Smarter Lending for Stronger Credit Unions

Credit unions are built on trust, community, and personalized service, but today’s financial landscape presents new challenges in managing risk, fraud, and compliance while meeting evolving member expectations. To remain competitive, credit unions must leverage AI-driven decisioning to optimize efficiency and enhance member experiences.

GDS Link equips credit unions with advanced decisioning solutions, integrating real-time risk assessment, fraud detection, and compliance automation to support faster approvals, smarter lending, and stronger member engagement.

How GDS Link helps credit unions deliver more value

Streamlined loan originations for faster member approvals

AI-Powered Lending Decisions: Approve loans with real-time credit risk insights.

Automated Workflows: Reduce manual processing time and enhance efficiency.

Frictionless Member Experience: Deliver fast, seamless digital lending solutions.

Personalized customer management for stronger relationships

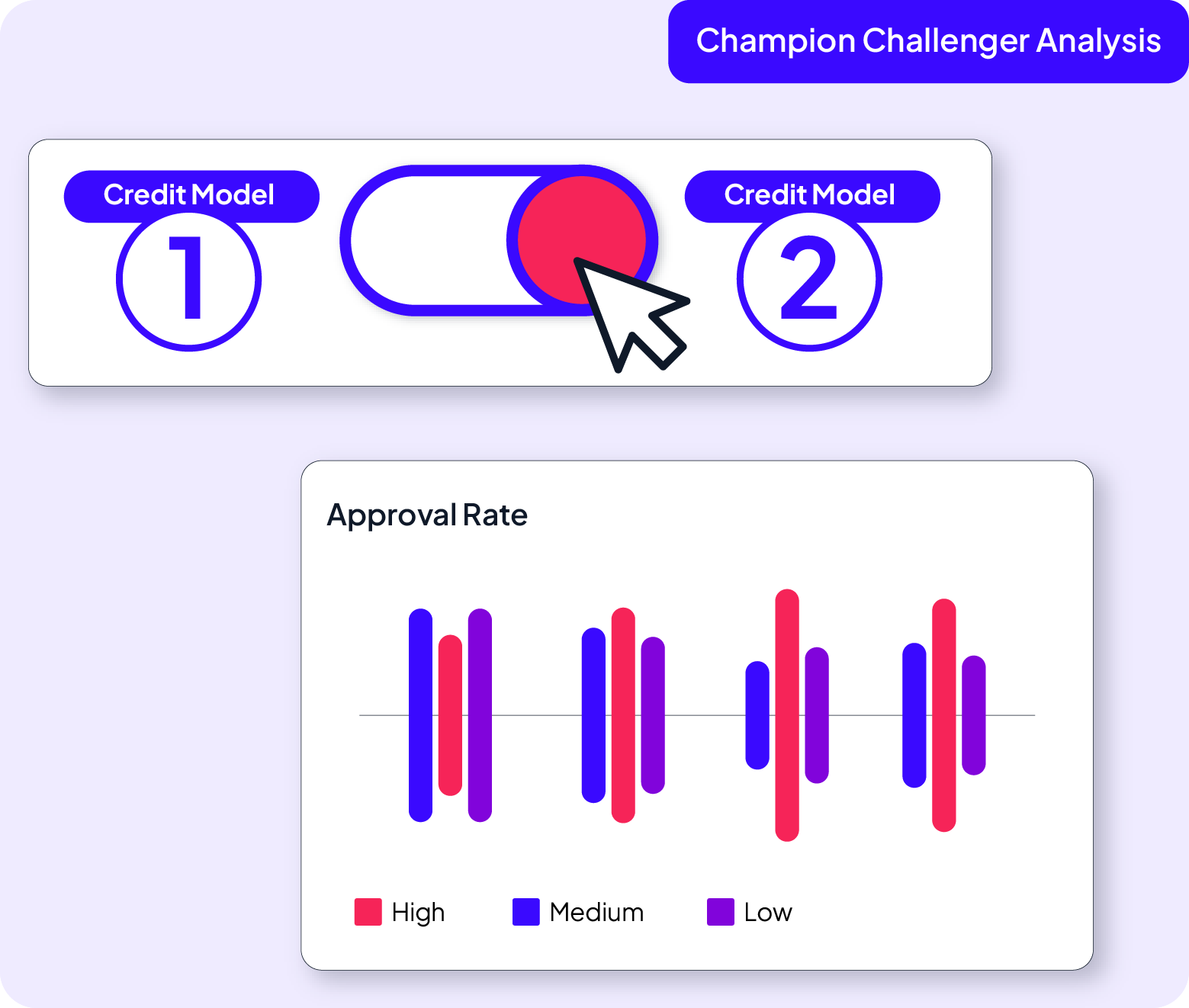

Risk-Based Credit Adjustments: Offer tailored credit increases and retention strategies.

Intelligent Cross-Sell & Upsell: Optimize member engagement with AI-driven insights.

Data-Backed Member Retention: Strengthen loyalty with proactive engagement strategies.

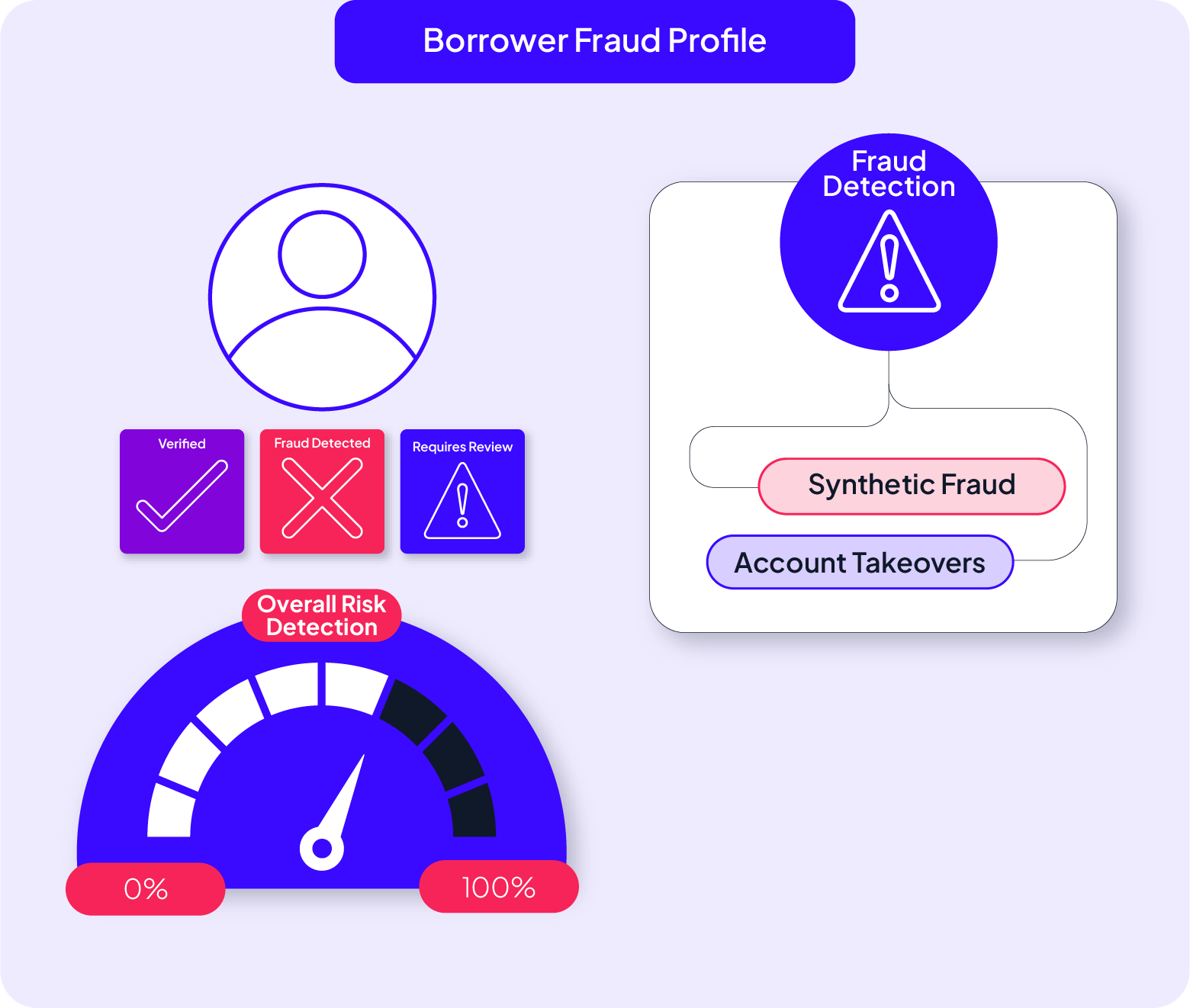

Fraud prevention to protect members and assets

Automated Compliance Enforcement: Maintain policy adherence with real-time rule enforcement.

Audit-Ready Reporting: Generate detailed compliance reports with AI-driven accuracy.

Seamless Regulatory Adaptation: Adjust policies instantly without vendor dependency.

How GDS Link helps credit unions solve their biggest challenges

Credit unions must provide quick, fair, and responsible lending to serve their communities effectively. GDS Link’s AI-driven originations platform accelerates approvals, integrates alternative data for better credit decisioning, and enhances financial inclusion without adding risk.

Learn moreRetaining members requires proactive engagement and personalized financial experiences. GDS Link helps credit unions optimize credit lines, create data-driven retention strategies, and provide tailored financial products based on real-time member insights.

Learn moreFraud attacks on credit unions are rising, from synthetic identity fraud to account takeovers. GDS Link provides AI-driven fraud detection, behavioral analytics, and automated risk monitoring to help credit unions prevent losses while ensuring seamless member interactions.

Learn more"Working with GDS Link has been a game-changer. Their expertise and experience helped us to streamline our loan application process, freeing up our team's time and resources to focus on more complex loan decisions. The credit union is now poised to achieve substantial growth opportunities, and we look forward to continuing to work with them in the future."

Own your credit union’s future. Seize every opportunity.

Transform how your credit union approves loans, manages risk, and prevents fraud with AI-driven decisioning. GDS Link helps you deliver smarter lending while ensuring responsible, member-first financial services.