Smarter Decisioning for

Smarter Banking

Today’s banking landscape is more complex than ever, with evolving regulations, heightened fraud risks, and increasing customer expectations for seamless financial experiences. To stay competitive, banks must enhance efficiency, mitigate risk, and optimize decisioning with AI-driven precision.

GDS Link equips banks with cutting-edge decisioning solutions, combining real-time risk assessment, AI-powered fraud detection, and no-code automation to deliver faster approvals, stronger compliance, and smarter risk strategies.

How GDS Link helps banks drive smarter lending

Accelerate approvals and improve customer experience

AI-Powered Risk Assessment: Make faster, more precise credit decisions with real-time data insights.

Automated Originations: Reduce manual intervention and speed up loan processing.

Frictionless Customer Journeys: Enable seamless digital lending experiences with integrated decisioning tools.

Strengthen fraud prevention and risk mitigation

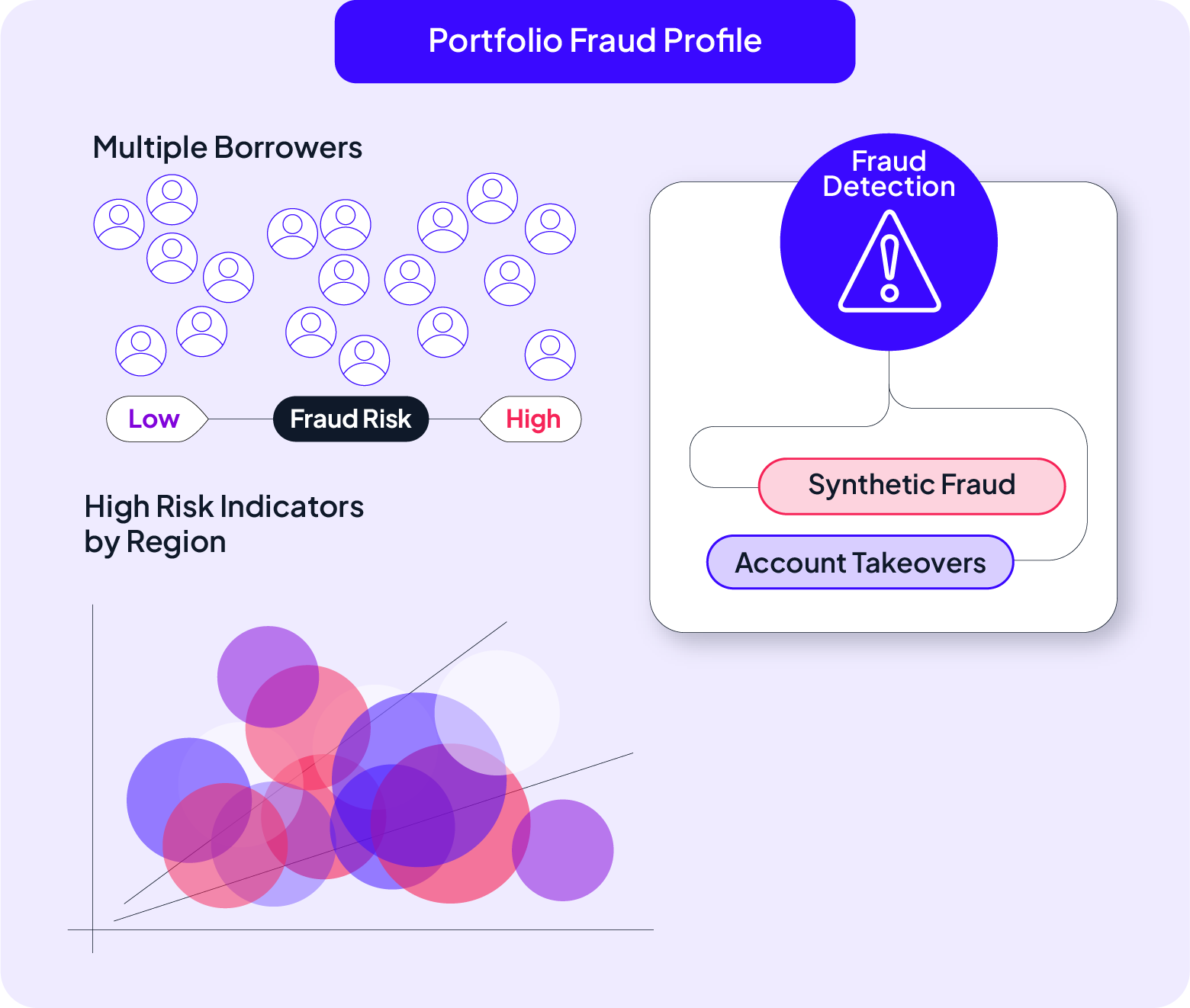

Multi-Layered Fraud Detection: Identify account takeover, synthetic identity fraud, and transaction anomalies.

Real-Time Risk Monitoring: Detect and stop fraud before it impacts your bottom line.

Behavioral Analytics & AI Models: Adapt risk strategies based on evolving fraud trends.

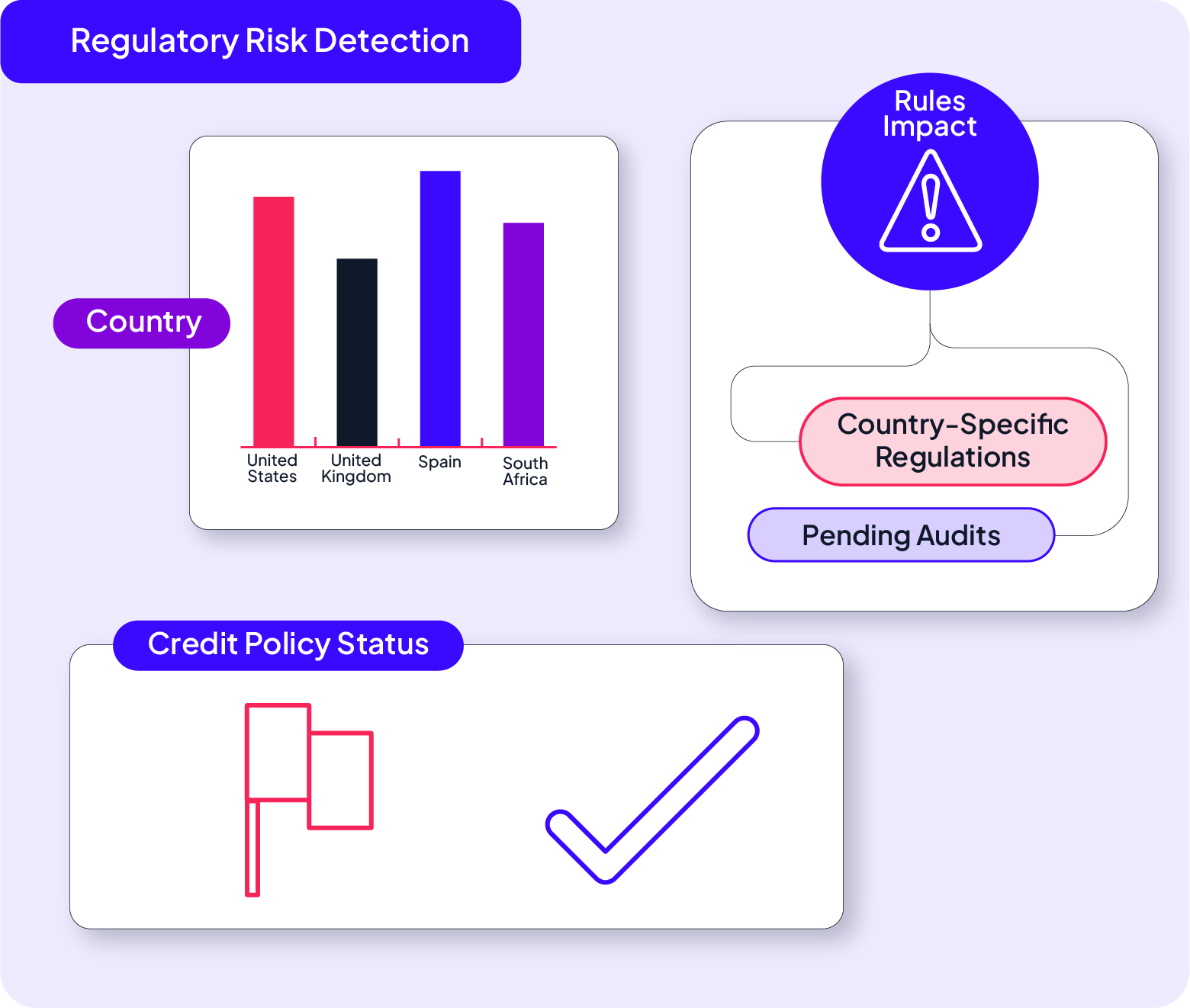

Ensure compliance and adapt to regulatory changes

Automated Compliance Enforcement: Maintain policy adherence with real-time rule enforcement.

Audit-Ready Reporting: Generate detailed compliance reports with AI-driven accuracy.

Seamless Regulatory Adaptation: Adjust policies instantly without vendor dependency.

How GDS Link helps banks solve their biggest challenges

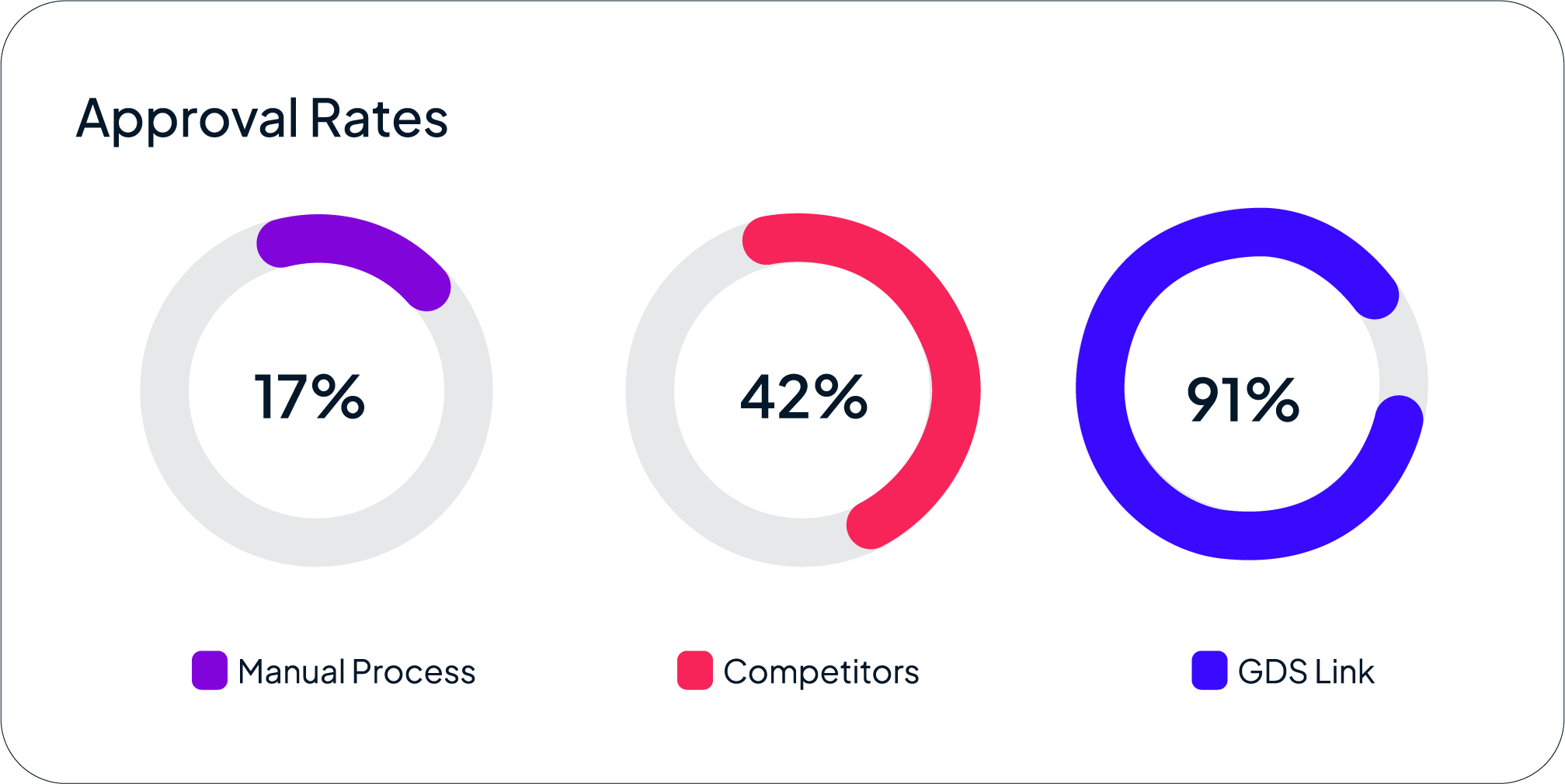

Banks face rising competition, regulatory complexity, and pressure to approve loans faster without increasing risk exposure. GDS Link’s AI-driven decisioning platform accelerates originations while ensuring precise risk assessment.

Learn moreBanks lose billions annually to fraud, from synthetic identities to account takeovers. GDS Link provides multi-layered fraud detection with AI-driven risk models to stop fraud before it impacts your bottom line.

Learn moreBanks face constantly shifting compliance requirements. GDS Link automates compliance enforcement, monitors policy adherence in real time, and generates audit-ready reporting.

Learn more"GDS Link enabled us to scale efficiently, with real-time underwriting and API integration for instant loan decisions at the point of sale. This partnership has been crucial in expanding our market reach and offering embedded financial services."

Own your banking strategy. Seize every opportunity.

Transform your banking operations with smarter, AI-driven risk management and lending automation. Contact us to learn how our solutions can optimize your bank’s digital strategy