The Precision and Speed to

Set Your Bank Apart

Seamless digital experiences, personalized loan offers, and instant decisions were once differentiators. Now borrowers expect these features as a matter of course – leaving banks searching for new ways to attract and retain customers.

That’s where GDS Link comes in.

Our real-time decisioning and analytics platform provides real-time decision-making and AI-powered advanced analytics – seamlessly integrated with your banking systems. Sharpen your competitive advantage with more precise decisioning and efficiency across the credit lifecycle.

“GDS Link enabled us to scale efficiently, with real-time underwriting and API integration for instant loan decisions at the point of sale. This partnership has been crucial in expanding our market reach and offering embedded financial services.”

Modern Lending Made Simple for Banks

Learn how GDS Link simplifies lending by seamlessly integrating with your existing banking infrastructure, providing real-time decisioning and

AI-driven analytics to enhance credit risk management and customer experiences.

Seize the Opportunity

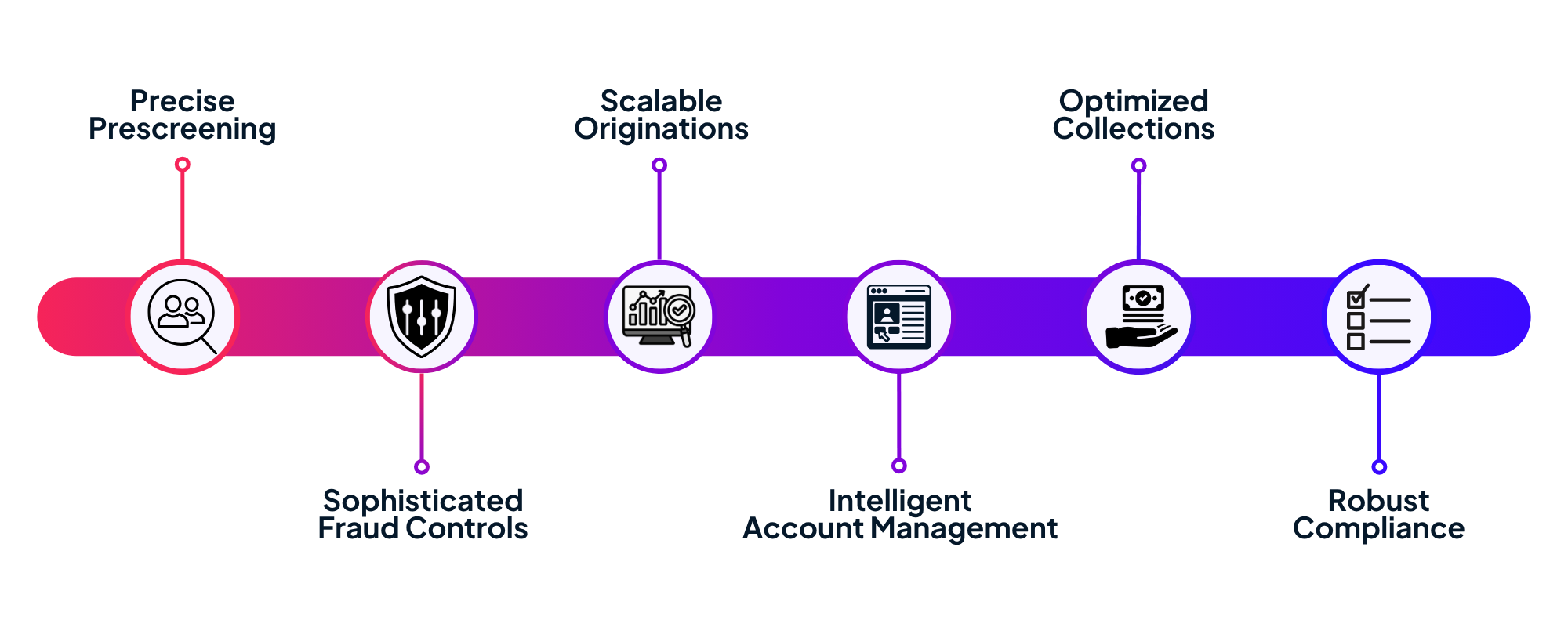

Accuracy and Agility

Across the Credit Lifecycle

Make Smarter Decisions Faster

Discover how you can meet your customers’ expectations for speed and personalization while managing your risk more effectively than ever.