Deciphering the impact of the oldest economic “game”

“Fraud is the oldest and simplest of economic games. But it is also the most dangerous, for when people lose faith in the system, everything falls apart”. How appropriate this quote from George Soros is for a topic such as the one we address on this page today. In an increasingly digitised and connected world, fraud has become a growing concern for consumers and businesses alike. Knowing the different types of fraud and understanding their scope is critical to protecting ourselves and taking preventative measures.

It is in this context that the US Federal Trade Commission (FCT) plays a key role through its Consumer Sentinel Network Data Book. This is a reference tool that provides a detailed classification of the various types of fraud and related crimes, based on thousands of complaints filed by consumers each year.

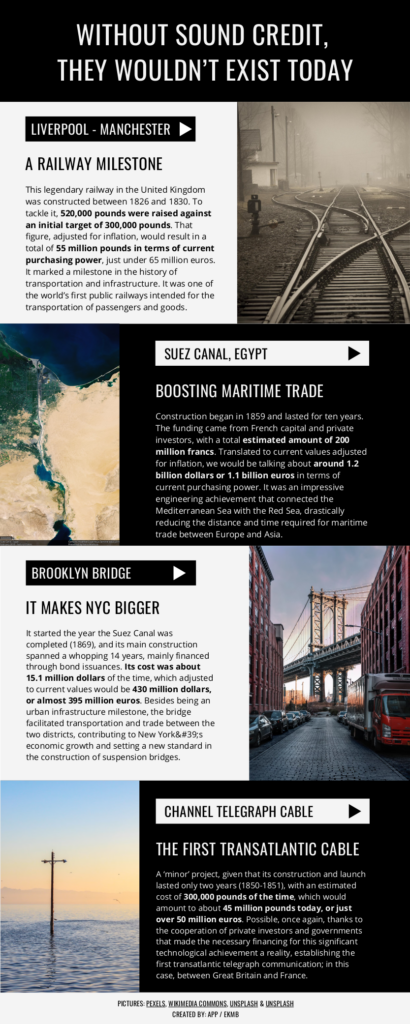

In addition to offering valuable insight into the magnitude of fraud, the FCT reports provide relevant information to identify patterns, improve legislation and promote public awareness of these crimes. We wanted to echo this tool and take note of the latest available data, corresponding to the first quarter of 2023, to draw attention to some striking points, such as those that accompany these lines in the form of an infographic.

For example, the fraud with the greatest economic impact, both in its totality and in its capacity to erode individual pockets, is that related to investments, considering as such opportunities in day-to-day trading, as well as in gold, gems, art, rare coins or even reports of all kinds. In this case, the average impact in the last available quarter was almost $40,000 per victim; taking into account that there were almost 20,000 reports, three quarters of which resulted in a financial loss, the total impact of this type of fraud was almost $750 million.

Most significant, by contrast, is fraud based on pure scamming, which the FCT defines as someone “pretending to be a trustworthy person in order to get consumers to send money or provide personal information”. In this case, the impact was well over $500 million, but it is a much more atomised type of fraud, 178,000 complaints, of which only 1 in 5 had an impact in the form of losses, reducing the average loss to just under $3,000.

Also particularly striking are the cases of fraud related to internet, telephone and health services. Although they rank 8th, 9th and 10th (out of a total of 19 types of fraud), their average economic impact is relatively small: $425, $230 and $90 per victim, respectively, and with sufficiently contained “success” figures: the reported cases involving economic losses accounted for 7.08%, 10.88% and 5.57%, also in the same order.

Regardless of the specific nature of the types of fraud and their direct link to banking activities, the fight against fraud is a win-win objective for all consumers. In a world where money in motion finds its way through financial institutions, stopping fraud has a direct impact on the security and confidence of users. By being informed about the types of fraud and taking preventative measures, we can protect our assets, safeguard our personal information and promote a safer and fairer economy.

In any case, we recommend direct consultation of the very revealing data in Tableau’s scorecard (business intelligence solution), which the Commission itself makes available to the public.

Request Demo