Optimize Borrower Targeting with GDS Link

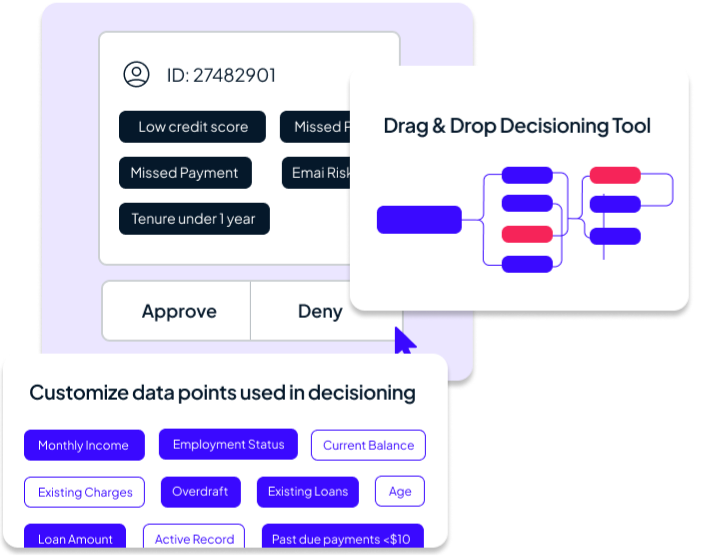

Effective prescreening is essential for increasing approval rates and optimizing marketing spend. GDS Link's Decisioning Platform leverages real-time data, behavioral analytics, and automated decisioning to help lenders accurately assess borrower eligibility upfront.

By integrating smarter targeting strategies, lenders can drive higher-quality applications while reducing risk exposure and operational inefficiencies.

Personalize customer offers, improve conversions with GDS Link

Target the right borrowers with precision

Data-Driven Prequalification: Instantly assess borrower eligibility using comprehensive credit and alternative data sources.

Smarter Marketing Spend: Optimize acquisition strategies by focusing on high-potential applicants.

Reduce risk and improve accuracy

Integrated Fraud Detection: Identify potential red flags before an application is submitted.

AI-Enhanced Decisioning: Use machine learning to refine targeting and qualification criteria.

Streamline borrower engagement

Seamless Integration: Connect prescreening insights directly to your loan origination workflow.

Automated Outreach Strategies: Personalize borrower engagement with timely and relevant offers.

Transform borrower acquisition with smarter prescreening

Make informed lending decisions faster by leveraging instant borrower assessments.

Proactively detect and mitigate fraud risks while ensuring regulatory compliance.

Drive higher approval rates by focusing on the most creditworthy applicants.

"With GDS Link's prescreening solution, we improved our targeting accuracy, reduced acquisition costs by 30%, and increased approval rates by 20%. Our marketing efforts are now more effective, bringing in higher-quality applicants."

Own your strategy, seize every opportunity

Enhance your borrower acquisition strategies with smarter, data-driven prescreening. Contact us to learn how GDS Link can help optimize your marketing and risk assessment processes.