Speed and Control for

Specialty Lenders

Specialty lenders serve specific audiences - and their credit decisioning needs to be just as unique. That means highly configurable credit decisioning software and customizable workflows.

That’s where GDS Link can help.

Our integrated credit decisioning and advanced analytics platform is ultra-flexible, making it easy to customize all aspects of the lifecycle. We automate decisions across the credit lifecycle and auto-scale as volumes grow, reducing operational costs while driving more informed decisions.

The GDS Link platform has enhanced our automated credit decisioning and underwriting processes, providing us with greater flexibility to iterate on new models and pilot new products faster and more frequently. This integration has reduced our dependency on in-house engineering resources for simple credit rule changes, making these adjustments a quick and straightforward process.

Modern Lending Made Simple for Specialty Lenders: Improve Credit Decisions with Real-Time Insights and AI Analytics

Specialty lenders face increasing demands while navigating fragmented legacy systems and manual processes. GDS Link simplifies lending by seamlessly integrating with your existing infrastructure, providing real-time decisioning and AI-driven analytics to enhance credit risk management and customer experiences.

Drive Profitability, Not Risk

Accuracy and Agility

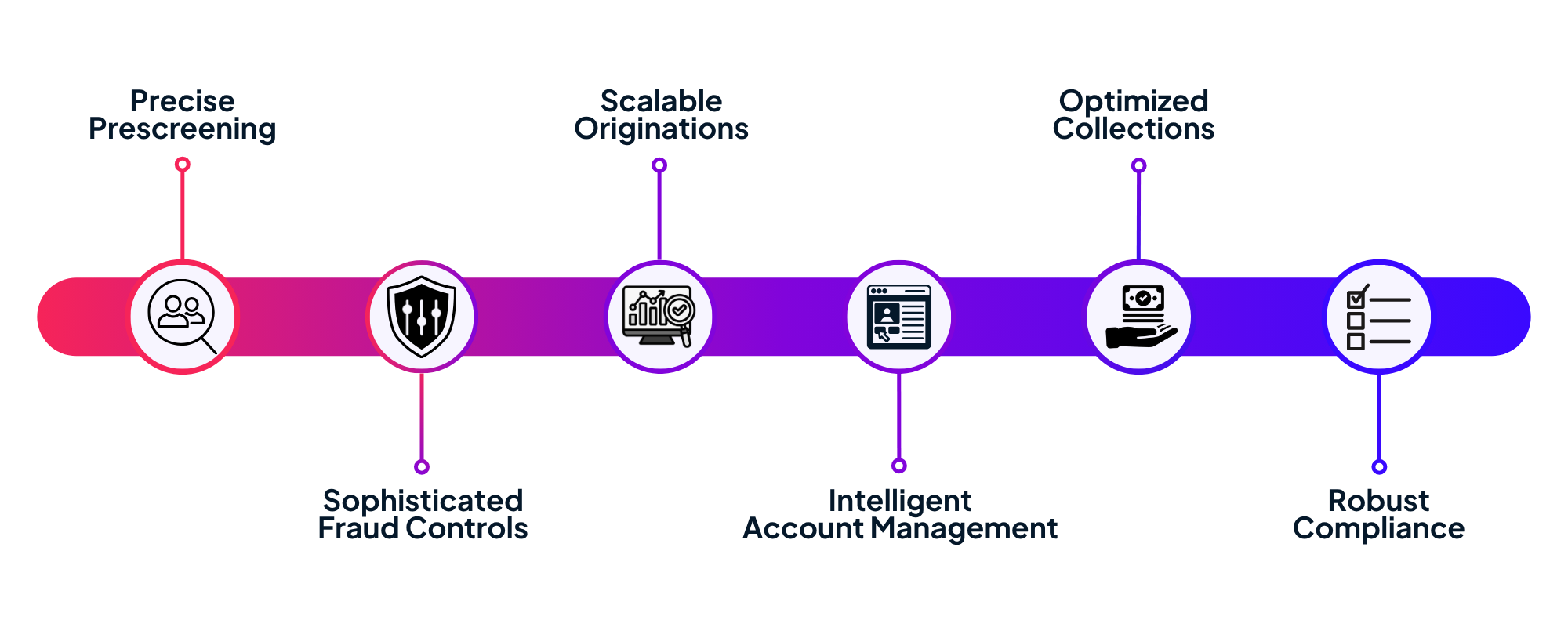

Across the Credit Lifecycle

Achieve More Across the Lifecycle

Get the automation, flexibility, and insights to drive your specialty lending business forward.