Faster Loan Approvals.

Smarter Decisioning.

In today’s competitive lending environment, speed, accuracy, and control are essential for success. Borrowers expect instant approvals and seamless experiences, while lenders must minimize risk, automate processes, and optimize credit strategies in real time.

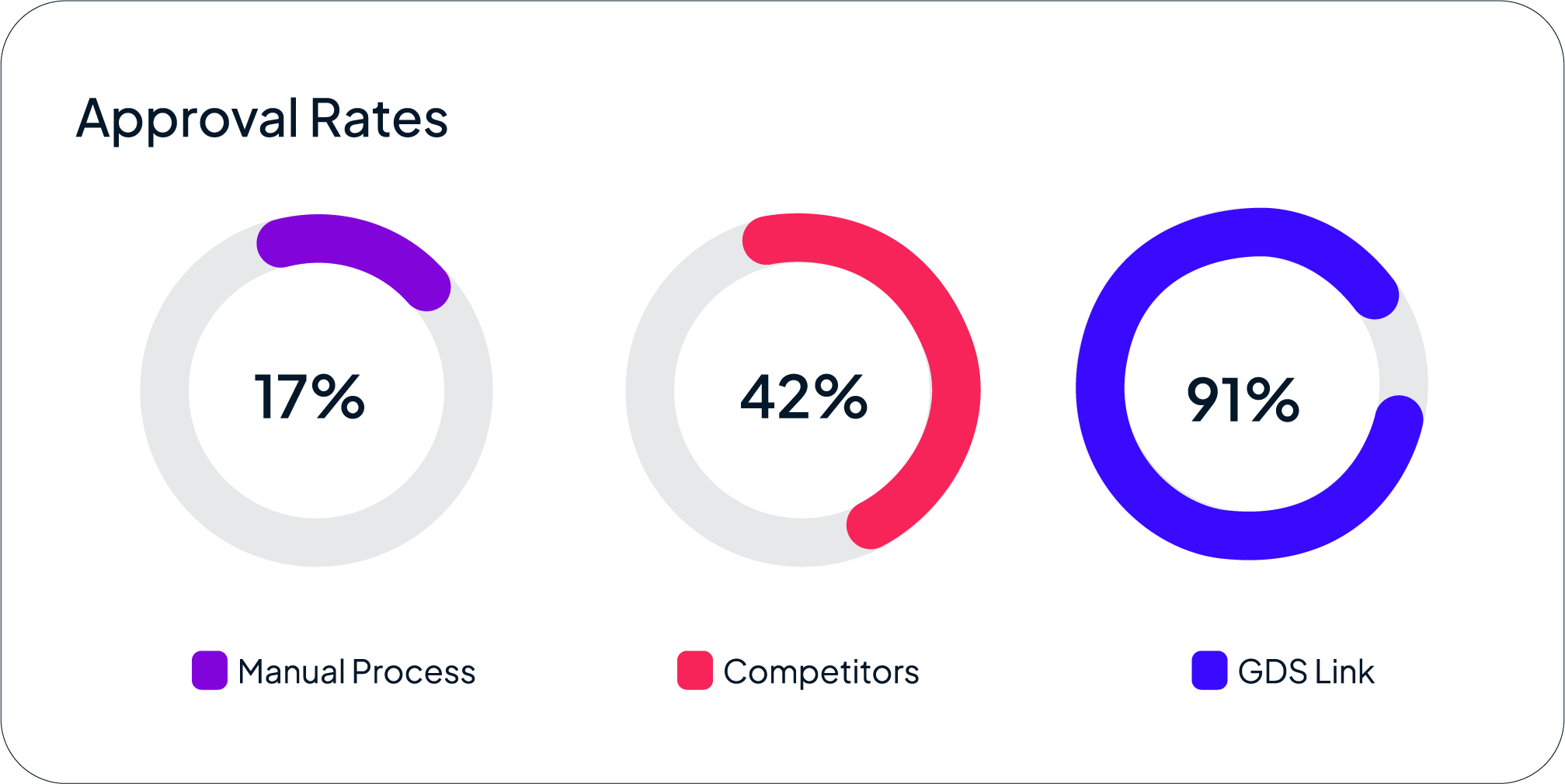

GDS Link delivers a smarter, AI-driven approach to loan originations, integrating data, automation, and risk analytics to increase approvals, reduce decision times, and provide unmatched credit policy flexibility. Unlike rigid, one-size-fits-all solutions, GDS Link puts lenders in control, empowering teams to customize risk models, adjust strategies on the fly, and future-proof their lending operations.

Automate & optimize loan originations with GDS Link

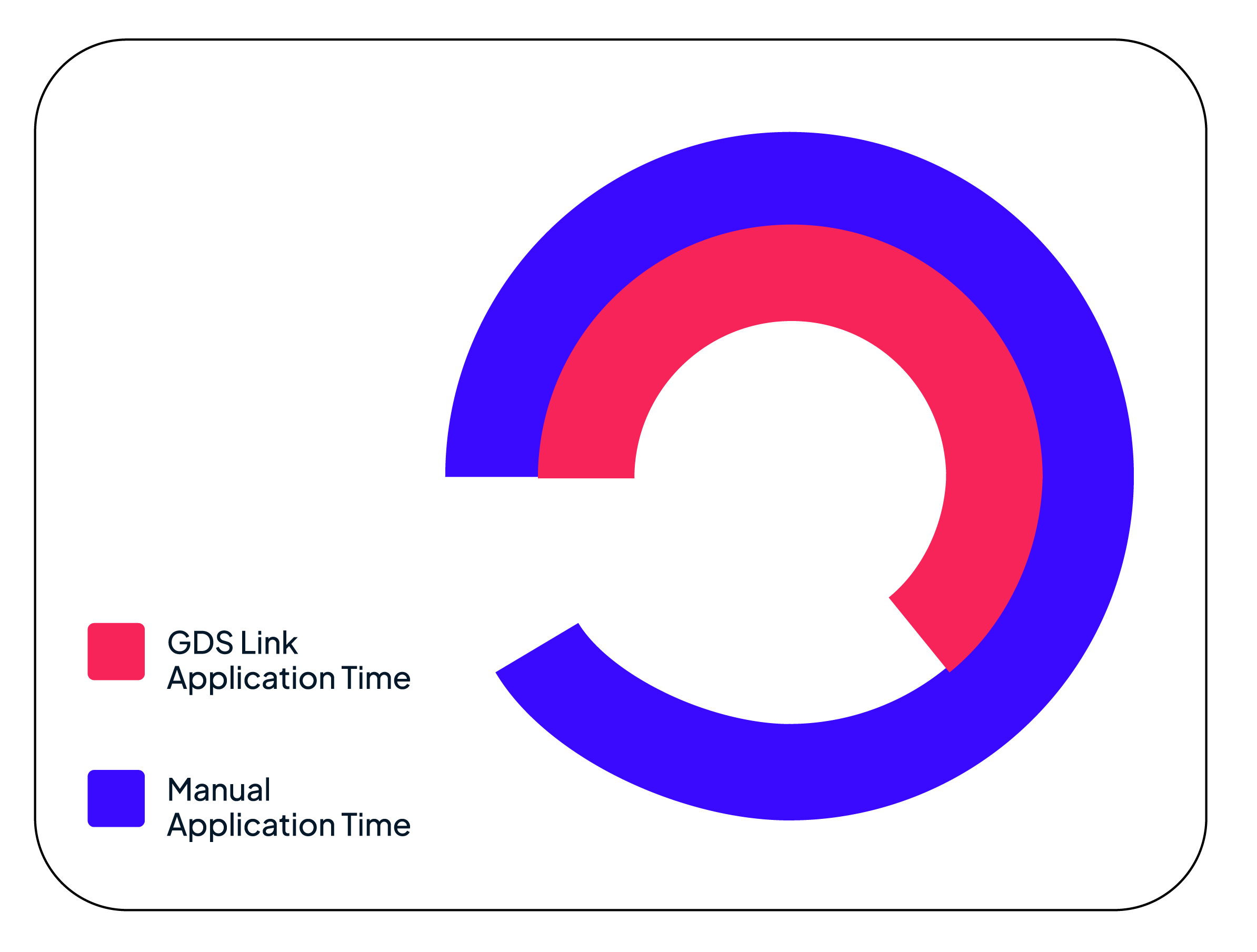

Accelerate approval time with

AI-powered decisioning

Real-Time Loan Processing: Instantly assess borrowers and deliver automated approvals without manual bottlenecks

Advanced Risk Modeling: Deploy AI-driven risk strategies to reduce defaults and optimize approval rates

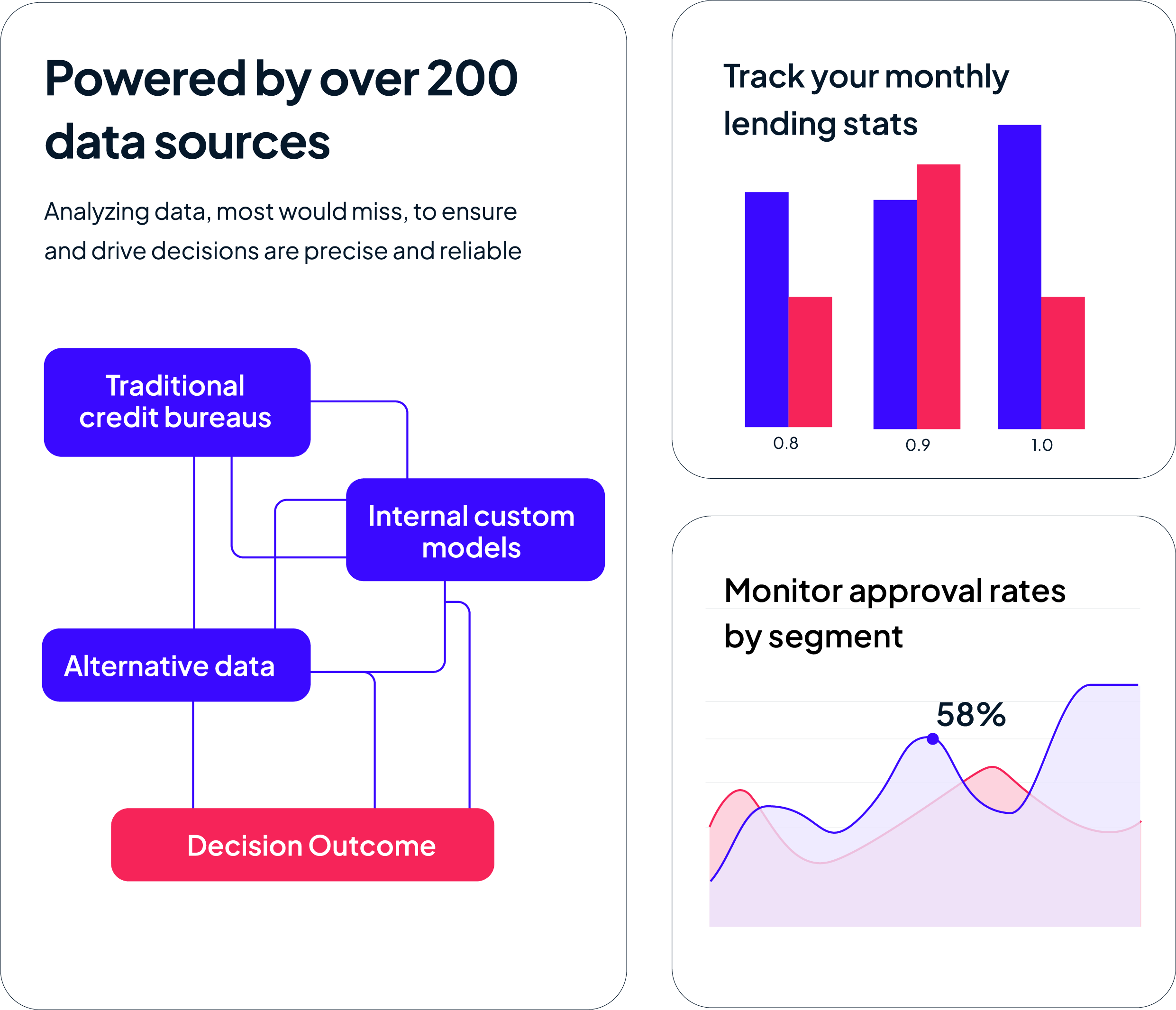

Data-Backed Decisioning: Leverage 200+ data sources, alternative data insights, and credit risk models for precise, confident lending decisions

Modernize your operations and improve efficiency

Frictionless, Digital-First Lending: Enable seamless onboarding and instant decisioning for higher borrower satisfaction.

Automated Credit Risk Assessments: Customize rules and streamline application-to-approval workflows without manual intervention.

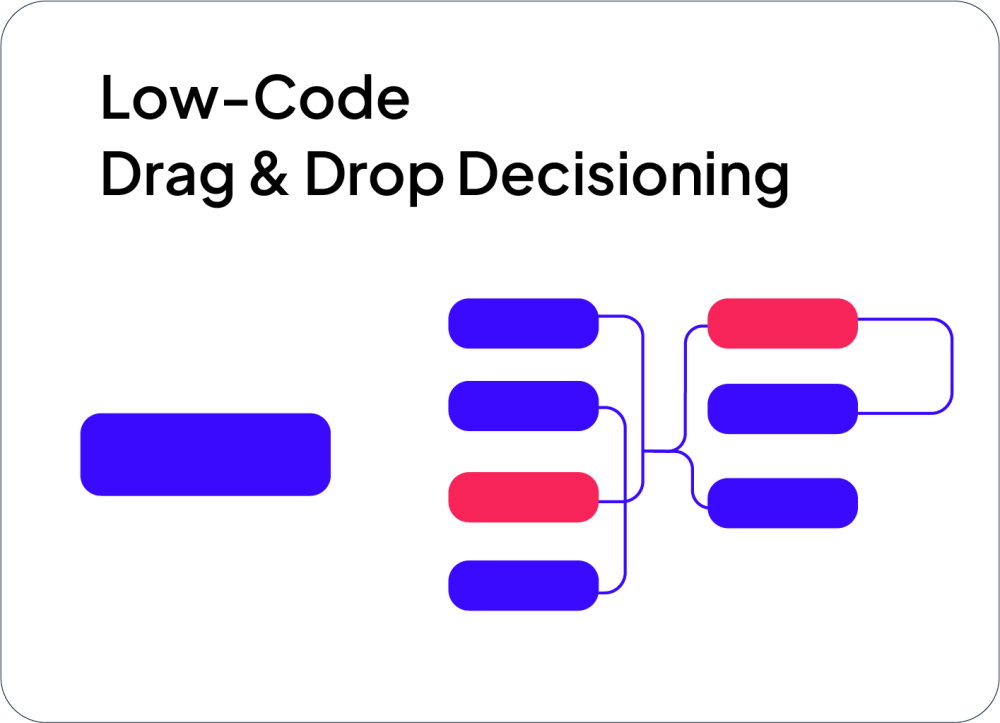

Configurable Policy Rules: Adjust decisioning in real time to respond to market shifts and lending strategy changes.

Maximize results across the entire loan lifecycle

Customizable Low-Code Workflows: Adapt decisioning rules and risk parameters with a drag-and-drop, low-code interface.

Scalable, API-First Integration: Connect effortlessly to core banking systems and third-party data providers.

Ongoing Risk Monitoring & Optimization: Continuously refine credit risk strategies using AI-powered analytics and policy testing.

Why GDS Link?

Unlike locked-down platforms, GDS Link gives you full control over credit policy management.

Seamlessly integrate with over 200+ data sources without vendor restrictions.

Empower teams to update decision rules in minutes—without IT dependency.

"With GDS Link, we’ve automated 65% of our decisions, more than tripled our revenue over five years, and gained the tools to grow even faster while improving accuracy and reducing fraud. GDS Link has been instrumental in our success."

Get Started Today

Experience the GDS Link advantage in loan originations. Contact us to learn how our solutions can be tailored to meet your lending needs. Discover how leveraging AI, real-time data, and automation can transform your lending business, leading to improved borrower satisfaction, reduced defaults, and enhanced operational efficiency.