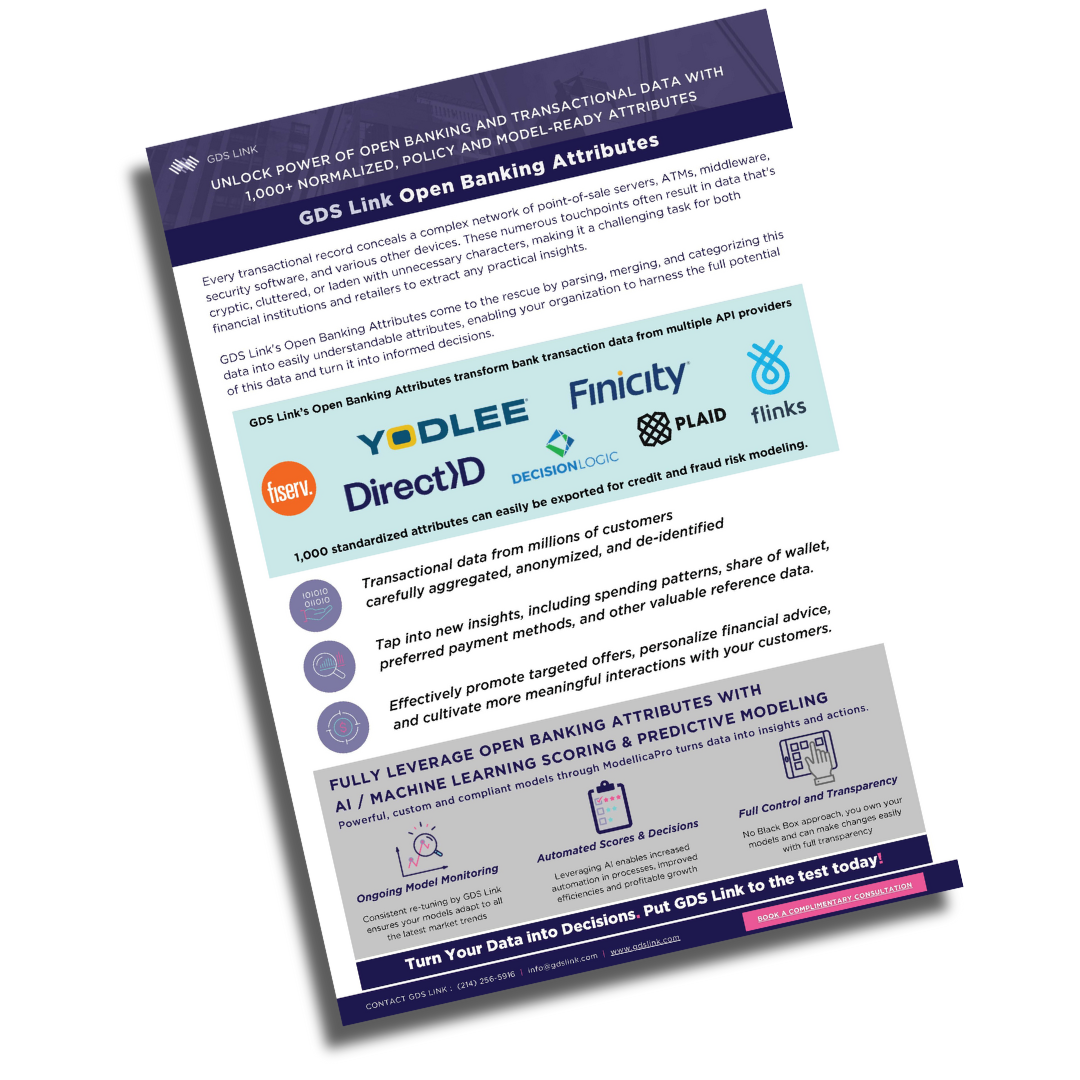

Dive into the new era of financial clarity with GDS Link’s Open Banking Attributes, where complex data from a multitude of banking API providers is distilled into over 1,000 standardized, model-ready attributes. Your pathway to smarter credit and fraud risk decisions begins here.

Behind every transaction lies a labyrinth of systems — from point-of-sale servers to security protocols. This intricate mesh generates data that’s often convoluted, hindering insight extraction. GDS Link cuts through the chaos, offering Open Banking Attributes that transform this dense information into crystal-clear indicators. Simplify the intricate for robust financial analysis and make informed decisions with confidence.

Enhanced Data Comprehension: Navigate through the complexities of transactional data, rendered straightforward and coherent, to uncover hidden insights.

Seamless Model Integration: Incorporate standardized data seamlessly into your existing risk models, optimizing accuracy and agility in response to emerging threats and opportunities.

Customization for Precision: Adapt our extensive attributes to your unique modeling needs, building upon a solid foundation to construct precise, tailored solutions.

Embark on a journey to demystify transactional data. Complete our form to download the exclusive marketing sheet, detailing how GDS Link's Open Banking Attributes can revolutionize your approach to credit analysis and fraud detection.