensure ongoing model accuracy across all decision workflows.

Easily integrate custom models into existing decision frameworks for uninterrupted lending processes.

Precision-driven models that evolve with your business

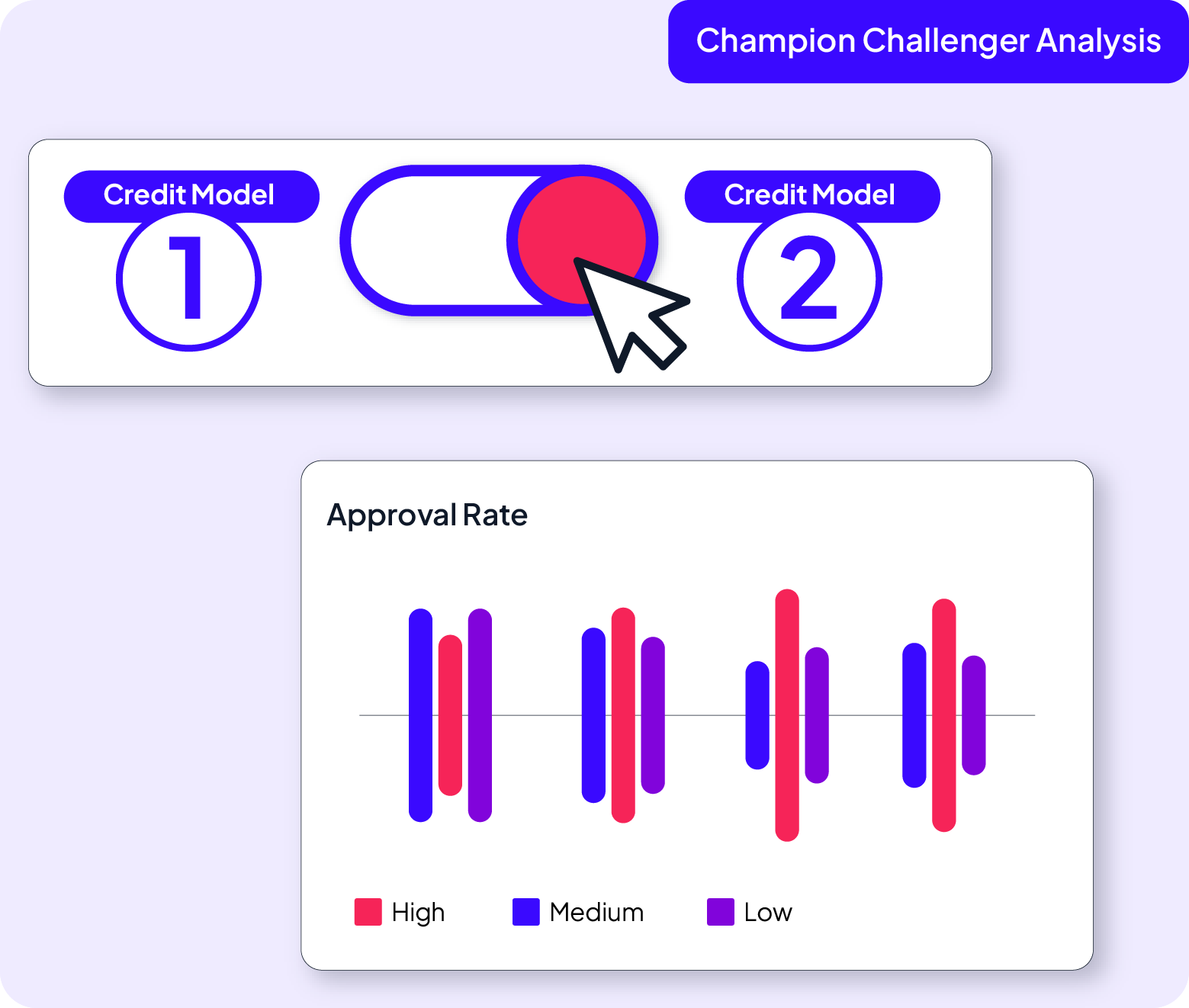

Off-the-shelf models can’t adapt to your business’s evolving risk environment. GDS Link’s Custom Model Development & Monitoring module allows lenders to build models tailored to specific business goals while proactively monitoring performance. With real-time stability checks, configurable alerts, and actionable insights, your models stay effective, relevant, and compliant over time.

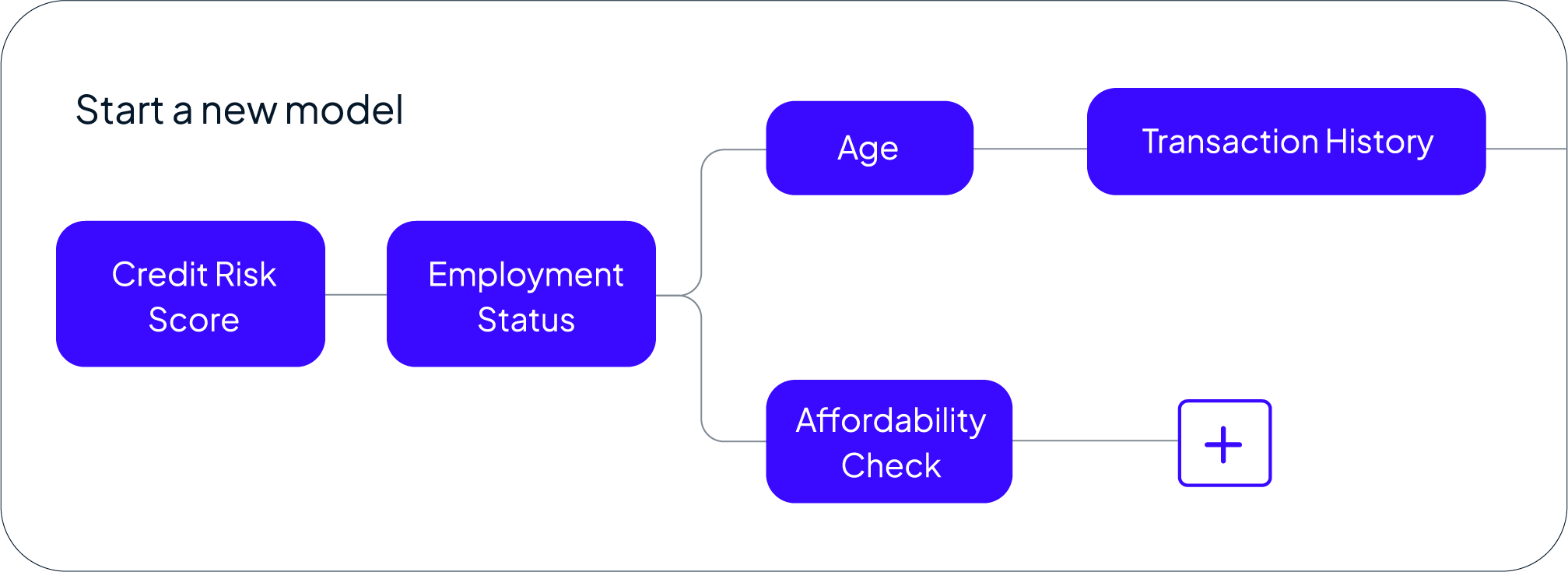

Tailored model development

Collaborate with GDS Link’s analytics team to develop AI-powered models that address your specific risk profiles, lending strategies, and operational goals. Tailor every element of your model to improve predictive accuracy and reduce risk exposure.

Continuous model monitoring

Track the health of your models in real time with key performance indicators like Population Stability Index (PSI), Gini coefficients, and AUC. Configurable alerts help detect early signs of degradation, allowing for recalibration before issues arise.

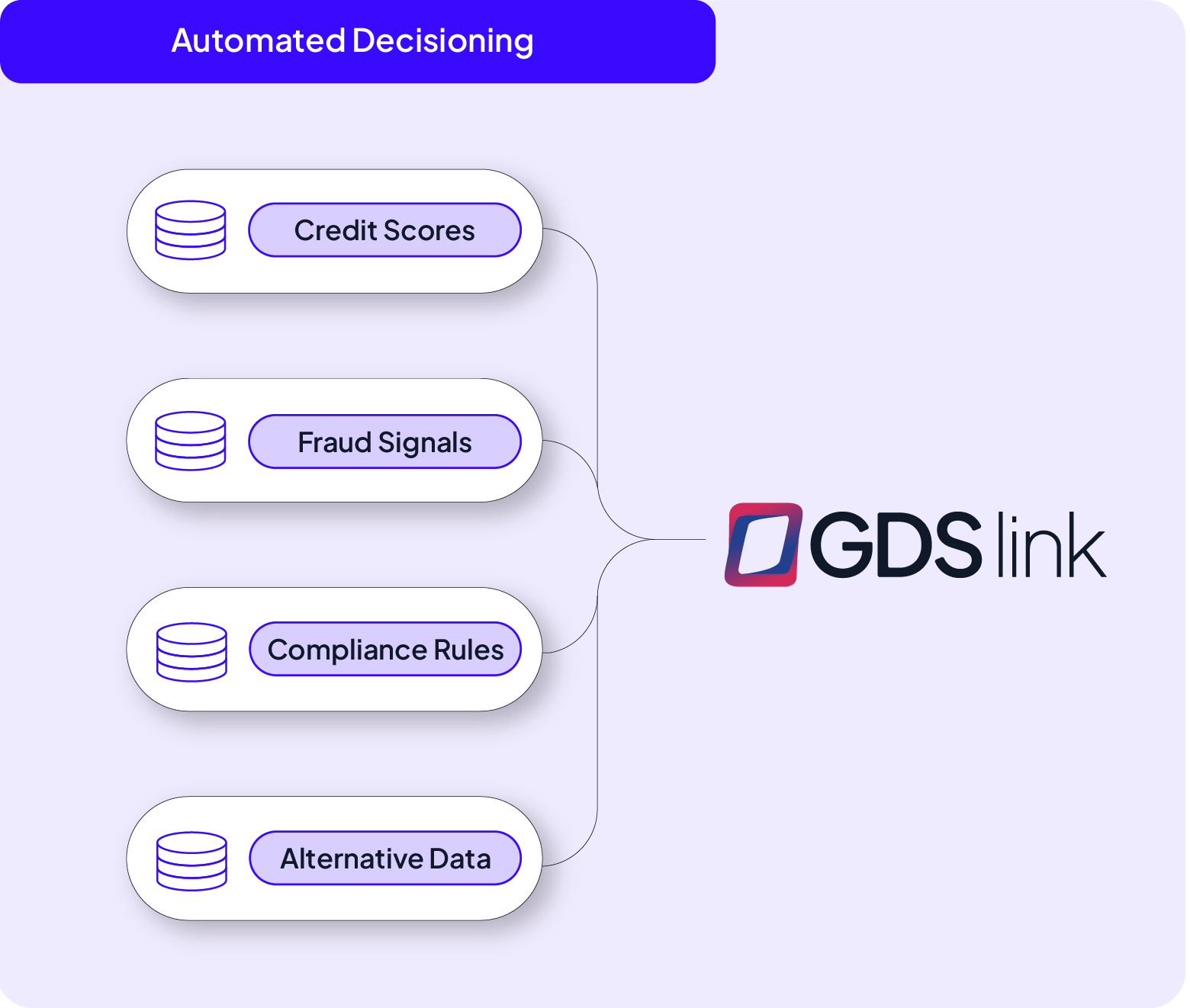

Seamless integration & deployment

Easily integrate custom models into your existing decisioning workflows without disrupting operations. The module supports a wide range of data sources, allowing you to enhance predictions with internal, external, and alternative data streams.

Custom models that adapt to any lending environment

Develop advanced risk models tailored for different loan products and monitor performance in real time to maintain regulatory compliance.

Read More

Create custom scoring models for member-focused lending strategies and ensure stability as member profiles evolve.

Read More

Build fast, flexible risk models tailored for digital lending environments while monitoring performance under high transaction volumes.

Read MoreCreate and monitor custom models that power smarter lending

Modern Lending Made Simple starts here. With GDS Link’s Custom Model Development & Monitoring module, lenders gain the flexibility to build models that reflect their unique business needs and ensure they stay accurate, aligned, and effective—no matter how fast the market evolves.