Optimize Credit Policies

for Better Outcomes

With competition increasing and borrower expectations rising, lenders need new ways to boost profitability – fast.

That’s why we’ve seamlessly integrated policy optimization into our credit decisioning and analytics platform.

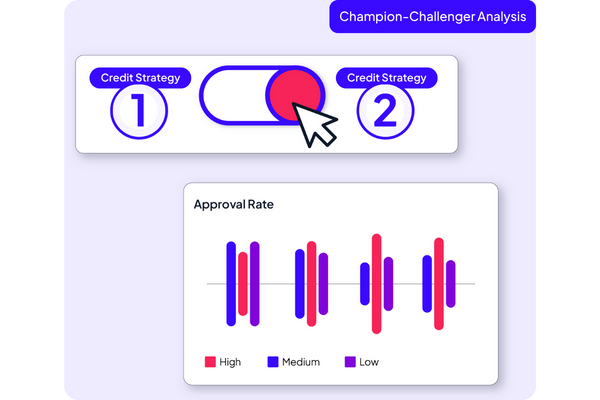

Evaluate and optimize your decisioning strategies. Validate and refine underwriting criteria, simulate challenger strategies, test alternative data, and develop custom models that enhance your predictive power.

Discover New Insights without Disrupting Operations

More precise decisions

Simulate the use of additional data to enable more approvals and fewer declines

Predictive AI and models

Build and execute advanced decisioning models within one unified platform

Powerful partnerships

Access industry-leading model building and state-of-the-art optimization capabilities

“GDS Link’s latest platform enhancements have been instrumental in optimizing our risk management processes. As we continue to grow and provide fast, hassle-free personal loans, their advanced credit decisioning capabilities are helping us deliver on that promise with confidence.”

Yaron Bernstein, CEO, Boodle

,Drive Profitability Across the Lifecycle

From data preparation and model development to deployment and monitoring, see how we can optimize performance, efficiencies and accuracy for your business.