The Unified Platform for

Growing Fintechs

Fintechs and alternative lenders are modernizing lending – prioritizing speed, scalability, and seamless digital experiences. Yet operational challenges can hinder their success.

That’s where GDS Link can help.

Our real-time decisioning and analytics platform streamlines and automates lending across the credit lifecycle, so you can make rapid and accurate lending decisions. And because our modular platform is built to grow with your needs, you can quickly leverage innovative technologies to scale your business and better compete with traditional lenders.

“GDS Link’s latest platform enhancements have been instrumental in optimizing our risk management processes. As we continue to grow and provide fast, hassle-free personal loans, their advanced credit decisioning capabilities are helping us deliver on that promise with confidence.”

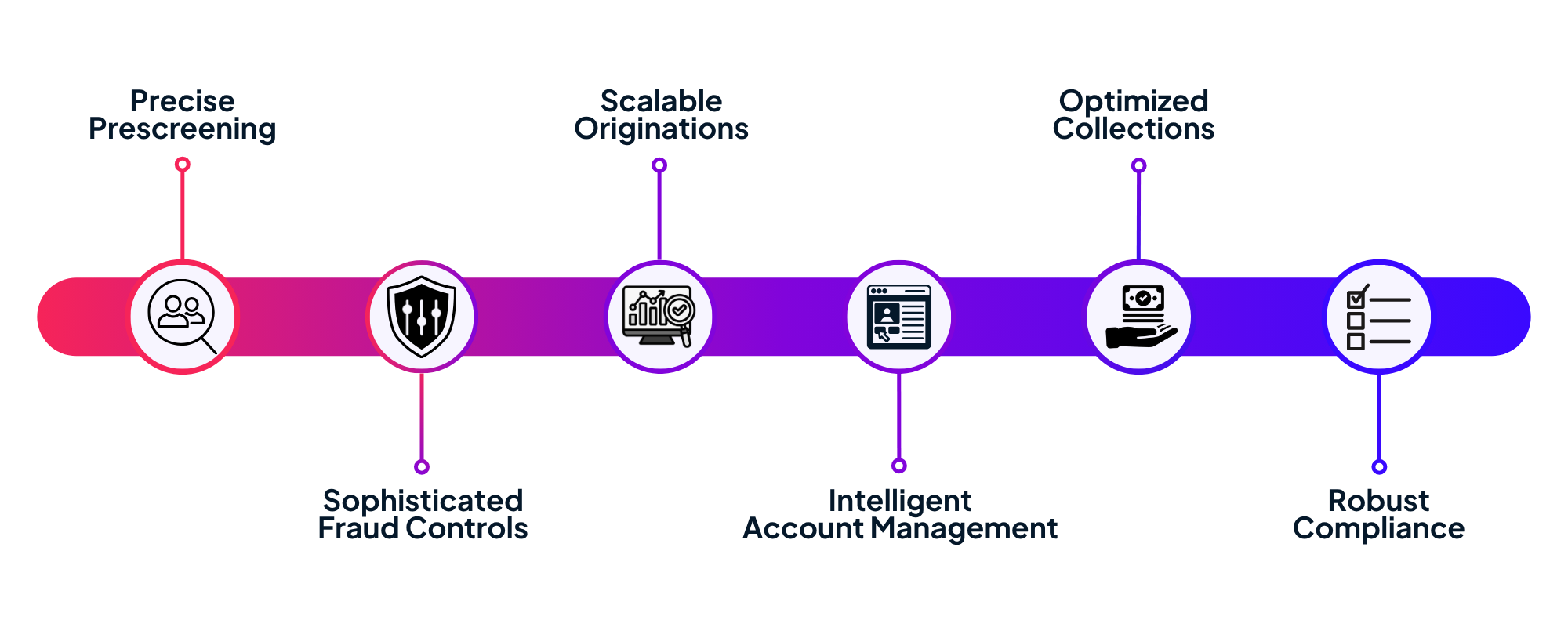

GDS Link for Fintechs: Empower Smarter Lending Decisions Across the Credit Lifecycle

With real-time insights, automated workflows, and seamless data integration, GDS Link helps Fintechs optimize performance, manage risk, and drive growth. Streamline your lending processes and stay ahead of market trends with precision and ease.

Scale Without Disruption

Accuracy and Agility

Across the Credit Lifecycle

Drive Your Business Forward

Unlock the full potential of your fintech with precise data, AI-driven risk management, and intelligent lending automation.