Proactive Account Management for Long-Term Growth

Managing customer accounts goes beyond tracking balances and credit limits—it’s about maximizing value, fostering loyalty, and mitigating risk. To stay ahead, lenders need proactive strategies that optimize portfolio performance and prevent defaults early.

GDS Link’s intelligent decisioning platform empowers lenders to adjust credit strategies dynamically, detect early risk signals, and personalize engagement throughout the customer lifecycle. With AI-driven analytics, real-time monitoring, and automated workflows, financial institutions can enhance retention, unlock revenue opportunities, and drive smarter, data-driven decisions—all while ensuring long-term portfolio health and growth.

Drive smarter account decisions with GDS Link

Manage portfolio and account-level risk for enhanced profitability

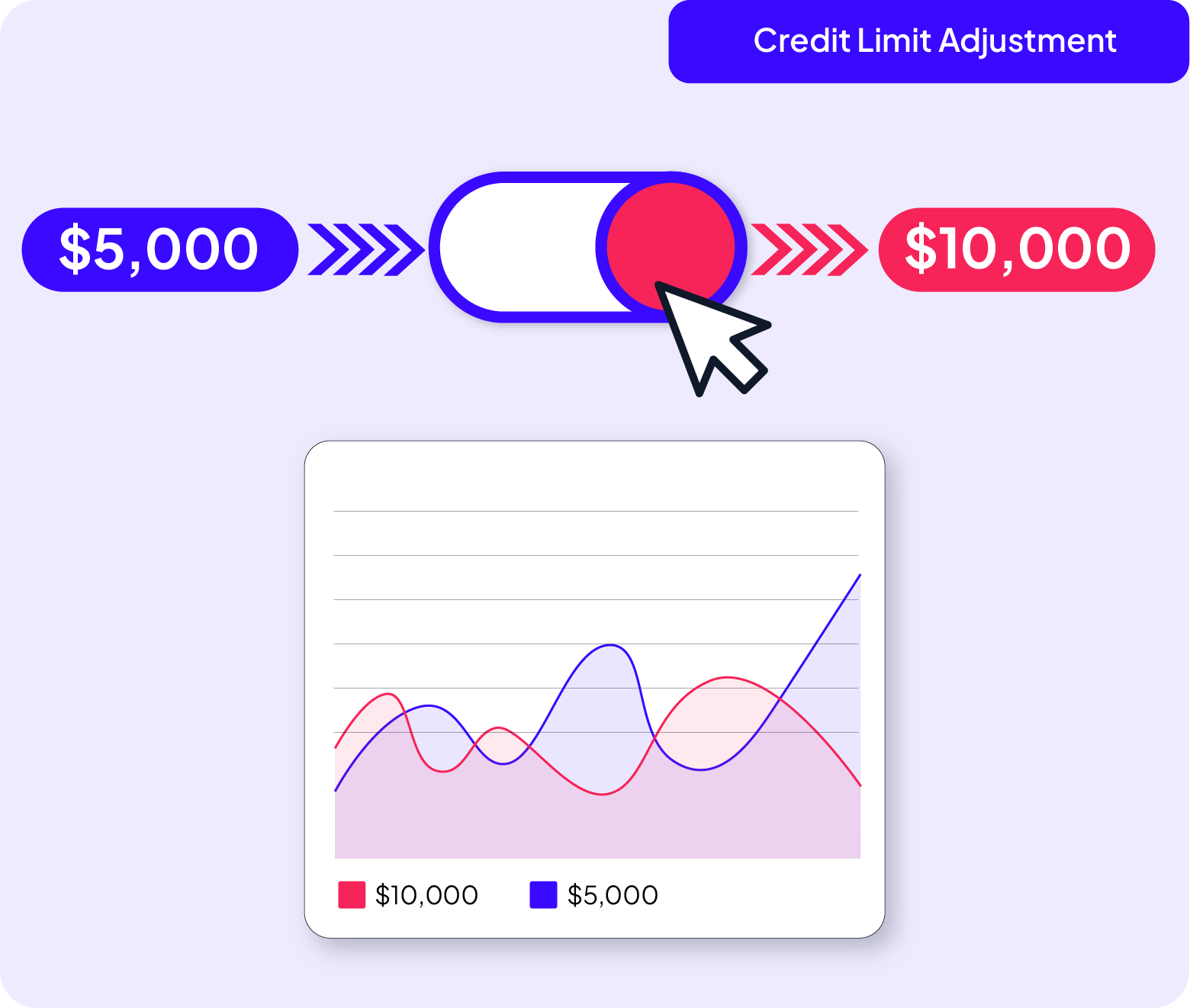

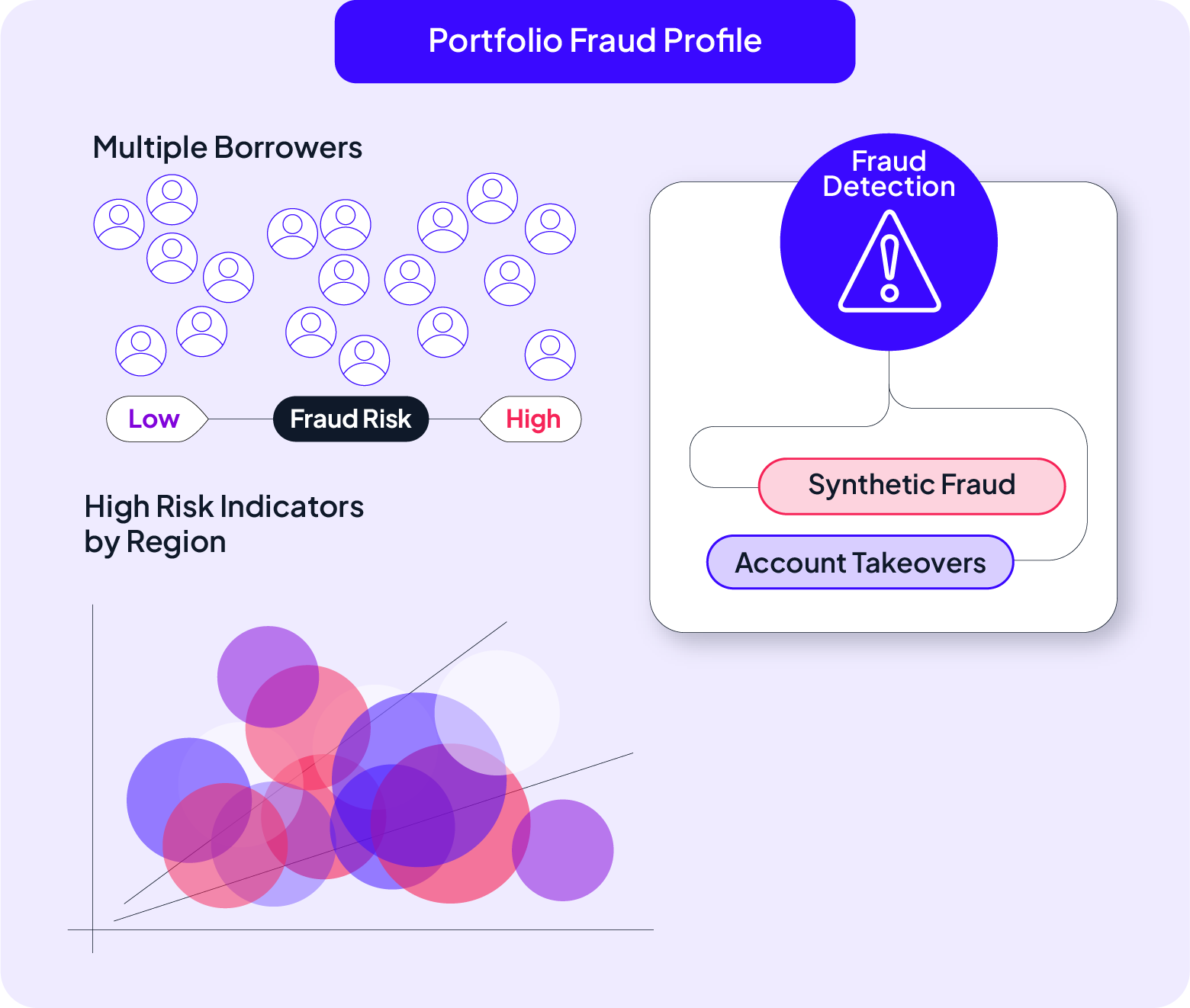

Proactive Risk Mitigation: Dynamically adjust credit decisions at the account level to identify and mitigate risk before it impacts portfolio performance.

Regulatory Compliance with Confidence: Stay ahead of evolving regulations with built-in compliance tools that adjust in real time to policy changes.

Real-Time Monitoring & Intervention: Detect early warning signs of delinquency and take preemptive action to reduce charge-offs and late payments.

Enable intelligent customer engagement

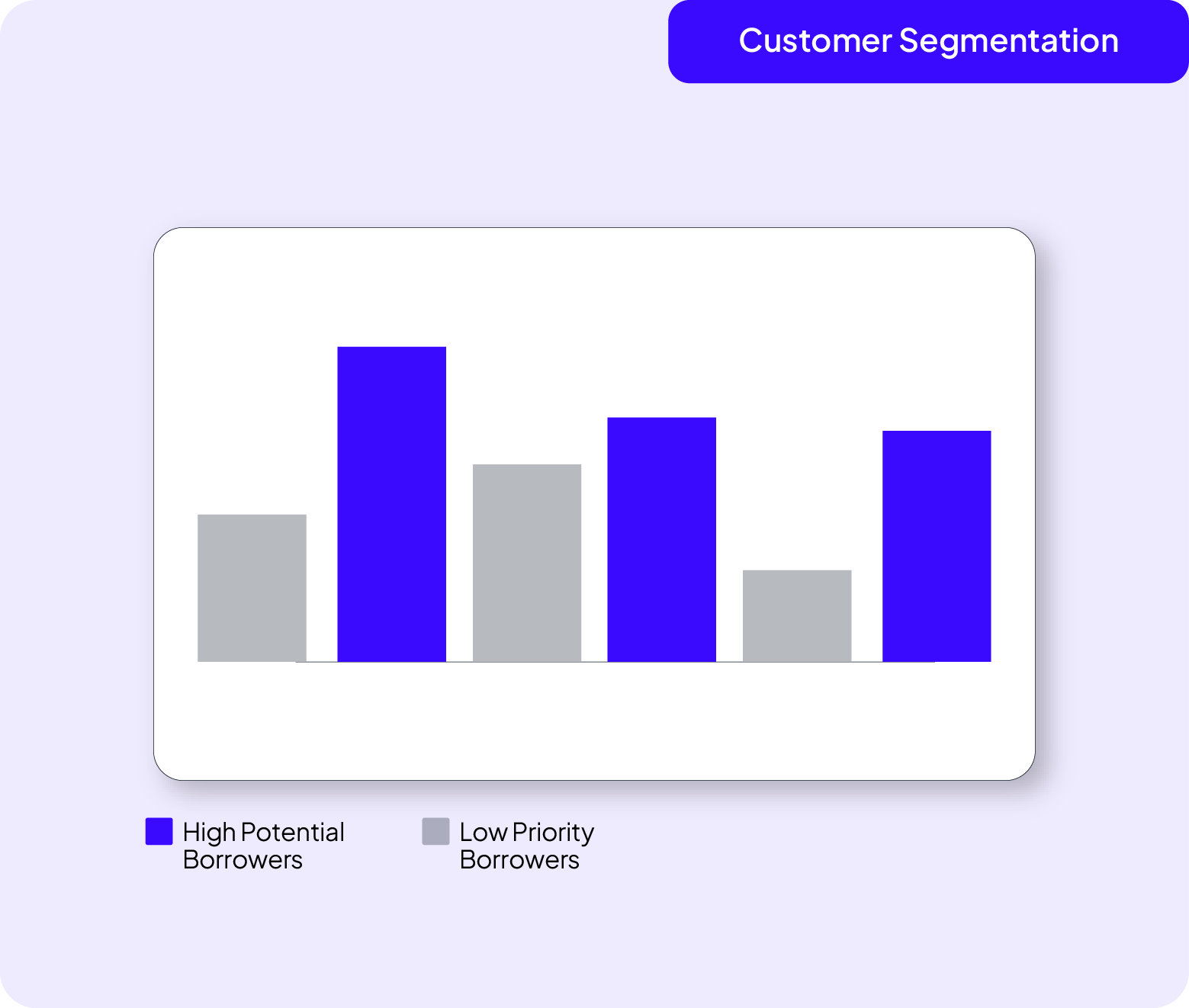

Behavioral Data-Driven Insights: Leverage advanced analytics to support personalized retention strategies and cross-sell opportunities.

AI-Powered Customer Segmentation: Tailor engagement efforts based on borrower behavior and risk profiles for more meaningful interactions.

Multi-Channel API Deployment: Boost borrower responsiveness through seamless outreach across preferred communication channels.

Gain full control and agility over customer management

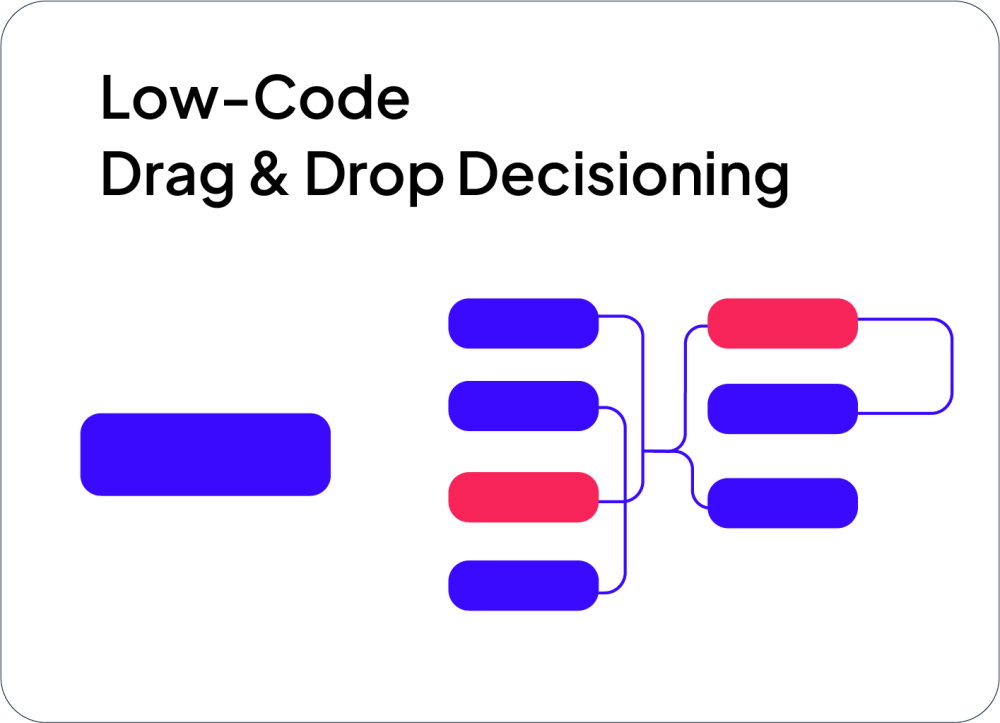

No-Code, Self-Service Configuration: Instantly adjust credit policies and engagement strategies without relying on IT support.

Seamless Data Integration: Connect to 200+ external data sources for more comprehensive and precise decision-making.

Scalable, Future-Proof Platform: Adapt quickly to market shifts and evolving customer needs while maintaining operational efficiency.

Why GDS Link outperforms other customer management solutions

Use AI-powered risk models and advanced machine learning insights to make proactive adjustments, ensuring continuously optimized credit policies, real-time customer engagement, and a significant reduction in default risk.

Unlike rigid competitor platforms, GDS Link empowers lenders to manage credit strategies on their own terms—with no vendor lock-in, full configurability, and a no-code interface that puts power back in your hands.

Proactively track portfolio health, adjust credit limits dynamically, and implement risk-based segmentation to increase profitability and minimize delinquency exposure.

"With GDS Link, we improved customer retention by 25% and increased profitability per account through smarter, data-driven engagement strategies."

Own your strategy, seize every opportunity

Maximize customer lifetime value, reduce delinquencies, and optimize account strategies with AI-powered decisioning solutions. Contact us to learn how GDS Link can enhance your portfolio performance and engagement strategies.