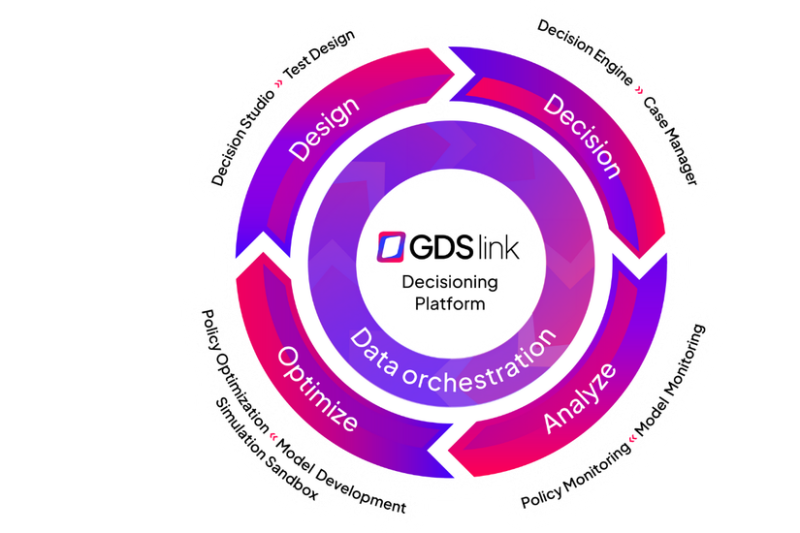

One Unified Platform for

Smarter Credit Decisions

The GDS Link Decisioning Platform gives lenders intuitive credit policy design, real-time digital decisioning, advanced analytics and comprehensive optimization in one environment. So lenders can continuously improve their lending strategy, portfolio growth and profitability.

Book a Demo

Own Your Lending Strategy:

Build, Test, Execute and Analyze with Confidence

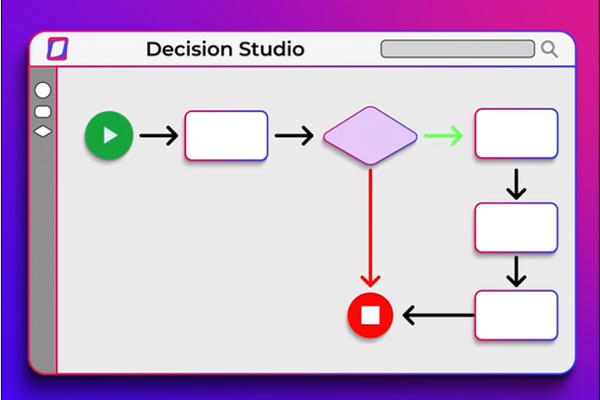

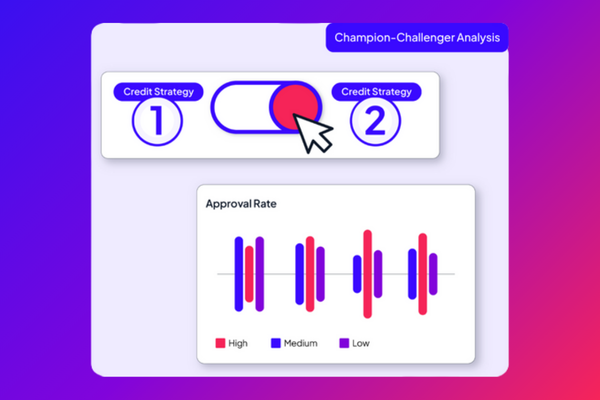

Automate and improve credit decisions across the lifecycle: design and test credit strategies efficiently and consistently in low-code environment.

Read More

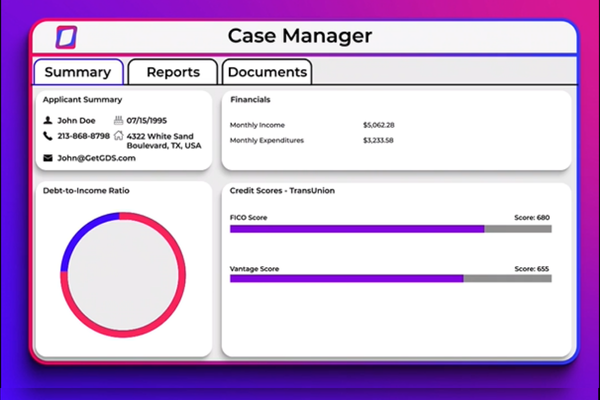

Increase your agility and free up resources: test, iterate and implement decision strategies in real time and simplify manual workflows

Read MoreOwn Your Advantage: From Monitoring to Maximizing

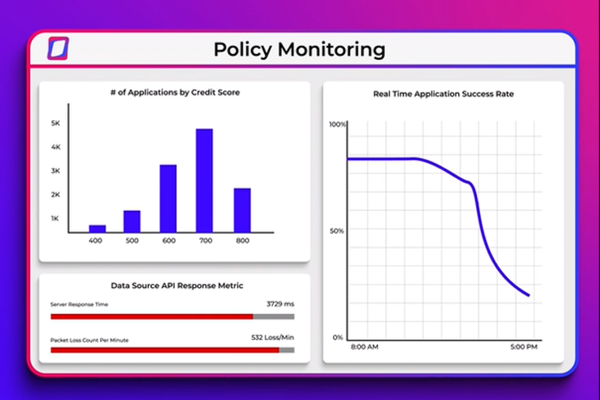

Monitor performance and anticipate outcomes in near real time: quickly analyze the impact of policy changes and monitor policy rules and predictive models

Read More

Rapidly build, optimize and execute more effective decisioning strategies: Validate and refine underwriting decisions, reveal hidden risk factors and enhance your predictive power.

Read MoreOwn Your Data Infrastructure: Access, Integrate, and Scale

Accelerate time to market, enhance the customer experience and minimize risk: Get seamless, real-time access to more than 200 pre-configured data sources and consolidate disparate data integration processes

Read MoreSee the GDS Link Decisioning Platform in action

Whether you need to modernize one part of your credit process or transform your entire risk strategy, the GDS Link Decisioning Platform gives you the flexibility and control to move with confidence.