Smarter Lending for

Stronger Credit Unions

Credit unions are built on trust, community, and personalized service. But today they face new challenges in managing risk, fraud, and compliance – not to mention keeping ahead of evolving member expectations.

That’s where GDS Link can help.

Our integrated credit decisioning and advanced analytics solution streamlines and automates lending across the credit lifecycle – powered by sophisticated AI. So, you can deliver more value without straining your resources.

“Working with GDS Link has been a game-changer... The credit union is now poised to achieve substantial growth opportunities, and we look forward to continuing to work with them in the future.”

Steve LeJeune, Business Intelligence Manager, Marine Credit Union

,Own Your Credit Union’s Future

Streamline Lending and Improve Performance

With real-time insights, automated workflows, and seamless data integration, GDS Link helps you optimize performance, manage risk, and drive growth. Streamline your lending processes and stay ahead of market trends with precision and ease.

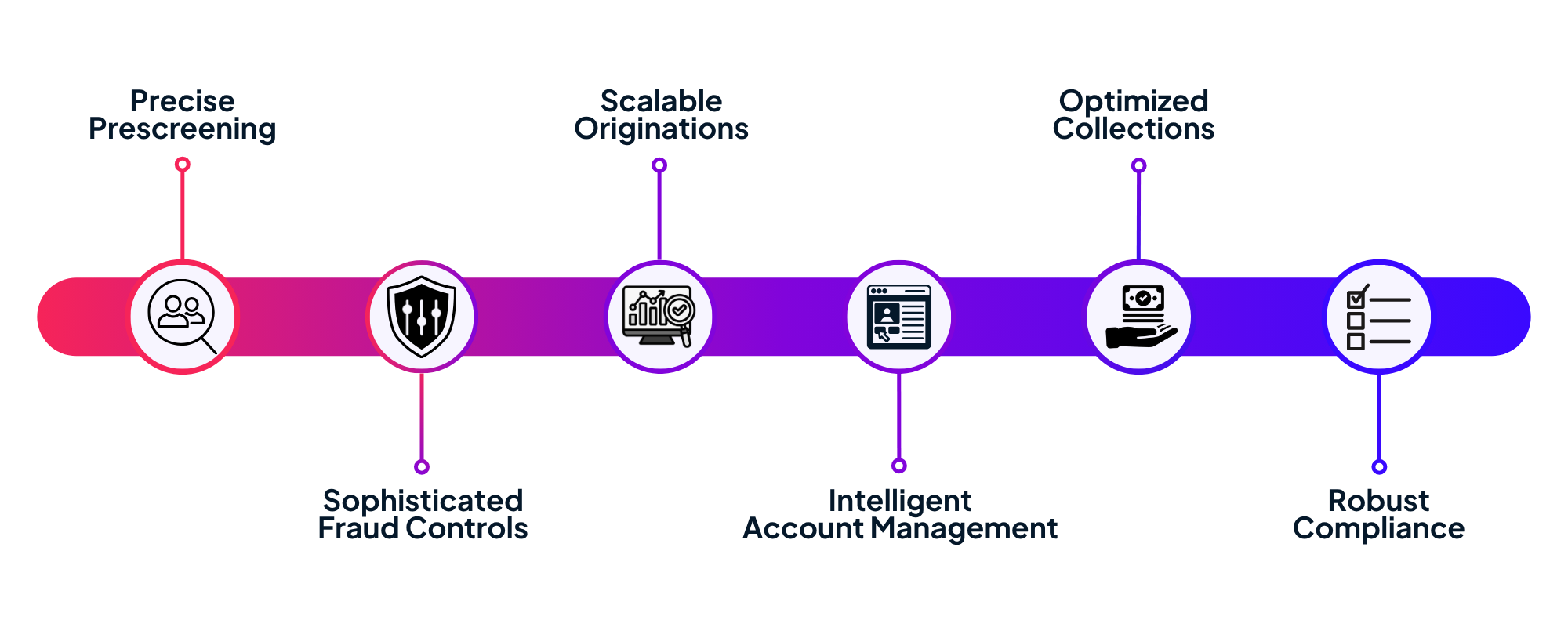

Accuracy and Agility

Across the Credit Lifecycle

Maximize Satisfaction and Profitability

Give your members the quick decisions and tailored offers they want without sacrificing the personal touch they expect.