Seamless Data Integration

for Smarter Decisioning

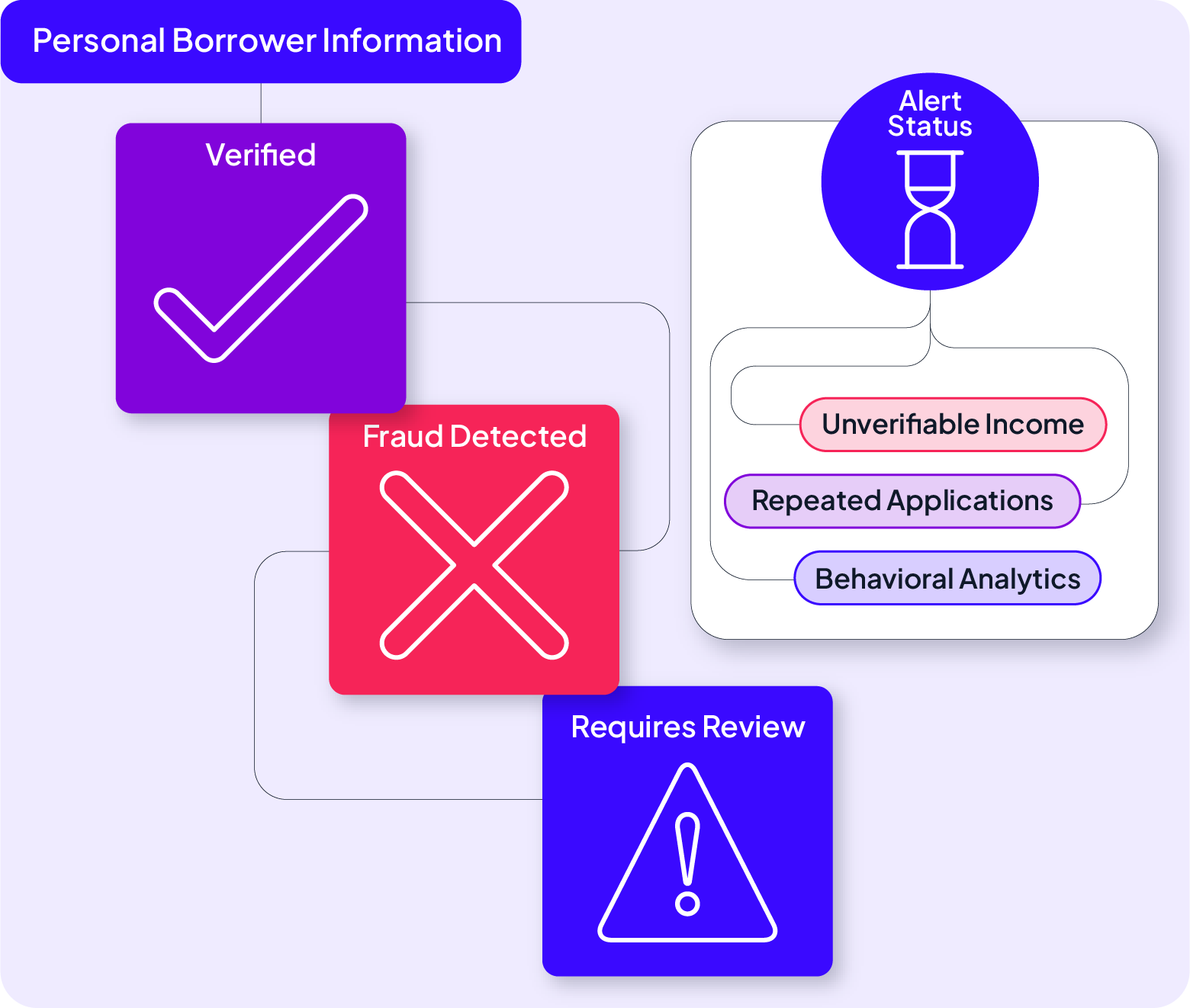

Lenders today face an overwhelming volume of data from an ever-growing number of sources. To stay competitive, businesses need a solution that consolidates data efficiently, enabling faster, more accurate risk assessments and lending decisions. GDS Link’s Data Exchange streamlines data integration, ensuring every decision is backed by real-time insights from the most relevant sources.

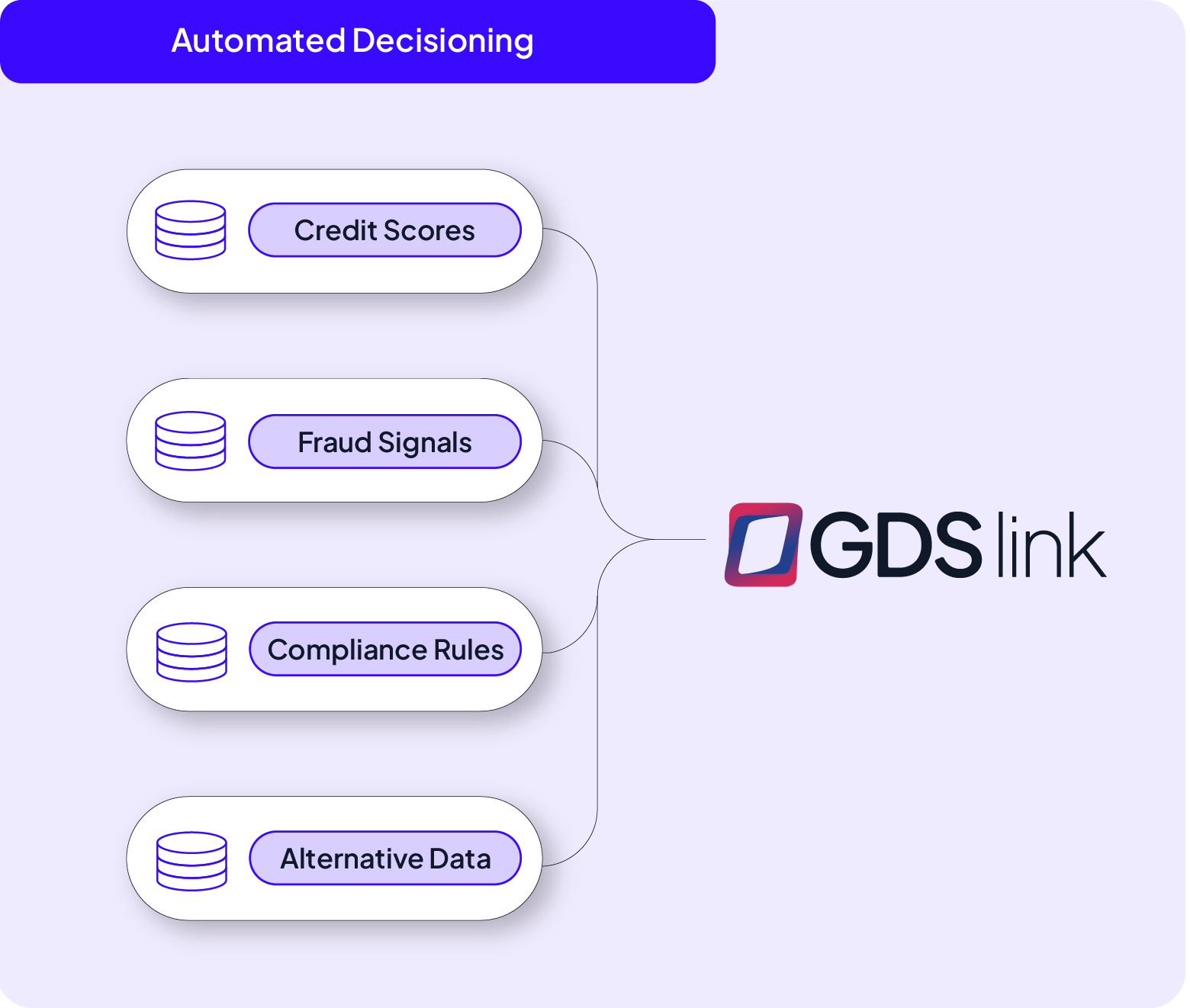

Part of the GDS Link Decisioning Platform, the Data Exchange empowers lenders to connect internal systems with over 200+ third-party data providers. Its flexible integration framework enhances risk models, optimizes workflows, and drives smarter lending strategies—keeping your business agile in a rapidly evolving financial landscape.

Connect, enrich, and optimize your data ecosystem

Easily connect with internal and external data providers to power more informed lending decisions.

A flexible solution designed to adapt to your business needs, ensuring compliance with top security standards.

Unifying data to strengthen every decision

Managing multiple data streams can be complex and inefficient. GDS Link’s Data Exchange consolidates diverse data sources—ensuring seamless integration, enriching decision workflows, and supporting smarter lending strategies across your organization.

Real-time data access

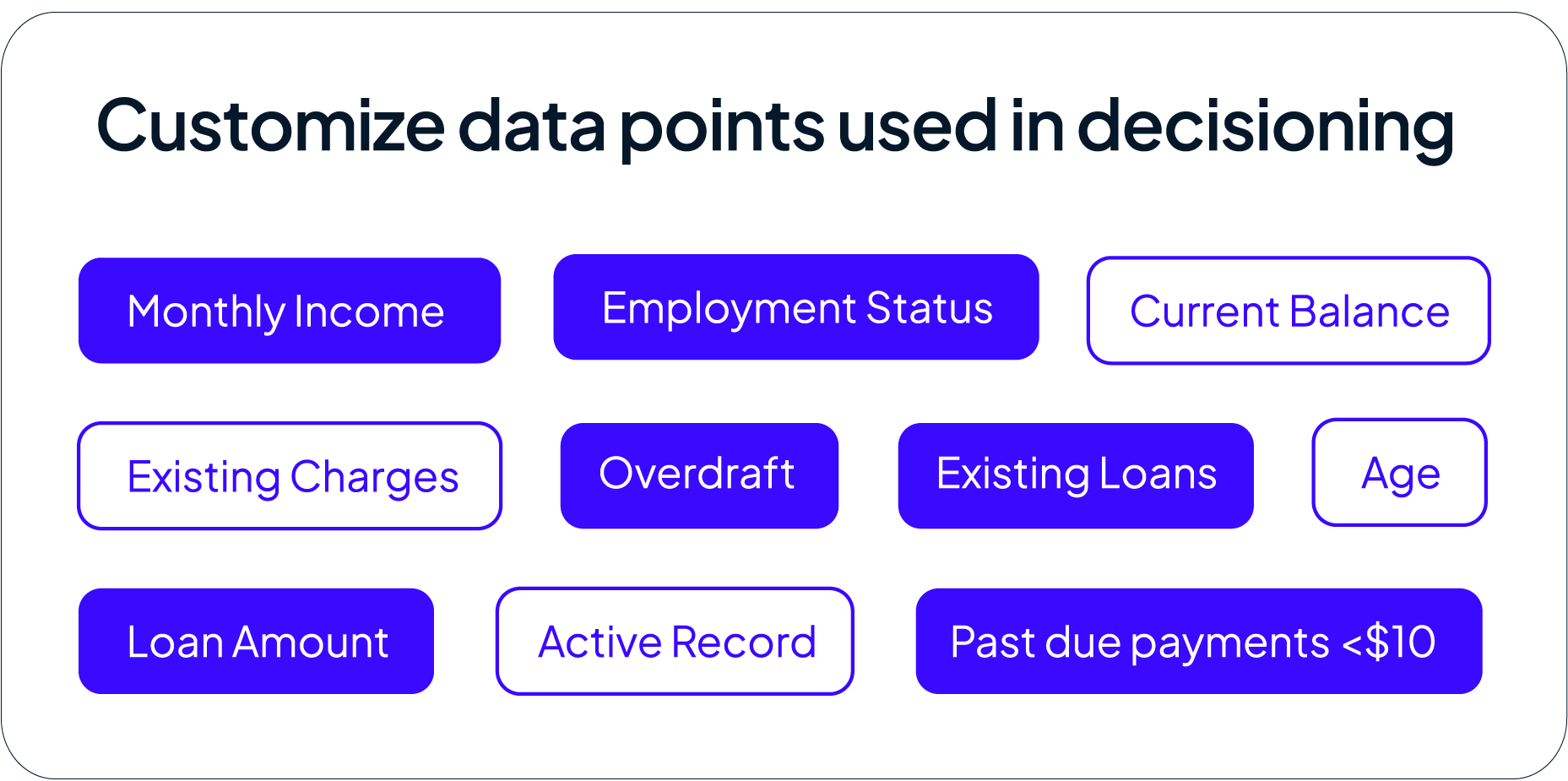

Gain instant access to diverse data streams from open banking networks, credit bureaus, and alternative finance sources. Stay ahead of risk by making decisions based on the latest borrower insights.

Flexible integration framework

Part of the GDS Link Decisioning Platform, this module allows easy connection with third-party providers via APIs. Simplify data connectivity across systems without relying on extensive IT involvement.

Comprehensive data coverage

Power smarter lending decisions across industries

Break down data silos by integrating traditional credit bureau data with alternative financial insights for more accurate loan decisions.

Learn more

Deliver personalized member experiences using enriched financial profiles and real-time data feeds.

Learn moreUnify your data, unleash smarter lending decisions

Modern Lending Made Simple starts here. Empower your lending strategies with seamless data integration. The GDS Link Data Exchange, part of the Decisioning Platform ecosystem, enables smarter decisions by connecting you to the data sources that matter most.