Automation + Accuracy for

Confident Compliance

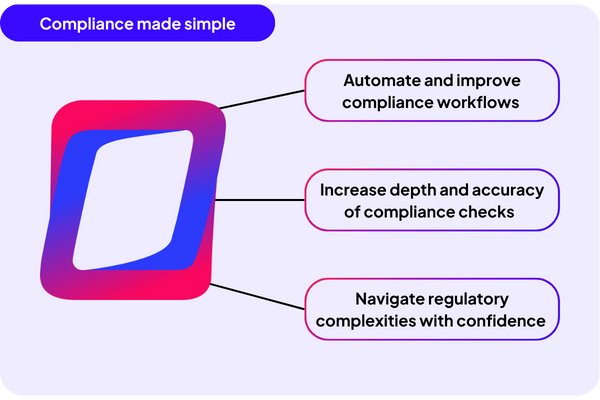

Managing regulatory compliance has long been a major challenge – and it’s only getting more complicated.

From KYC/KYB to SARs, lenders need to accurately and efficiently meet all their compliance requirements – without slowing down decisions or funding.

That’s where GDS Link can help.

“Users of the GDS Link Decisioning Platform – at each entity level – can independently perform simulations of different scenarios, being able to execute them in the high-performance environment.”

Senior Risk Director

, Global Banking ClientStronger Controls, Streamlined Processes

Optimize the Credit Lifecycle with GDS Link

Accelerate approvals, reduce defaults, and align operations with your credit and risk strategies

Check it OutDetect and address potential fraud in real time, without disrupting the borrowing experience

Check it OutTarget borrowers more accurately, reduce costs, and boost approval and satisfaction rates

Check it OutDrive growth and loyalty with streamlined processes and better customer engagement

Check it OutBoost recovery rates with smart segmentation, real-time monitoring, and automated workflows

Check it OutTrust Your Compliance

See how GDS Link can give you confidence in your compliance with real-time monitoring, seamless data orchestration, and customizable workflows – backed by the latest AI and machine learning capabilities.