Advanced Analytics for

Smarter Lending Decisions

In today’s lending environment, data is everything—but making sense of it is the real challenge. Traditional credit scoring can leave gaps, predictive models degrade over time, and shifting regulations demand constant adaptation. That’s where GDS Link’s Advanced Analytics solutions come in.

Our analytics-driven modules give lenders the precision, intelligence, and flexibility to optimize risk, refine decision strategies, and improve portfolio performance. Whether you need to monitor policy effectiveness, enhance predictive modeling, or integrate alternative data sources, we deliver actionable intelligence tailored to your lending needs.

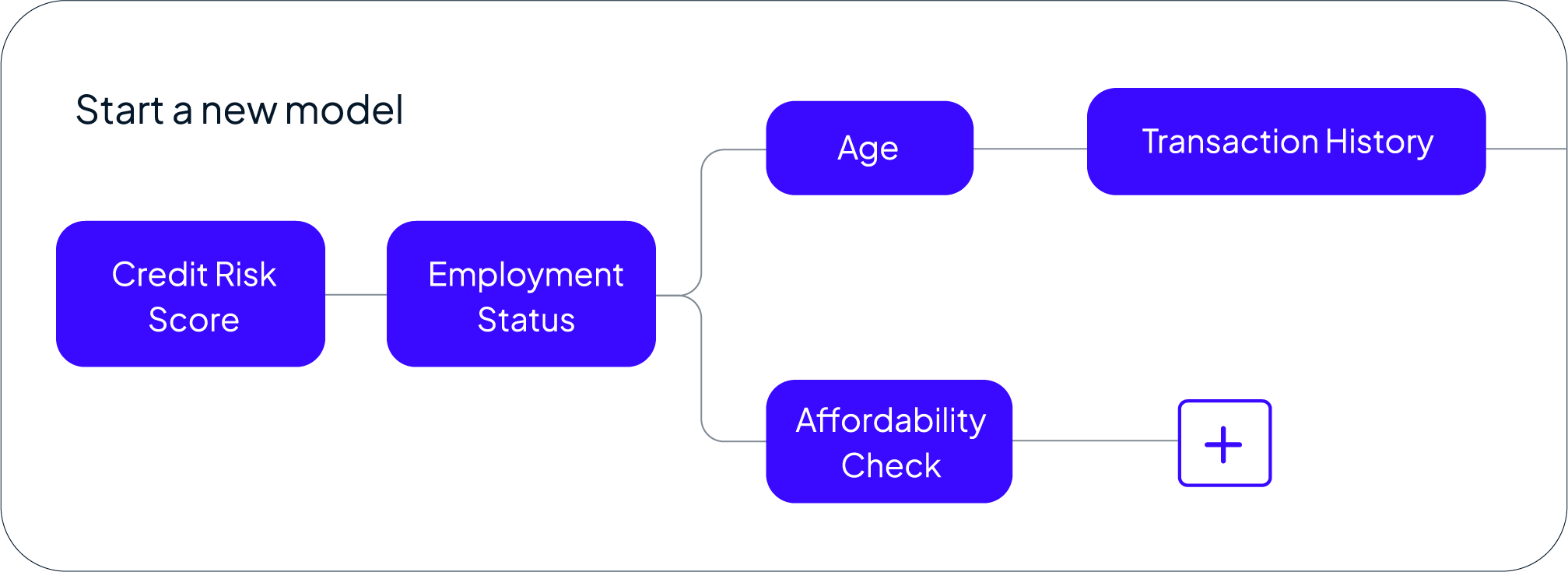

Custom Model Development & Monitoring

Off-the-shelf risk models don’t always fit unique credit policies or customer segments. Custom Model Development & Monitoring helps lenders build, deploy, and continuously optimize AI-powered models for more accurate decisioning.

- Develop models customized to your credit risk framework

- Monitor model performance in real time to detect degradation

- Refine decision strategies based on predictive insights

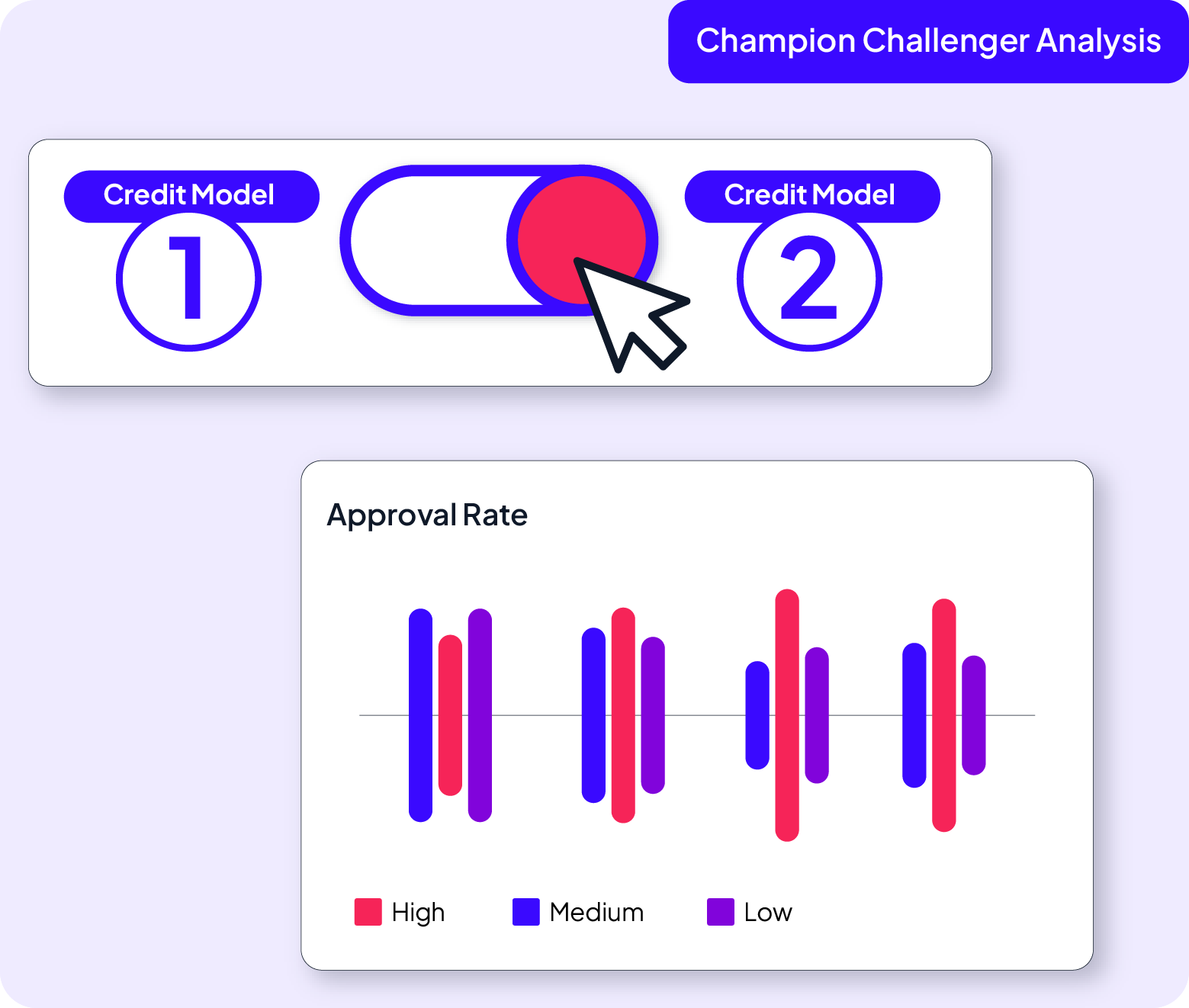

Policy Monitoring & Insights

Lending policies need to evolve with market conditions, borrower behaviors, and regulatory changes. Policy Monitoring & Insights provides real-time analysis of policy effectiveness, helping lenders fine-tune credit strategies and maximize approval rates.

- Analyze policy rules and track approval rates

- Simulate potential decline rates and optimize credit strategies

- Visualize key metrics across geographies, loan types, and score distributions

GDS Link Credit Attributes

Accessing credit bureau data should be seamless and cost-effective. Tri-Bureau Attributes unify and standardize borrower data across TransUnion, Experian, and Equifax—delivering deeper risk insights without the complexity.

- Harmonized attributes across all three major credit bureaus

- Improved risk segmentation and borrower profiling

- Optimized cost savings with a streamlined approach

Open Banking Attributes

Not all borrowers have extensive credit histories. Open Banking Attributes leverages real-time banking data to enhance credit assessments, giving lenders deeper visibility into cash flow, spending patterns, and financial stability.

- Expand credit access for subprime and SMB markets

- Integrate predictive variables from leading open banking providers

- Enhance fraud mitigation and ID verification

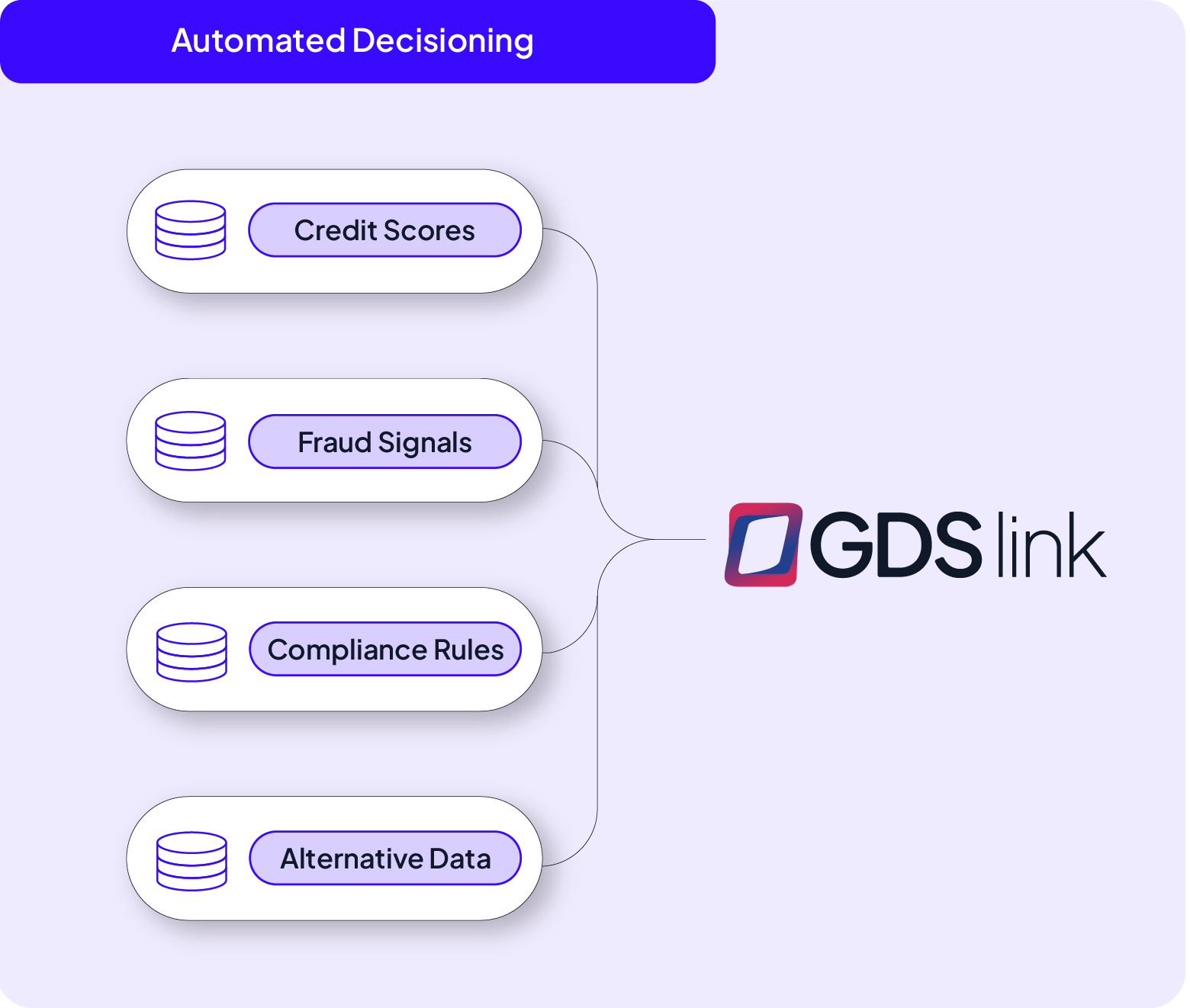

Powering Advanced Decisioning Across the Credit Lifecycle

All GDS Link Advanced Analytics solutions integrate seamlessly with the GDS Link Decisioning Platform, ensuring that every insight translates into smarter lending decisions.

Ready to unlock deeper credit intelligence?