Modernized Originations

for Maximum Agility

Today’s lending landscape demands faster approvals, smarter decisions and exceptional borrower experiences.

A nimble underwriting process at loan origination is now the most critical point in the credit lifecycle management process. So, lenders need the ability to quickly adapt their originations policies as conditions change – without affecting portfolio risk, compliance or profitability.

That’s where GDS Link can help.

“Working with GDS Link has been a game-changer. Their expertise and experience helped us to streamline our loan application process, freeing up our team's time and resources to focus on more complex loan decisions.”

Steve LeJeune, Business Intelligence Manager

, Marine Credit UnionTransform Your Loan Origination Process

Optimize the Credit Lifecycle with GDS Link

Detect and address potential fraud in real time, without disrupting the borrowing experience

Check it OutDrive growth and loyalty with streamlined processes and better customer engagement

Check it OutTarget borrowers more accurately, reduce costs, and boost approval and satisfaction rates

Check it OutBoost recovery rates with smart segmentation, real-time monitoring, and automated workflows

Check it OutGet confidence and accuracy with embedded controls, audit trails, and explainability

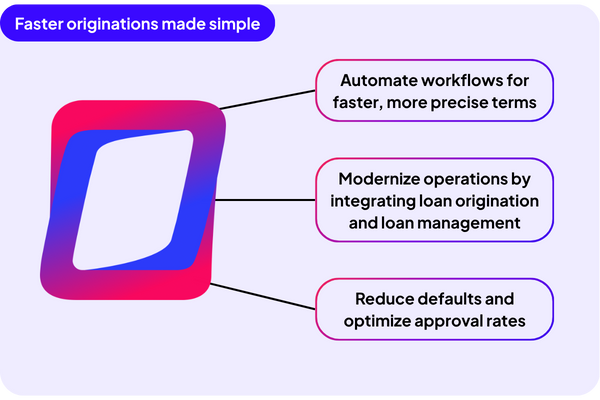

Check it OutLoan Originations that Put Lenders in Control

Discover how our unified credit decisioning and analytics platform can accelerate approvals, reduce defaults and provide unmatched credit policy flexibility for your business.