Generative AI Decision Engines Transform Bank Credit Software in 2026

The financial services industry has adopted new technology for decades, but few changes match the impact now underway in credit decisioning.

While many banks and credit unions started with chatbots and basic automation, the real shift is happening inside the credit engine. Generative AI decision engines are reshaping how institutions evaluate risk, underwrite loans, and meet regulatory requirements.

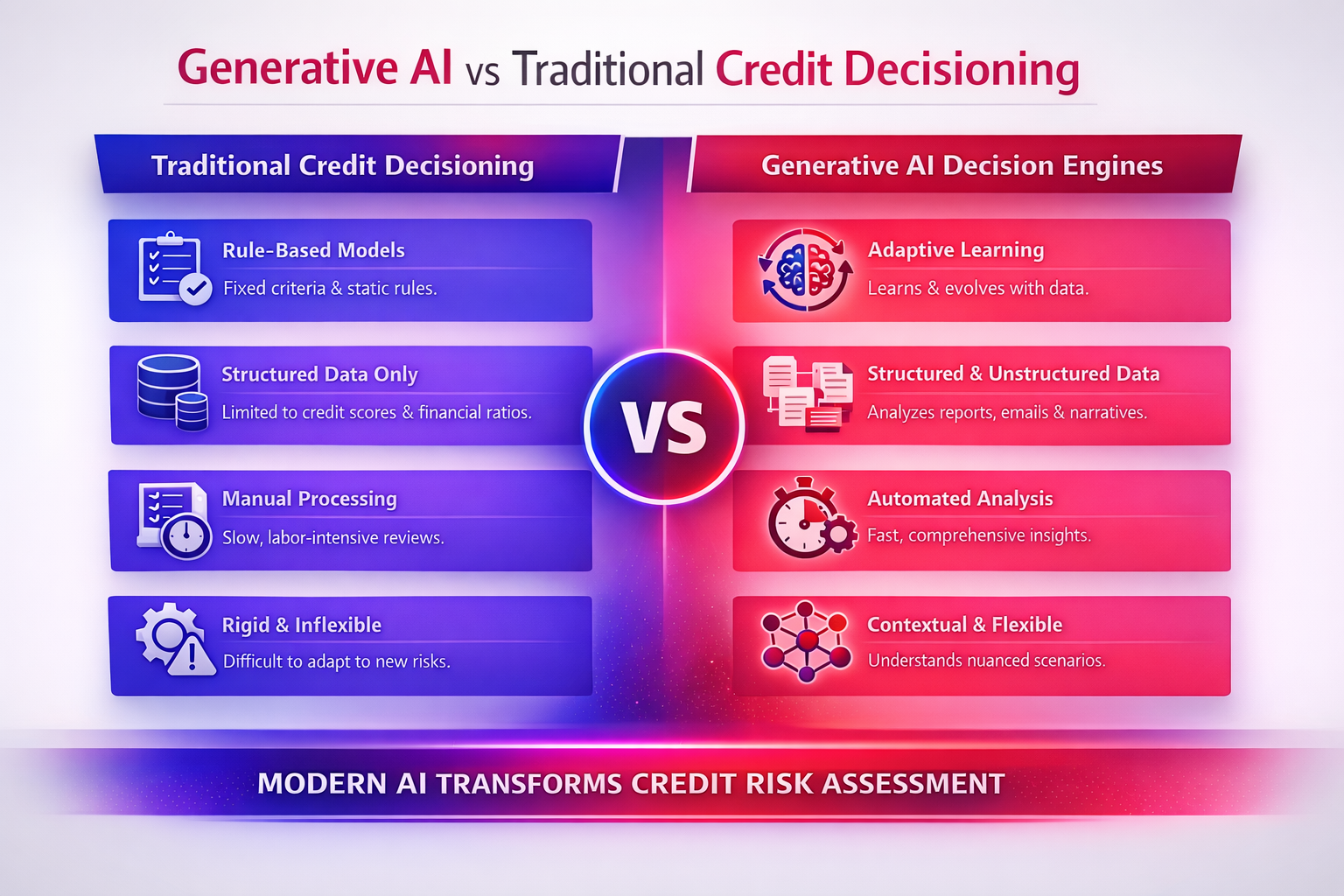

This is not an incremental upgrade. It is a fundamental change in how credit decisions are made. Traditional rule-based systems are giving way to platforms that can analyze both structured and unstructured data in one workflow. Early adopters are seeing measurable improvements in default prediction and underwriting speed.

If your current decision engine is limiting growth or slowing underwriting, now is the time to define your AI strategy and request a strategy session to explore how AI-driven credit decisioning can modernize your stack and strengthen your competitive position.

The Limitations of Traditional Credit Decisioning Systems

Legacy credit platforms were built for a different era of lending. They rely on static scoring models that evaluate borrowers using predefined thresholds like credit scores, debt-to-income ratios, and payment history.

These systems handle simple consumer loans. They break down when context matters.

A commercial borrower may show short-term revenue volatility due to expansion. A seasonal business may report uneven cash flow. Rule-based engines often interpret both as elevated risk, leading to overly conservative decisions or unnecessary manual review.

Manual underwriting fills the gap. In many institutions, more than a third of commercial applications require intervention. Underwriters spend hours reviewing financials and narratives, creating delays, higher costs, and inconsistent outcomes.

Compliance adds further friction. Updating legacy platforms to meet fair lending requirements demands IT resources, testing cycles, and long implementation timelines. At the same time, many lenders still operate with siloed bank data, bureau data, and alternative sources that do not connect. This limits visibility and slows approvals.

If your team is spending more time collecting and interpreting data than making informed credit decisions, your infrastructure is likely holding you back.

How Generative AI Decision Engines Differ from Earlier AI Applications

Not all AI delivers the same value.

Earlier banking AI tools were built for specific tasks. Chatbots handled customer inquiries. Fraud systems flagged unusual transactions. Recommendation engines suggested products. Each operated within a narrow scope.

Generative AI decision engines take a broader approach. They analyze unstructured information such as financial statement footnotes, business plans, regulatory guidance, and industry commentary alongside structured credit data. Instead of scoring isolated fields, they assess relationships and context across the full borrower profile.

When reviewing a commercial loan file, the system can evaluate management discussions, identify revenue concentration risk, assess sector exposure, and synthesize findings into a clear risk assessment. It connects financial performance, qualitative factors, and external market conditions in a single analysis.

These platforms can evaluate large volumes of variables at once, including financial ratios, payment histories, contract terms, and narrative disclosures. The result is a more complete view of borrower risk.

They also improve over time. As new performance data becomes available, the engine recalibrates risk assessments based on outcomes. Institutions deploying advanced decision engines are reporting stronger predictive performance and faster underwriting cycles.

This is not automation layered on top of legacy rules. It is a fundamentally more capable decision engine.

Real-World Applications in Credit Underwriting and Risk Assessment

Generative AI is already delivering value across commercial and consumer lending.

Commercial Loan Underwriting

Commercial underwriting benefits significantly from contextual analysis. Generative AI engines can review full financial packages in a fraction of the time required for manual review. They identify revenue concentration risk, supplier dependency, industry headwinds, and emerging sector risks while generating detailed credit narratives for underwriter review.

Instead of replacing human judgment, the AI provides a structured, consistent first pass. Underwriters focus on relationship dynamics and strategic considerations rather than document review.

This combination improves time-to-decision and strengthens risk discipline.

Consumer Credit Decisioning

For consumer lending, generative AI enhances income verification and alternative data analysis. Self-employed borrowers, gig workers, and applicants with non-traditional income sources can be evaluated more accurately when AI analyzes bank data, transaction patterns, and stability trends.

Rather than averaging deposits or relying solely on bureau data, the engine distinguishes recurring income from one-time deposits and evaluates sustainability.

This enables lenders to responsibly expand approvals without increasing portfolio risk.

Portfolio Risk Monitoring

Beyond origination, AI-driven monitoring continuously evaluates portfolio health. Instead of waiting for delinquency triggers, the system analyzes early signals such as shifts in payment behavior, sector conditions, and external risk indicators.

Relationship managers receive actionable alerts with clear explanations. Early engagement reduces loss severity and strengthens borrower relationships.

Strengthen portfolio oversight with proactive risk alerts and continuous monitoring capabilities.

Regulatory Compliance and Explainability Challenges

Regulatory compliance remains a core requirement. Credit decisions must be explainable, consistent, and free from bias.

At first glance, generative AI may seem difficult to audit. In practice, when implemented properly, it can strengthen transparency and documentation.

Modern decision engines generate structured explanations that show which factors influenced each outcome and how risk elements were evaluated. These narratives support regulatory reviews, internal governance, and clear borrower communication.

Automation also reduces compliance overhead. Adverse action notices, model validation summaries, and fair lending documentation can be produced with greater consistency and accuracy, freeing teams from manual reporting work.

Successful deployments require strong governance frameworks. This includes routine bias testing, model validation, full audit trails, and defined human oversight for material credit decisions.

When governance is designed into the system from day one, AI supports compliance instead of creating new risk.

Implementation Considerations for Financial Institutions

Adopting generative AI requires more than choosing a vendor.

Integration with core banking systems and loan origination platforms is often the first hurdle. Many institutions operate on infrastructure that was never designed to support modern decision engines.

A phased rollout delivers the best results. Start with a specific loan segment. Run AI recommendations alongside existing workflows. Validate outcomes, adjust thresholds, and build confidence across credit teams before expanding.

Data readiness is critical. Historical loan data must be accurate, consistent, and well structured. Governance standards should be in place before moving into production.

Training and change management matter just as much as technology. Underwriters need to understand how decisions are generated and when human judgment should override system recommendations.

Institutions that approach AI as a strategic modernization effort, rather than a plug-in upgrade, see faster adoption and stronger returns.

The Future of AI-Driven Credit Decisioning

AI-driven credit decisioning is becoming standard across the industry.

Real-time underwriting is replacing static, point-in-time assessments, allowing lenders to continuously evaluate borrower financial behavior. Open banking data is improving visibility into transaction patterns, strengthening income verification and expense analysis.

Predictive analytics is also shifting from reactive risk detection to proactive portfolio management. Institutions can identify refinancing opportunities, emerging risk concentrations, and relationship expansion potential earlier in the lifecycle.

Lenders investing now in AI-enabled credit platforms gain advantages in speed, accuracy, and customer experience. Those that wait risk falling behind competitors that can approve faster, price more precisely, and manage risk more effectively.

Conclusion

Generative AI decision engines are reshaping how financial institutions assess and manage credit risk. Improvements in predictive accuracy, underwriting speed, and portfolio monitoring are already measurable in production environments.

This is not experimental technology. It is becoming core infrastructure.

The strategic decision for finance leaders is whether to lead this transition or react to it. Institutions that invest in AI capabilities, governance frameworks, and modern decision infrastructure will gain measurable competitive advantages in approval speed, pricing precision, and risk control.

The future of lending belongs to institutions that combine advanced AI with disciplined credit governance.

Recent articles

How a Multi-Lender Marketplace Scaled Embedded Finance and Stopped $300K in Fraud

Read article

Audit-Ready Automation: Why a Compliance Management System is Your Secret Scaling Weapon

Read article