More Reward, Less Risk

for Auto Lenders

Auto finance firms are caught between rising risks and rising expectations. Loan balances, delinquencies and the risk of fraud are increasing. Meanwhile, consumers want instant approvals, whether they're buying online or in a dealership.

That’s where GDS Link can help.

Our integrated credit decisioning and advanced analytics platform delivers credit decisions in milliseconds, impressing both borrowers and dealers. And with a comprehensive view of each applicant, you can also reduce fraud and defaults.

“GDS Link has transformed how we manage credit and risk automation. Their platform lets us model, test, and deploy decision strategies in hours instead of weeks, which is crucial in the fast-moving auto finance space. The ability to integrate multiple data sources seamlessly has elevated both our speed and accuracy in underwriting.”

Modern Lending Made Simple for Auto Lenders

Read about how GDS Link can help you meet your borrowers’ expectations while managing risk more effectively than ever.

Increase Clarity and Drive Profitability

Accuracy and Agility

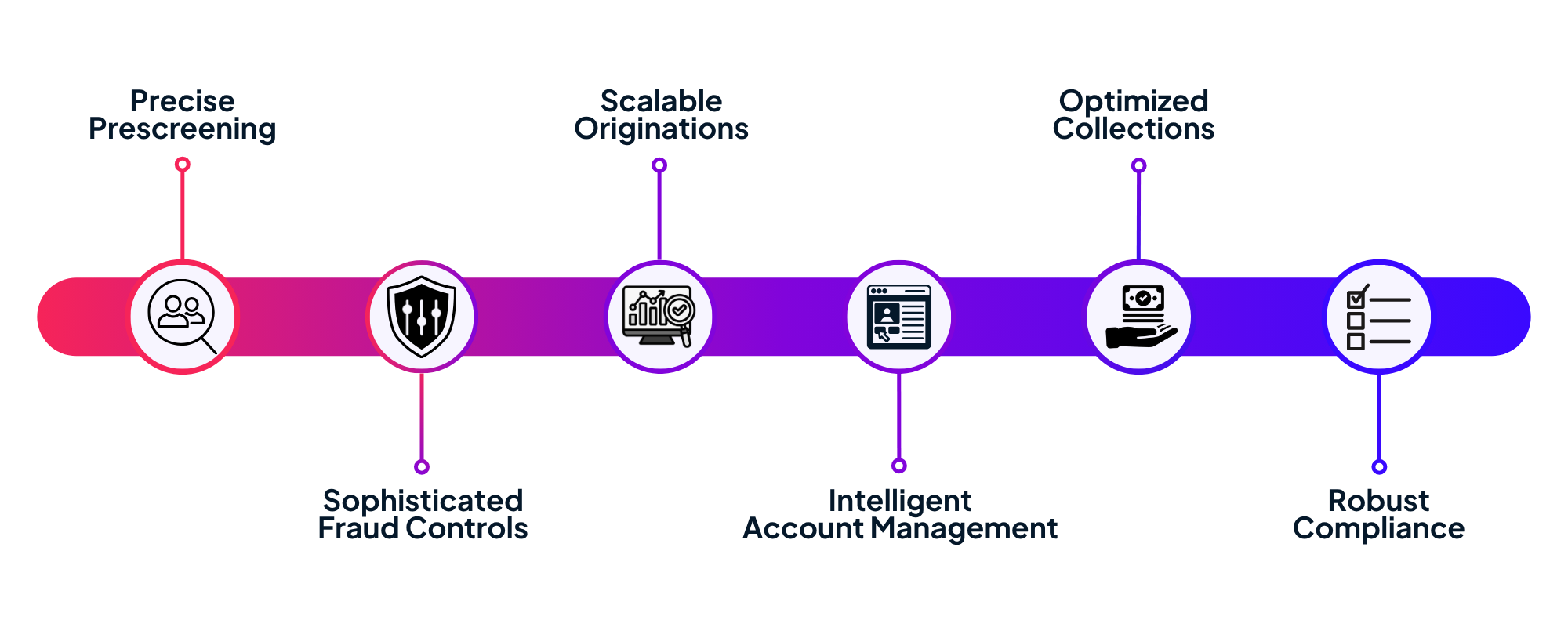

Across the Credit Lifecycle

Sharpen Your Competitive Edge

Drive borrower and dealer satisfaction and protect your business with one integrated platform for origination, fraud, and account management.