How to Succeed in

Buy Now, Pay Later

Buy Now, Pay Later is growing fast. But BNPL borrowers may have limited credit information or they may be carrying multiple BNPL loans. With an ever-changing market landscape, how do you deliver the one-click BNPL experience with robust risk controls?

That’s where GDS Link can help.

Our integrated credit decisioning and advanced analytics solution delivers decisions in milliseconds, backed by deeper applicant profiles and sophisticated risk tools. So, you can boost model accuracy and make decisions that will optimize performance – fast.

“With GDS Link, we’ve been able to make instant, automated credit decisions at checkout without sacrificing accuracy or compliance. The platform’s flexibility and low-code environment let us adapt our underwriting logic in real time, supporting faster growth and better customer experiences.”

GDS Link for BNPL Lenders: Real-Time Insights and Automated Workflows for Smarter Lending

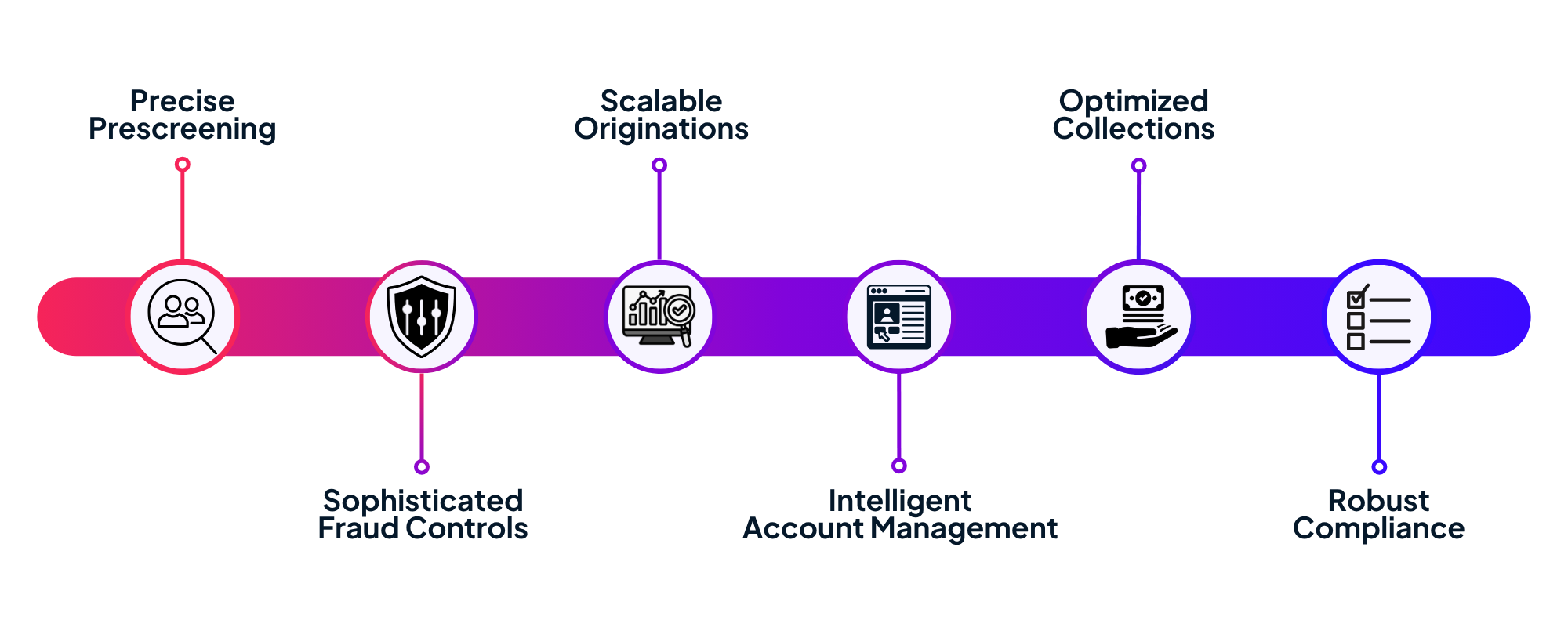

With real-time insights, automated workflows, and seamless data integration, GDS Link helps you optimize performance, manage risk, and drive growth. Streamline your lending processes and stay ahead of market trends with precision and ease.

Seize the BNPL Opportunity

Accuracy and Agility

Across the Credit Lifecycle

Stay Ahead in Buy Now, Pay Later

Get the accuracy, control, and speed you need to succeed in this fiercely competitive market