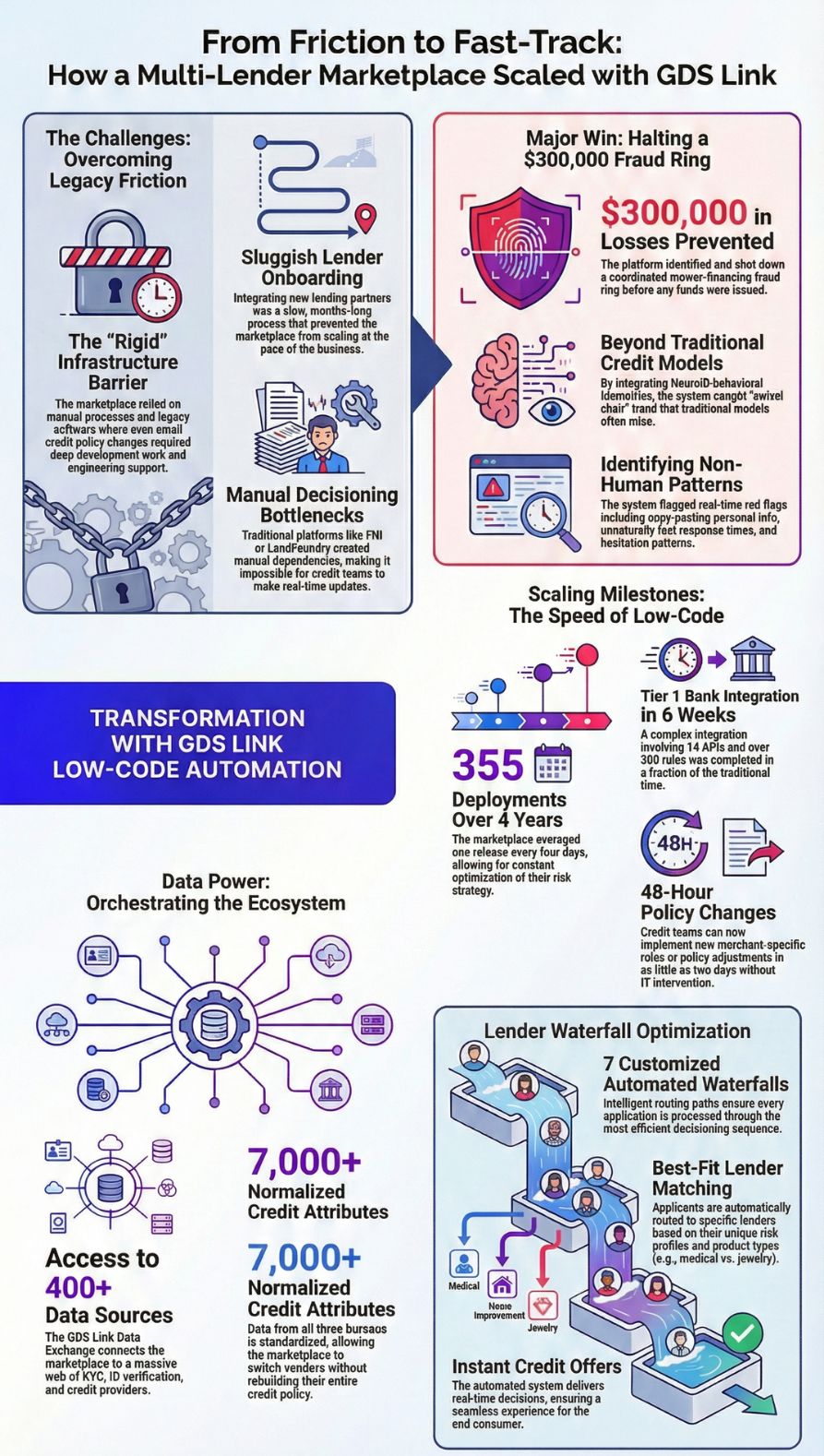

How a Multi-Lender Marketplace Scaled Embedded Finance and Stopped $300K in Fraud

Digital transformation in lending is no longer optional. To stay competitive, lenders need systems that move quickly, adapt easily, and protect against fraud without slowing down customers.

For a fast-growing multi-lender marketplace serving industries like medical financing, luxury jewelry, and home improvement, the challenge was straightforward. They needed to scale embedded finance across multiple lending partners while maintaining strong compliance and risk controls.

Their existing setup made this hard. Even small changes required development work. Adding a new lender took weeks. Fraud defenses struggled to keep up with increasingly sophisticated attacks.

After partnering with GDS Link, they replaced their rigid decisioning infrastructure with a more flexible, automated system. The result was instant credit offers across seven customized waterfalls, faster lender onboarding, and real-time fraud prevention that stopped major losses before they happened.

Stop waiting on your vendor’s development queue.

Schedule a Technical Deep Dive to see how GDS Link puts you in control of your credit strategy.

The Challenge:

Scaling Across Multiple Lenders Without Slowing Down

Running a marketplace means coordinating workflows across many lenders, each with their own credit policies, APIs, and approval criteria. The Client found that traditional loan origination software created friction instead of speed.

Simple policy updates required engineering support. New lenders took months to onboard. Credit teams could not make changes in real time.

They needed a platform that could:

- Orchestrate data across multiple sources

- Support complex lender waterfalls

- Allow credit teams to update policies without relying on IT

- Handle high application volume without adding staff

Like many lenders moving away from platforms such as FNI or LendFoundry, they wanted to remove manual dependencies and move toward fully automated decisioning.

Success Milestone:

Stopping a $300,000 Fraud Ring

One of the biggest proof points came when the platform identified and shut down a coordinated mower-financing fraud ring worth more than $300,000.

Traditional credit models often miss “swivel chair” fraud, where bad actors use stolen identities while behaving just enough like real customers to pass basic checks.

To address this, the Client integrated NeuroID behavioral biometrics through GDS Link. Instead of only looking at what data was entered, NeuroID analyzes how users interact with application forms in real time.

The system flagged patterns such as:

- Copy-pasting personal information instead of typing

- Unnaturally fast response times linked to automation

- Hesitation patterns consistent with organized fraud

Every fraudulent application in the ring was declined before funds were issued, preventing more than $300,000 in losses. Legitimate customers continued to receive fast approvals without added friction.

Losing money to sophisticated fraud?

Request a Fraud Defense Audit and learn how to protect your portfolio.

Scaling Embedded Finance With Low-Code Control

For high-growth lenders, manual review processes quickly become a bottleneck. This marketplace wanted their Chief Credit Officer to control risk strategy directly, without waiting on developers.

Using GDS Link’s low-code environment, they achieved:

- 355 deployments over four years, averaging one release every four days

- Policy changes in as little as 48 hours, including merchant-specific rules

- A Tier 1 bank integration completed in six weeks, covering 14 APIs and more than 300 rules

- Custom waterfall routing that sends applicants to the best-fit lender based on product type and risk profile

What once took months now takes weeks or days. Credit teams can test, adjust, and deploy changes at the pace of the business.

Streamlining KYC and Data Management

Customer experience matters. Slow identity checks or inconsistent data flows hurt conversions.

Through GDS Link’s Data Exchange, the Client connected more than 400 data sources, including KYC and ID verification providers.

A major advantage is standardized data across the three credit bureaus. With access to over 7,000 normalized credit attributes and more than 850 open banking attributes, the Client can change vendors without rebuilding their credit policies.

This flexibility reduces technical debt and helps keep risk strategies consistent, even when market conditions shift.

Looking Ahead:

Agentic AI for Smarter Financing

The Client is now testing agentic AI to support conversational financing experiences. These tools sit on top of GDS Link’s decision engine, ensuring automated interactions still follow compliance and risk rules.

Using the Policy Monitoring Dashboard, the team tracks:

- Response times

- Conversion drop-offs

- Data hit rates

This visibility helps them continuously refine their loan origination flows, moving beyond basic automation toward smarter, more adaptive credit operations.

Conclusion:

A Practical Blueprint for Fintech Growth

This marketplace shows what is possible when lenders replace manual processes with flexible automation.

By combining fast decisioning, behavioral fraud detection, and centralized data orchestration, they scaled a multi-product lending platform without sacrificing security, compliance, or customer experience.

GDS Link continues to provide the risk management and automated decisioning infrastructure modern lenders need to compete in a digital-first economy.

Ready to modernize your lending lifecycle?

Request Your Free Personalized Demo and start building a faster, more flexible credit operation.

Recent articles

The $3.6 Billion Leak: Automating Income Verification in Auto Loan Origination

Read article

Closing the Narrative Gap: Turning Multi-Model Complexity into “One Story”

Read article