Decisioning Engine:

Precision, Speed, and Flexibility

The lending market moves faster than ever. To stay competitive, you need technology that adapts in real time, enabling you to adjust credit policies, test decision strategies, and seamlessly integrate custom models. The Decisioning Engine from GDS Link simplifies decision-making, providing the tools to help you stay ahead in dynamic markets.

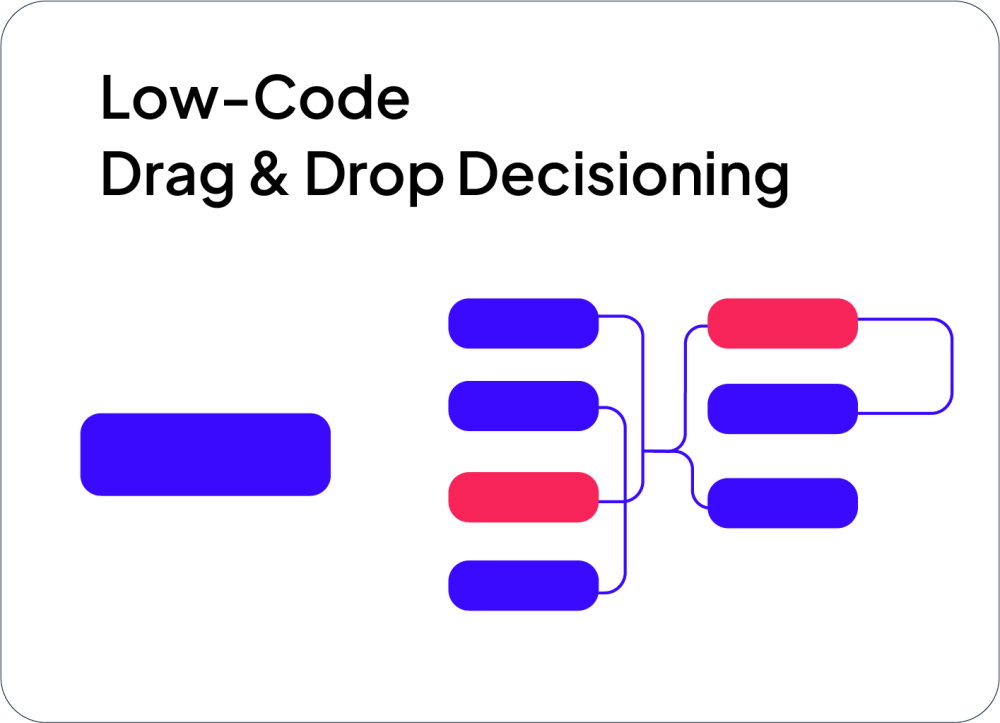

Part of the GDS Link Decisioning Platform, the Decision Engine empowers lenders to create, deploy, and optimize decision policies with unmatched speed and precision. Its low-code environment makes it easy to simulate outcomes, automate policy changes, and continuously align decision strategies with your evolving business objectives.

Simplified decisioning with precision and speed

Quickly adjust credit policies and deploy decision strategies to meet evolving market demands with confidence.

Easily integrate Python, PMML, and R models while leveraging a low-code interface to enhance decision accuracy.

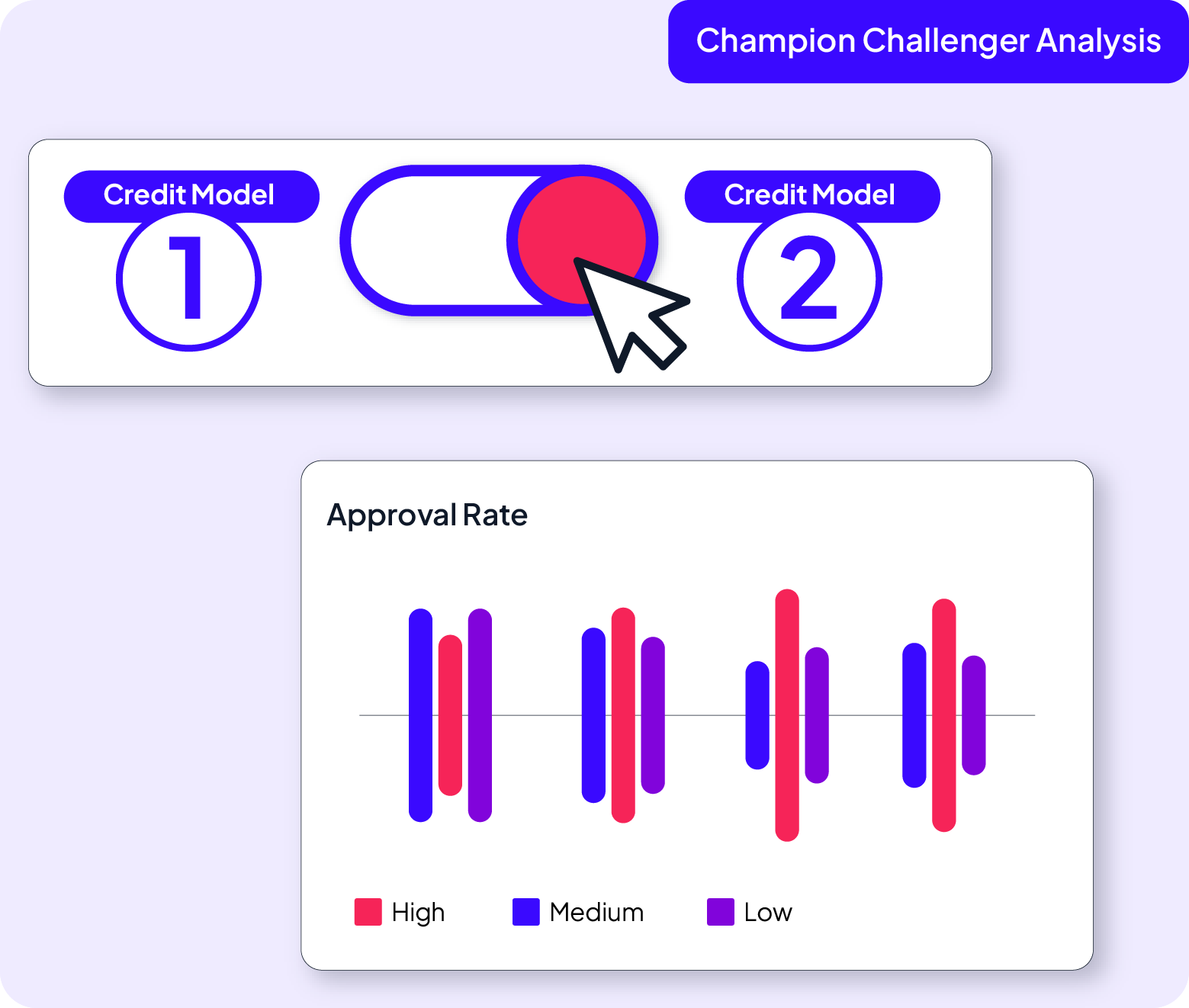

Test, refine, and optimize decision policies in real time to achieve optimal outcomes and ensure compliance.

Solving key lending challenges

In today’s fast-paced lending environment, staying ahead requires tools that deliver precision, adaptability, and speed. The Decisioning Engine addresses critical challenges by equipping your team with advanced capabilities to make informed, agile decisions.

Adjust credit policies in real time

Quickly adapt to changing regulations, shifting market conditions, and evolving customer demands with tools that provide the flexibility to refine policies on the fly.

Deploy and test strategies rapidly

Accelerate decision-making with streamlined workflows and low-code interfaces that empower teams to implement, test, and iterate strategies in real time without heavy IT reliance.

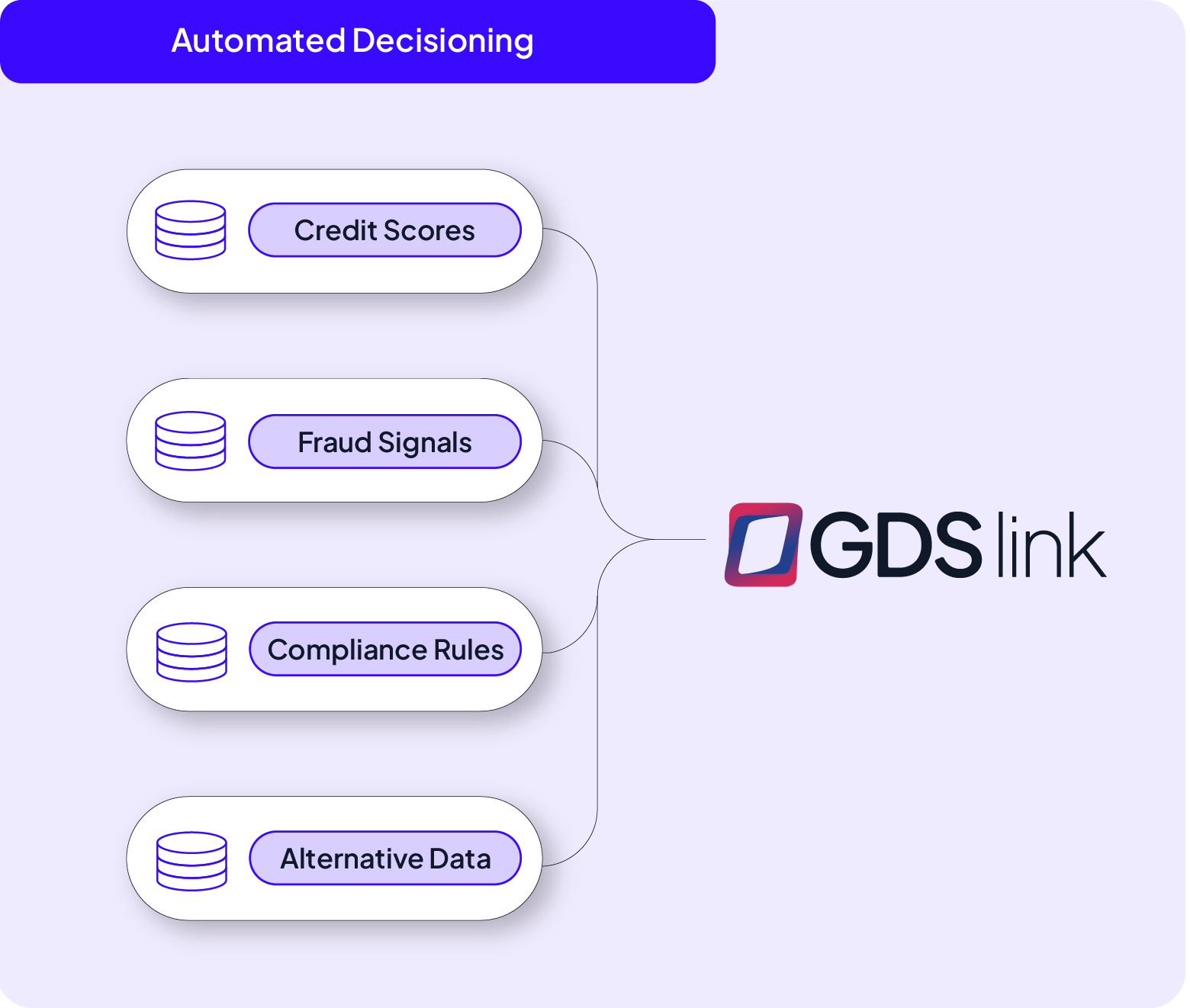

Integrate custom models seamlessly

Easily incorporate custom models and diverse attribute sets into decision workflows effortlessly, enhancing the precision and scalability of your decisioning processes for optimized results.

Driving value across every lending vertical

Optimize decision-making with real-time policy adjustments and scalable workflows. Modernize legacy systems, streamline operations, and deliver faster approvals to meet customer expectations and regulatory demands.

Read More

Enhance member-first experiences with efficient, data-driven decision workflows. Quickly deploy compliant credit policies and scale operations without sacrificing personalization or service quality.

Read More

Accelerate innovation with rapid strategy testing and custom model integration. Leverage advanced risk assessments to manage diverse borrower profiles and unlock new growth opportunities.

Read MoreUnlock the full power of our Decisioning Platform

Modern Lending Made Simple starts here. As a core feature of the GDS Link Decisioning Platform, the Decisioning Engine empowers business users to own their credit risk strategy with precision, speed, and adaptability. Designed for seamless collaboration, the platform enables smarter decisions and optimized workflows across the entire credit lifecycle.