Audit-Ready Automation: Why a Compliance Management System is Your Secret Scaling Weapon

For high-growth lenders, scaling volume without expanding headcount creates a familiar challenge. Legacy systems force teams into manual review workflows that slow decisions, increase costs, and introduce audit risk.

Many lenders still rely on human intervention to move applications forward. This approach limits consistency, strains operations, and makes compliance harder to manage.

To modernize credit decisioning, lenders are adopting compliance management systems as the foundation for scale, enabling faster reviews, stronger controls, and consistent outcomes. By replacing manual workflows with light-touch or no-touch processing, teams can reach auto-decisioning rates approaching 90 percent while staying audit-ready.

Stop the Manual Bottleneck

Is your credit team buried in manual reviews? Schedule a technical deep dive to see how automated decisioning can process applications in seconds.

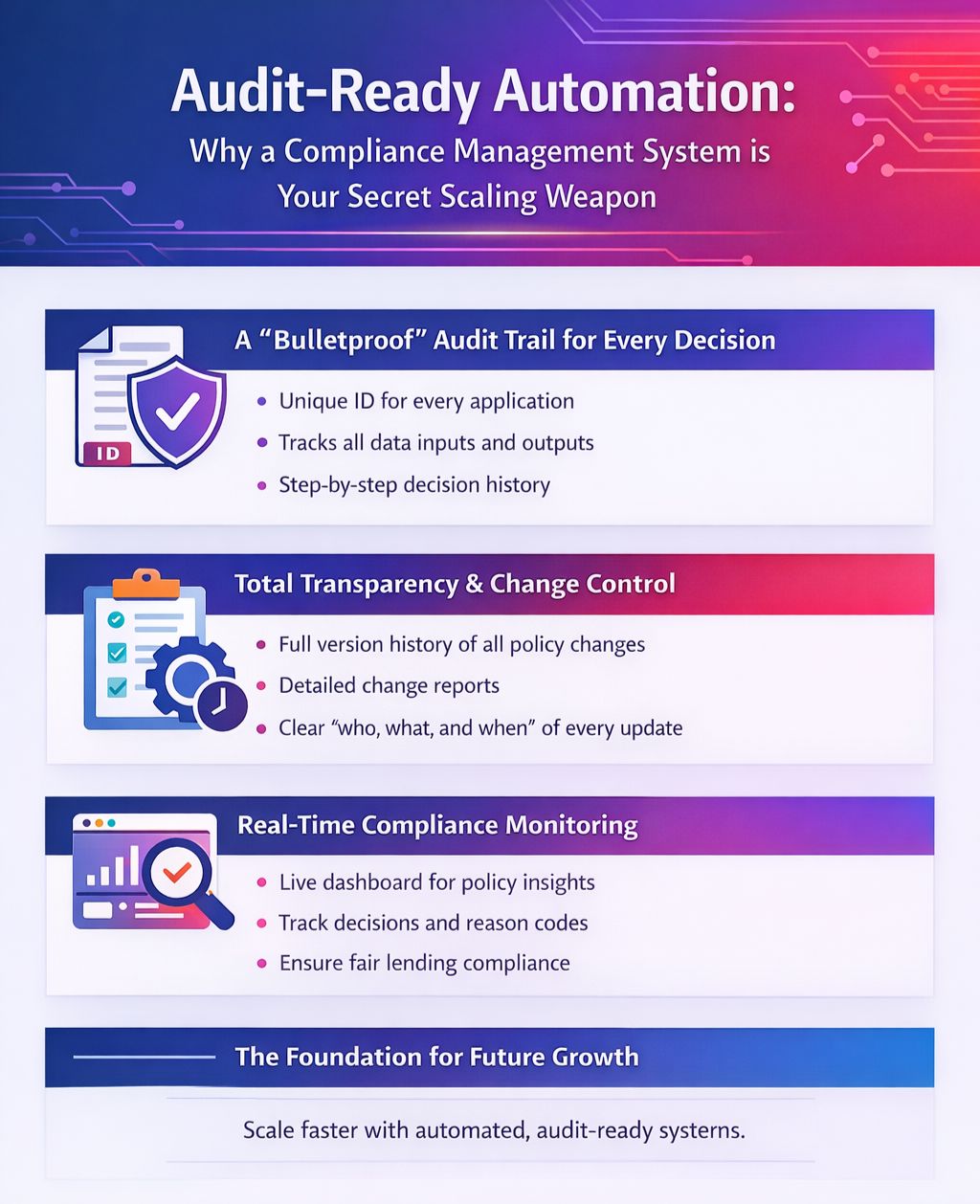

A “Bulletproof” Audit Trail for Every Decision

Regulatory confidence depends on your ability to recreate any credit decision on demand.

In manual environments, decision data lives across spreadsheets, emails, and internal notes. Modern compliance platforms assign every application a unique record ID that connects all inputs and outputs in one system.

Each record captures every data source used, from credit bureaus to identity verification, along with every rule applied and outcome produced.

Instead of operating as a black box, automated decision platforms provide a clear, step-by-step view of how each decision was made. This level of transparency supports audits, internal reviews, and executive reporting, especially for lenders preparing for broader regulatory oversight.

Total Transparency with Version Control and Change Reports

Automation only works when credit teams can adjust strategies without waiting on development cycles.

Self-service decisioning allows credit leaders to update policies directly while maintaining full oversight. Every change is tracked through built-in version control.

Each production update generates a change report showing:

- Who made the change

- When it was deployed

- What logic or thresholds were modified

This gives credit leadership full visibility into every strategy update and allows teams to roll back instantly if performance shifts.

Take Control of Your Strategy

Stop waiting in your vendor’s dev queue. Download the Credit Attributes Sales Sheet to learn how to move to a self-service decisioning environment.

Real-Time Compliance via Policy Monitoring Dashboards

Operational efficiency depends on real-time insight.

These insights also support ongoing fair lending compliance by giving credit teams real-time visibility into approval trends and decision drivers.

Policy monitoring dashboards provide visibility across the full lending funnel, helping teams spot conversion gaps where qualified applicants may be blocked by overly restrictive rules.

These dashboards also support fair lending oversight. By reviewing reason codes and approval trends as they happen, lenders can ensure decisioning stays within regulatory boundaries while maintaining flexibility to introduce new data sources.

This gives executives confidence that growth initiatives align with compliance standards.

Conclusion: The Foundation for Future Growth

Whether supporting embedded finance programs or high-volume consumer lending, automated compliance management is no longer optional.

Audit-ready automation replaces manual review bottlenecks with a transparent, scalable credit infrastructure. Lenders gain faster approvals, stronger governance, and clearer insight into portfolio performance.

3 Benefits of Why a Compliance Management System is Your Secret Scaling Weapon

A modern compliance management system does more than support audits. It becomes a core driver of operational scale.

1. Faster Decisions Without Adding Headcount

Automated workflows replace manual reviews with consistent logic, allowing teams to approve more applications without expanding staff. This reduces cycle times, lowers operating costs, and removes human bottlenecks from credit decisioning.

2. Built-In Accountability for Every Policy Change

Every strategy update is logged with a user record, timestamp, and change summary. Credit leaders maintain full visibility into what changed, when it changed, and why. This ensures clean audit trails and faster rollback when performance shifts.

3. Continuous Compliance Monitoring

Real-time dashboards surface approval trends, reason codes, and policy impact across the portfolio. Teams can identify risk early, correct conversion gaps, and maintain fair lending compliance without waiting for quarterly reviews.

See It in Action

Want to see how automated underwriting and compliance monitoring work together in a real lending workflow?

Recent articles

How a Multi-Lender Marketplace Scaled Embedded Finance and Stopped $300K in Fraud

Read article

Generative AI Decision Engines Transform Bank Credit Software in 2026

Read article