Modern Lending Made Simple

Empower your business with advanced credit risk decisioning. GDS Link’s intelligent platform integrates real-time data and decisioning, AI-powered analytics, and automated workflows to simplify decision-making and improve precision across the credit lifecycle.

Book a Demo

Smarter credit risk decisioning

In today’s competitive environment, lenders face mounting challenges: ever-changing regulations, macroeconomic uncertainty, and the need for speed. GDS Link addresses these complexities with a platform designed to streamline credit risk decisioning.

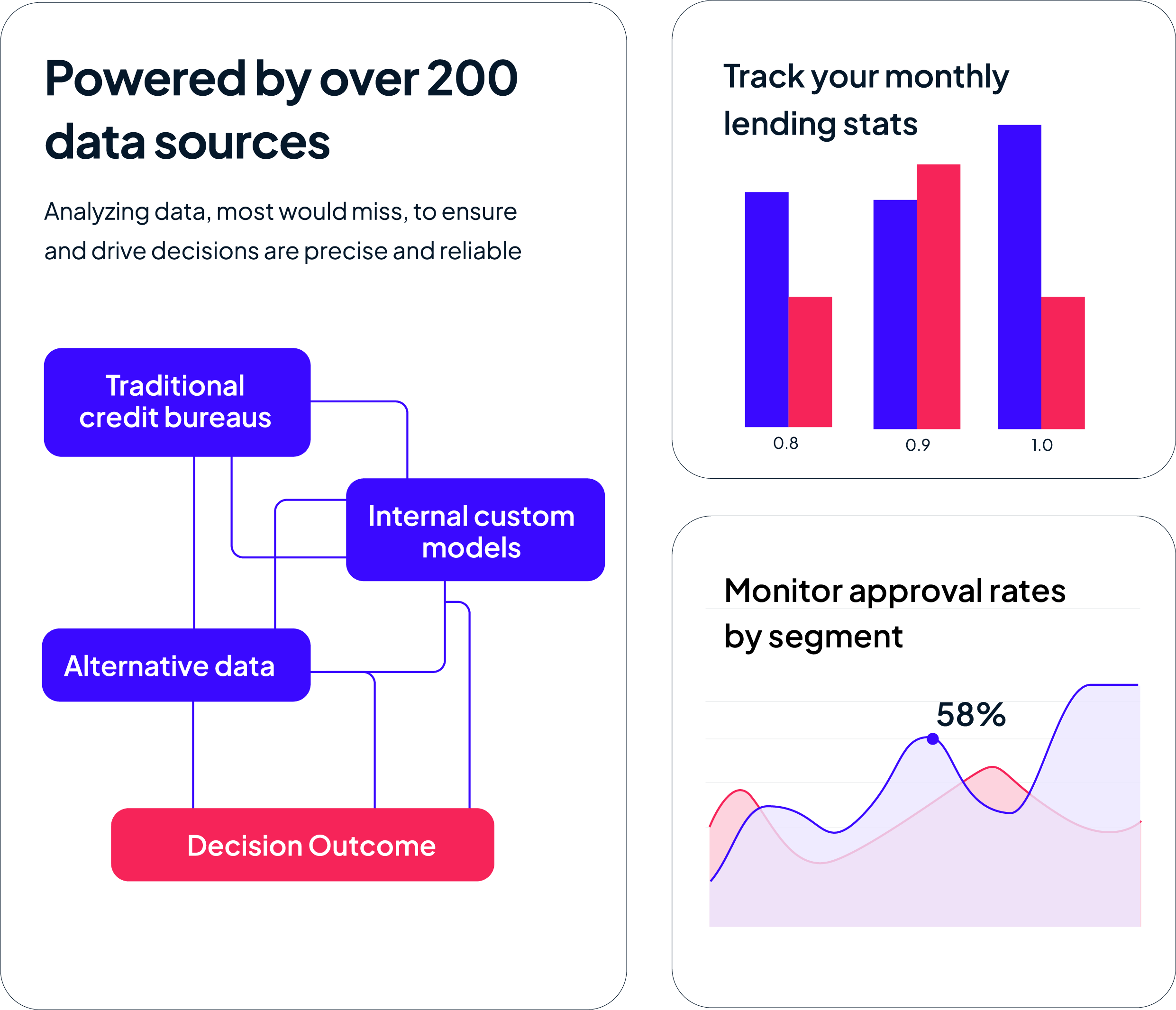

By integrating over 200 data sources, applying advanced AI analytics, and automating workflows, we provide the tools to make smarter, faster decisions.

The result? Increased accuracy, improved borrower experience, and the ability to adapt to a constantly evolving credit landscape. Empower your business with a solution built for precision, scalability, and efficiency.

Understanding your needs

Decades of risk and analytics experience allow us to problem-solve and adapt to meet the needs of you and your customers.

Collaborative solutions

No two lenders are the same, which is why we deliver flexible, configurable solutions through a highly collaborative approach.

Driving innovation

We push past industry standards, developing innovative decisioning solutions that transform lending and unlock new opportunities.

We work with a range of industries

Navigate shifting markets, regulatory pressures, and legacy systems with ease. GDS Link helps banks modernize credit decisioning, streamline operations, and respond to evolving customer demands.

Find out more

Balance personalized service while improving the digital member experience. GDS Link simplifies decision workflows, enhances risk management, and ensures compliance to support member-first experiences.

Find out more

Adapt to fast-paced markets and unique borrower profiles. GDS Link provides fintechs and specialty lenders with scalable decisioning tools to manage risk, enhance speed, and capture new growth opportunities.

Find out moreWorking with GDS allows us to automate very complex decisioning algorithms and incorporate new models that could not be accomplished in our old system. It is the key to our success.

Trusted leaders in credit risk decisioning

Driving Innovation in Credit Risk

Dedicated Data Sources

Security Certifications

Transform your lending strategy

With GDS Link, lending becomes seamless, data-driven, and scalable. Our platform combines real-time analytics, AI-powered decisioning, and flexible workflows to optimize every stage of the credit lifecycle. Discover how Modern Lending Made Simple empowers your organization to streamline operations, mitigate risk, and unlock new growth opportunities.